Berkshire (BRK.B) Q4 Earnings Up on Strong Segment Results

Berkshire Hathaway Inc. BRK.B delivered fourth-quarter 2020 operating earnings of $5 billion that increased 13.6% year over year. The increase was driven by lower insurance loss, and higher earnings at Railroad, Utilities and Energy, and other businesses.

Operating earnings at Railroad, Utilities and Energy increased 6.5% year over year to about $2 billion. Manufacturing, Service and Retailing increased 4.8% year over year to about $2.1 billion. However, operating earnings at Insurance and Others declined 57.8% year over year to $971 million.

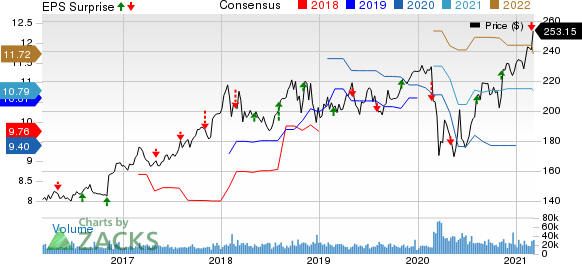

Berkshire Hathaway Inc. Price, Consensus and EPS Surprise

Berkshire Hathaway Inc. price-consensus-eps-surprise-chart | Berkshire Hathaway Inc. Quote

Full-Year Highlights

For 2020, operating earnings of $21.9 billion decreased 8.6% year over year. Soft performance in Insurance and Others, Railroad, Utilities and Energy as well as Manufacturing, Service and Retailing resulted in the decline.

Revenues decreased 3.6% year over year to $245.5 billion, attributable to lower insurance premiums earned, sales and service revenues, leasing revenue, railroad, utilities and energy revenues, interest, dividend and other investment income.

Costs and expenses increased 2.5% year over year to $231.3 billion, largely due to increase in costs and expenses in Insurance and Other.

Berkshire Hathaway’s Insurance and Other segment revenues increased 2.5% year over year to $69.4 billion in 2020 on the back of higher insurance premiums earned. Pretax earnings were $6.8 billion, down 3.3% year over year. The results suffered due to premium reductions from the GEICO Giveback program, reduced claims frequencies for private passenger automobile insurance and increased loss estimates for certain commercial insurance and property and casualty reinsurance business as well as low rate environment.

Railroad, Utilities and Energy operating revenues declined about 4% year over year to $42.9 billion. Pretax earnings of $9.3 billion were down 6% year over year. The results reflect lower railroad operating revenues from lower shipping volumes, attributable to the negative effects of the COVID-19 pandemic, partly offset by lower operating costs and the effects of productivity improvements and increased tax benefits from renewable energy and increased earnings from the real estate brokerage business.

Total revenues at Manufacturing, Service and Retailing decreased 6% year over year to $134.1 billion. Pretax earnings declined about 12% year over year to $9.3 billion. Impacts of COVID-19 weighed on the results.

Financial Position

As of Dec 31, 2020, consolidated shareholders’ equity was $451.3 billion, up 5.3% from the level as of Dec 31, 2019. At quarter end, cash and cash equivalents were $48 billion, down 25.2% from the level at 2019 end.

The company exited 2020 with a float of about $139 billion, up $9 billion from the figure at year-end 2019.

Cash flow from operating activities totaled $39.8 billion in 2020, up 2.8% from the year-ago period.

The company bought back shares worth $24.7 billion in 2020.

Zacks Rank

Berkshire Hathaway currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Of the insurance industry players that have reported fourth-quarter results, The Travelers Companies TRV, W.R. Berkley Corporation WRB and Progressive Corporation PGR beat the Zacks Consensus Estimate for earnings.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

Berkshire Hathaway Inc. (BRK.B) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research