Bender's 2023 market predictions include rising rates, office investments and a recession

It’s a question that's been in the headslines for months: Will 2023 be the year of another recession?

According to brokers and researchers from Bender Commercial Real Estate in Sioux Falls, the answer is most likely.

During the recent 2023 annual Bender Market Outlook, six specialists at Bender made their predictions for the year, each focusing on a specific market. Some common themes were increasing rates and inflation.

And while a recession is nothing to get excited about, Bender predicts there will be some positives to come out of 2023, especially considering Sioux Falls is still in the expansion stage.

“We do think that recession is coming,” Bender President Reggie Kuipers said. “Some headwinds are coming. They're on the way. Maybe they're already here in some sectors, but be prepared to take advantage.”

Here are some of the key takeaways from Bender’s market predictions:

More:Is downtown Sioux Falls getting too expensive with all these new developments? Not necessarily.

Inflation will get worse before it gets better, affecting investments

The consumer price index (or CPI) finished at 6.4% for the year, according to the Federal Reserve Economic Data. Kuipers said the number would have to be below 2.5% before the Fed stops raising rates, a statement that made many people in the audience sigh.

“The Fed meets again in two weeks. They’re going to certainly raise 25–maybe even 50–basis points, … and they'll do at least two more 25’s in May," he said. "… I think they'll probably push pause at that point, but we don’t know. Inflation feels really sticky, and we’ve gotten a lot of mixed signals.”

Kuiper predicts interest rates will top out at 5.5% this year, and that the 10-year US treasury rate will remain below 4.5%.

“Macro economic trends will strongly influence our market this year,” Bender partner Nick Gustafson said. “If the Fed continues to aggressively raise interest rates, we are definitely going to feel that in the investment sales market.”

He said 2023 will be a "pause year" for a lot of investment transactions and that cap rates (used to compare different real estate investments) will continue to go up. A higher cap rate means there’s more risk in an investment.

“Inflation might be with us for a lot longer than we’d like,” Gustafson said.

More:Apartments, commercial construction saw biggest boom in Sioux Falls in 2022

Commercial sector will continue to thrive, industrial will decline

While the housing market is tight, Kuipers said the commercial sector will be a year or two behind that. So for now, commercial construction will continue to boom.

It’s no secret Sioux Falls had a huge growing year in 2022 when it comes to construction projects and building permits. In 2022, there were 18 projects valued at more than $20 million in building permits. Only four of them were apartment complexes.

“The other 14 were in other areas of the market. This tells me there are 18 people, 18 city leaders, 18 investors, 18 bankers that are betting big on Sioux Falls,” Kuipers said. “We're gonna watch this trend and watch us continue to grow.”

Kuipers also said new commercial construction will outpace addition and remodel.

When it comes to the industrial sector, commercial broker Bradyn Neises said it will be a down year, but that’s not a bad thing.

“The demand is there. Pricing is going up and our supplies are limited,” he said. “However, I think we’ll see some private developers really turning their focus to industrial.”

Bender partner Rob Fagnan shared similar views.

“We’re absorbing at the same rate we’re building,” Fagnan said.

Since there’s not as much being built right now, Fagnan predicted the industry will continue to have record low vacancies.

Technology, white-collar jobs will feel the pressure

Kuipers said to look out for what he calls a “white-collar recession,” after there were nearly 100,000 layoffs in the technology industry in 2022.

“We were starting to see some cracks last year, especially with the technology sector,” Kuipers said. “Several Fortune 500 companies announced mass layoffs, especially in tech…. This white-collar recession…It is impacting the upper middle class families.”

More:South Dakota saw record unemployment rates in 2022. Here's what that means.

Kuipers said to watch this play out the rest of the year, and see if it trickles down into other sectors.

“Another trend to watch this year is going to be a thinning of the herd,” he added. “Some of these large companies don't want mass layoffs. They're going to force the people back to the office which they know will thin their herd.”

