How We All Benefit From Student Debt Relief

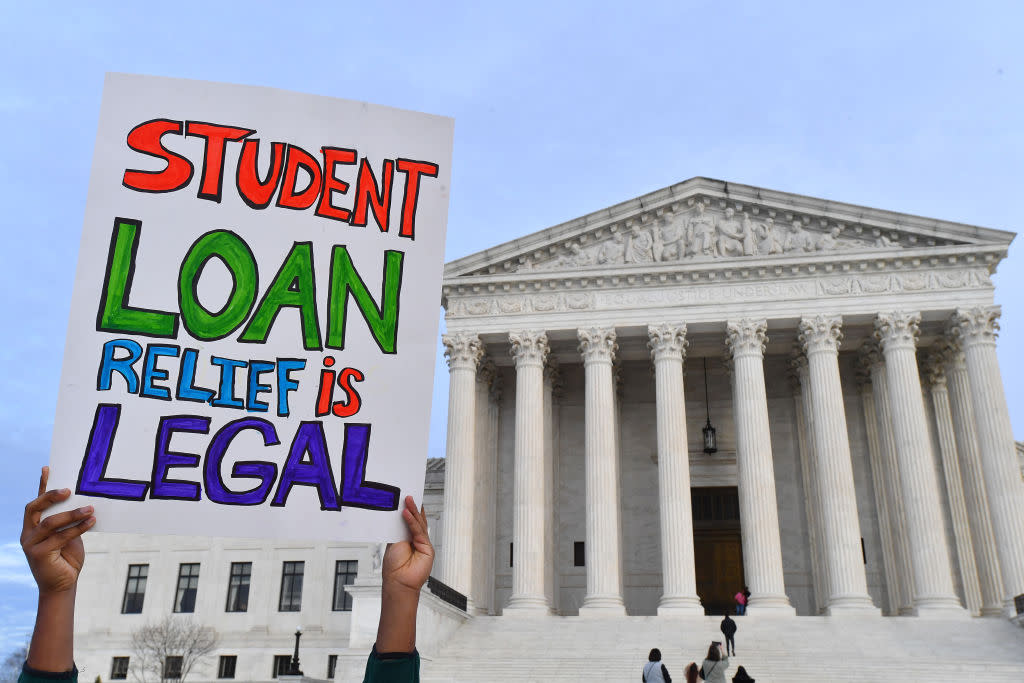

Student loan borrowers gathered at the Supreme Court today to tell the court that student loan relief is legal on Jan. 2, 2023 in Washington, D.C. Credit - Larry French—Getty Images/We, The 45 Million

On Tuesday, Feb. 28, 2023, the Supreme Court will hear arguments in a case challenging the Biden administration’s decision to cancel the debt of millions of student borrowers across the country. The attorneys general of our states are seeking to block needed relief—the cancellation of up to $20,000 in student debt per resident—from flowing to our communities. They claim this debt relief will harm our states. They are wrong.

As the mayors of four major cities (Kansas City, Little Rock, Birmingham, and Montgomery) with significant Black and brown populations, we hope the justices kick this ill-conceived case out of court. The Biden administration’s debt cancellation plan is not only especially meaningful for our constituents, it will also lift up our cities and states economically.

In August 2022, Education Secretary Miguel Cardona announced steps to eliminate or reduce debt burdens for millions of student borrowers. The plan was targeted at those who need relief the most, with nearly 90% of those likely to receive debt relief earning less than $75,000 per year. Importantly, this plan would also help more than 40 million student borrowers, many of whom are at risk of delinquency or default because of hardships brought on by the COVID-19 pandemic. In fact, more than half of all student borrowers say their entire financial stability depends on loan forgiveness.

Read More: The Supreme Court Is Set to Rule on Student Loan Forgiveness. Here’s What Could Happen Next

Instead of celebrating crucial relief of economically burdened residents, our state attorneys general decided to fight the plan in federal court. Though millions of borrowers have applied to receive cancellation, none has happened yet. The plan has been put on hold by the lower courts, despite clear and convincing evidence that the states suing won’t actually be harmed by the debt relief.

In partnership with the Public Rights Project, we filed a brief joined by 40 local governments in 24 states across the country. Collectively, we represent more than 30 million Americans, including almost 20 million people of color. The point we made to the Supreme Court was simple: When debt burdens of our residents are lifted, we all benefit.

When debt burdens are lifted, student borrowers can start new businesses and in turn, create job opportunities for others. They can buy homes for the first time in their lives, pay down other debts such as their credit card bills, and have less reliance on social safety net programs. Reducing educational debt improves mental health, allows families to start saving, and gives more people a realistic chance to stay in the professional field they actually chose and are trained for.

For our four cities alone, the Student Borrower Protection Center estimates that more than 177,000 thousand residents will receive greater than $1.3 billion in debt relief, which includes more than 85,000 borrowers seeing their entire loan balances eliminated. This debt relief will have intergenerational impacts, as it will allow families to accumulate wealth and support relatives to pursue and complete their own degrees in higher education.

Despite the many benefits of freeing our residents of oppressive debt, our states’ attorneys general, however, are claiming that our states will somehow be “harmed” economically by the debt cancellation plan—a strained attempt to establish what is called standing in federal court. What they are really doing is misusing their power in an effort to score political points, all at the expense of our communities and so many people of color.

Across the U.S., student borrowers owe nearly $1.75 trillion. These burdens are borne disproportionately by people of color. Black women are especially hard hit by student debt, as many have fallen victim to the promises of predatory for-profit schools. One survey from the Education Trust found that Black women have more debt—an average of $38,800 in federal loans—after completing undergraduate schooling than any other group. These unique burdens have lasting intergenerational effects, as the Institute for Women’s Policy Research estimates that nearly 40% of Black women in college are caring for at least one child.

Overall Black borrowers have more difficulty paying their student debts back. The average Black borrower still owes 95% of their debt after 20 years, while a comparable white borrower owes only 5%.

Debt cancellation is a shot at greater equity. Almost half of Latino borrowers and a quarter of Black borrowers will see their debts entirely eliminated by the debt cancellation plan. Significant reduction or elimination of debt not only lowers or zeroes out monthly payments but also leaves people less vulnerable to wage garnishment, loss of tax credits, or Social Security offsets—among the strict remedies available to those who enforce student debt obligations.

We are four mayors who were lucky to have been able to afford our student loan payments, although not without struggle for some of us. But, there are millions of Americans across the country living paycheck to paycheck and forced to make difficult decisions, including whether to pay their student loan bill, or put food on the table for their families or stay housed.

Debt relief is critical for our communities. We are urging the Supreme Court to reinstate the program right away to give everyone an opportunity to thrive and ensure America’s families can live stronger financial lives.