Berkshire's Top Holdings Report Earnings as Markets Dip on Macroeconomic Issues

During a week featuring several geopolitical fronts, which included Brexit and the U.S.-China trade negotiations, four of the top five holdings of Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) reported third-quarter earnings: Bank of America Corp. (NYSE:BAC), The Coca-Cola Co. (NYSE:KO), Wells Fargo & Co. (NYSE:WFC) and American Express Co. (NYSE:AXP).

Buffett's conglomerate has not yet released its third-quarter portfolio as the deadline is 45 days after the quarter ends per U.S. Securities and Exchange Commission regulations. As of second quarter-end, Buffett's top 10 holdings account for 80.41% of the $208.1 billion equity portfolio.

U.S. market ends week lower as Chinese economic growth disappoints

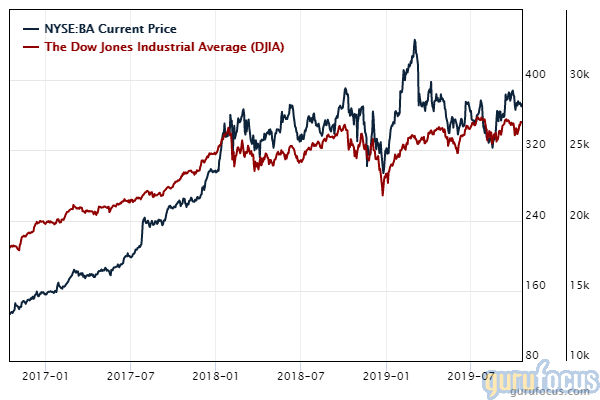

On Friday, the Dow Jones Industrial Average closed at 26,770.20, down 255.68 points from Thursday's close of 27,025.88 and 46.39 points from last Friday's close of 26,816.59. Stocks leading the Dow's decline included Boeing Co. (NYSE:BA) and Johnson & Johnson (NYSE:JNJ).

The Chinese economy grew 6% during the third quarter, its lowest growth in 27 years, as its trade war with the U.S. weighs on domestic and foreign demand for its goods. While the two countries made a trade agreement last Friday, investors questioned the validity of the deal on Monday, sending oil prices lower.

Additionally, despite the U.K. and European Union negotiating a "great" new Brexit deal, opposing parties might still reject it and increase the likelihood of a "no-deal Brexit" on Halloween.

Bank of America

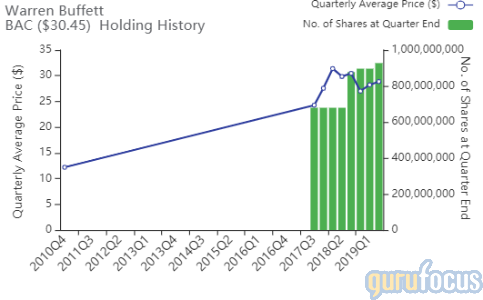

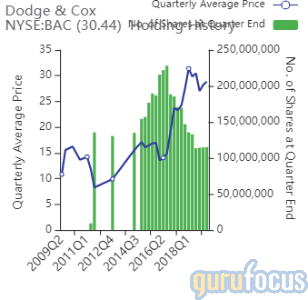

Berkshire owns 927,248,600 shares of Bank of America as of second quarter-end, giving the stake 12.92% weight in the equity portfolio. Based on GuruFocus estimates, the conglomerate has an estimated gain of 18.01% on the stock since its initial purchase during third-quarter 2017.

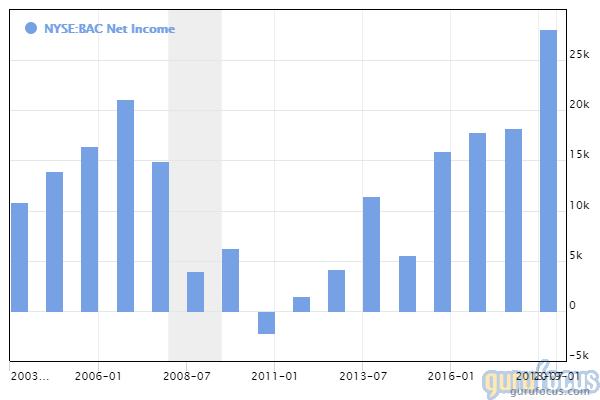

Bank of America reported net income of $5.8 billion, or 56 cents per diluted share, compared with $7.2 billion, or 66 cents per diluted share, during the prior-year quarter. Revenues net of interest expense increased modestly as an equity investment gain in the prior-year quarter offset strong growth in investment banking fees and net interest income.

