Do Benchmark Electronics's (NYSE:BHE) Earnings Warrant Your Attention?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Benchmark Electronics (NYSE:BHE). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Benchmark Electronics

Benchmark Electronics's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that Benchmark Electronics has grown EPS by 58% per year, over the last three years. Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

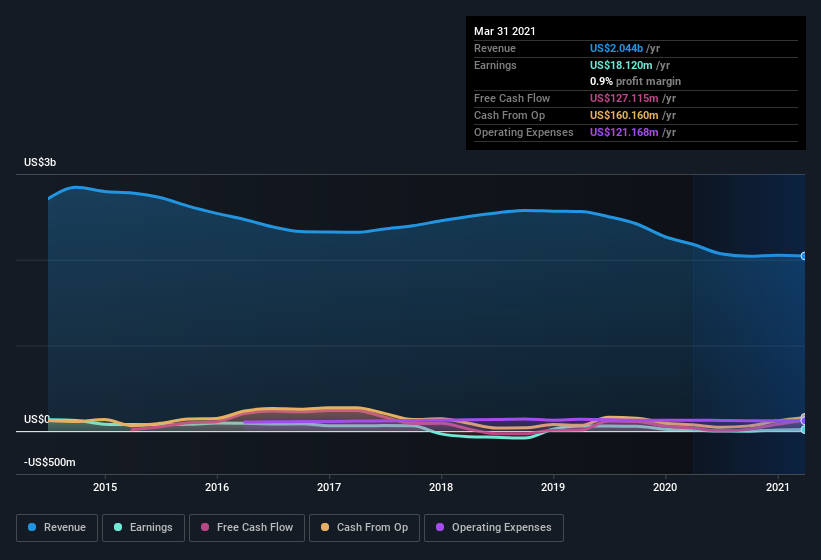

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Benchmark Electronics's EBIT margins are flat but, of some concern, its revenue is actually down. Suffice it to say that is not a great sign of growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Benchmark Electronics's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Benchmark Electronics Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Benchmark Electronics shareholders can gain quiet confidence from the fact that insiders shelled out US$329k to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the Independent Director, Jeffrey McCreary, who made the biggest single acquisition, paying US$151k for shares at about US$20.19 each.

The good news, alongside the insider buying, for Benchmark Electronics bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$15m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 1.3% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Benchmark Electronics To Your Watchlist?

Benchmark Electronics's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. What's more insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Benchmark Electronics deserves timely attention. What about risks? Every company has them, and we've spotted 2 warning signs for Benchmark Electronics you should know about.

The good news is that Benchmark Electronics is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.