Employers will invest more in the office experience

The flip side of that is employers who want they’re workers to come back.

Alex Soundy, a commercial broker at Bender, said with the national trend of more people working from home, he believes many employers are looking to invest in the office to get employees to come back.

That could look like more collaborative spaces, golf simulators, catered office lunches, happy hours and open-door policies with management, Soundy said. Extra amenities and high-end spaces are typical for Class A office space, compared to Class B or C.

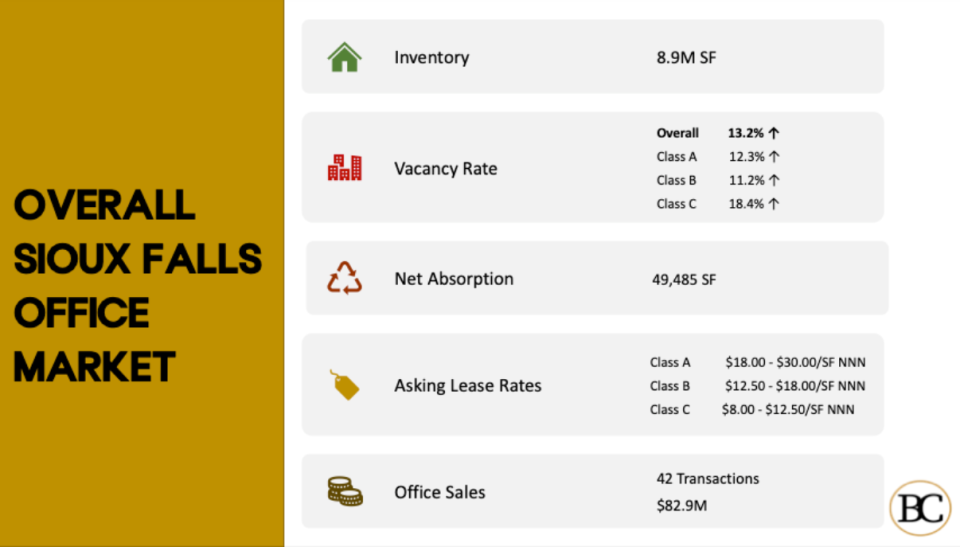

“This year is the first time we separated Class B and Class C when looking at vacancy,” Soundy said. “With the new additions of the Steel District and Cherapa II, among other large Class A developments, it’s really changed … the Sioux Falls market. Therefore it’s kind of a reclassification across all of our office classes.”

Soundy predicts the Central Business District (CBD) will continue to gain momentum as the desire to work downtown and the office construction increases. The CBD is made up of the downtown, uptown, east bank and Riverline submarkets.

Thanks to new construction projects, Class A lease rates will climb while Class C vacancy rates also increase, particularly in suburban areas, Soundy said.

He further said call centers will continue to collapse, and his prediction is that Sioux Falls will join the national trend of purchasing and repurposing these buildings for things such as residential apartments or industrial warehouses. They might even be sold just for the value of the land, he said.

“With increasing vacancy rates, heightened construction and steady employment, I have Sioux Falls toggling the line between expansion and hypersupply," he said. "I imagine it being there for the remainder of 2023.”

More:Officials blame inflation for South Dakota building projects that are millions over budget

People will buy less, but customer experience should improve

High inflation will continue to make people think twice about making a purchase, commercial broker Rob Kurtenbach said. He says thrifting, reusing and recycling will all become even more popular this year as consumer spending and finances tighten.

But it’s not all doom and gloom for the consumer. In fact, Kurtenbach believes that when they do make a purchase, the customers will start to feel better about it.

“We've all been pretty graceful with some difficulties and staffing over the last few years,” Kurtenbach said. “However, there are some new customer satisfaction surveys that are really starting to point out the lack of customer experience….So look for retail centers and start focusing more and more on the customer.”

This article originally appeared on Sioux Falls Argus Leader: Upcoming recession? Bender looks ahead at 2023 for its Market Outlook