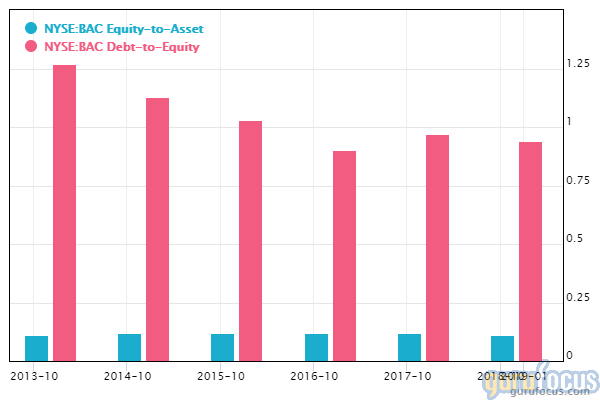

According to GuruFocus, Bank of America's cash-to-debt ratio of 0.6 underperforms 60.88% of global banks while its debt-to-equity ratio of 0.98 underperforms 62.76% of global competitors. Despite this, Bank of America has an equity-to-asset ratio that outperforms 60.49% of global banks.

Other gurus with large holdings in Bank of America include Dodge & Cox and PRIMECAP Management (Trades, Portfolio).

Coca-Cola

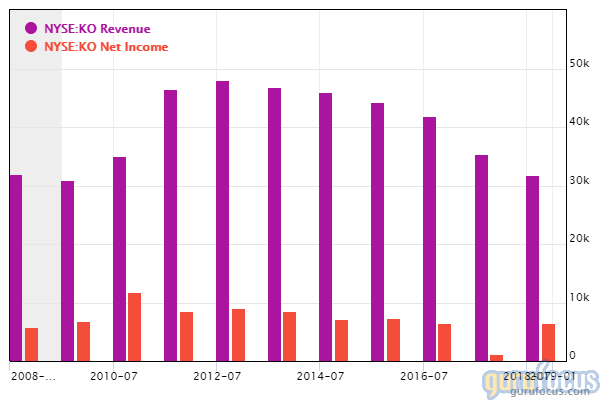

Shares of Coca-Cola were trading over 2% higher on Friday as the company reported revenue of $9.5 billion during the quarter, outperforming the Refinitiv consensus estimate of $9.4 billion. The Atlanta-based beverage giant reported net income of $2.6 billion, or 60 cents per diluted share, compared with net income of $1.8 billion, or 44 cents per diluted share, in the prior-year quarter.

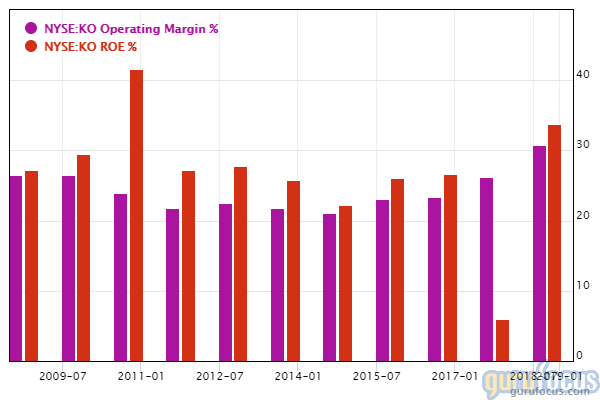

GuruFocus ranks Coca-Cola's profitability 9 out of 10: Coke's operating margin is near a 10-year high of 31.71% and outperforms 94.44% of global competitors, while its return on equity is close to a 10-year high of 42.25% and outperforms 97.65% of global non-alcoholic beverage producers.

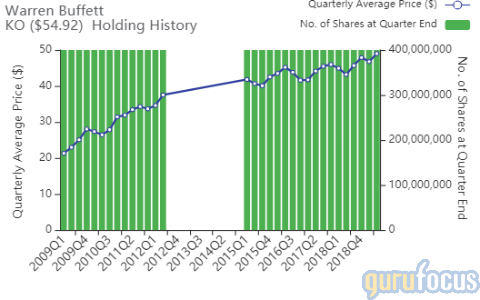

Buffett's conglomerate owns 400 million shares of Coca-Cola, dedicating 9.79% of its equity portfolio to the position.

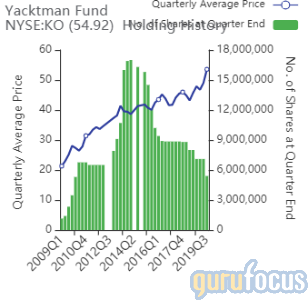

The Yacktman Fund (Trades, Portfolio) sold 1.7 million shares during the quarter, trimming its position 23.94%. While Coca-Cola shares averaged $53.55 during the quarter, shares closed on Friday at $54.78, up approximately 1.84% from the previous close and approximately 2.3% from the third-quarter average price.

Wells Fargo

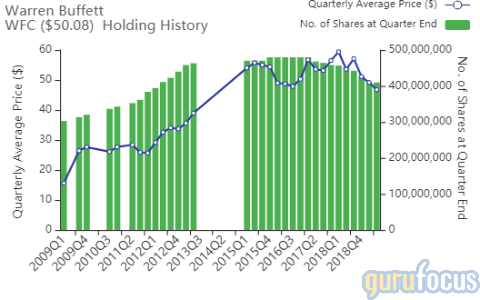

Berkshire owns 409,803,773 shares of Wells Fargo, giving the holding 9.32% equity portfolio weight.

Wells Fargo Interim CEO Allen Parker said on Tuesday that management is looking forward to former Bank of New York Mellon Corp. (BK) CEO Charles Scharf taking the head role of the San Francisco-based bank on Oct. 21.

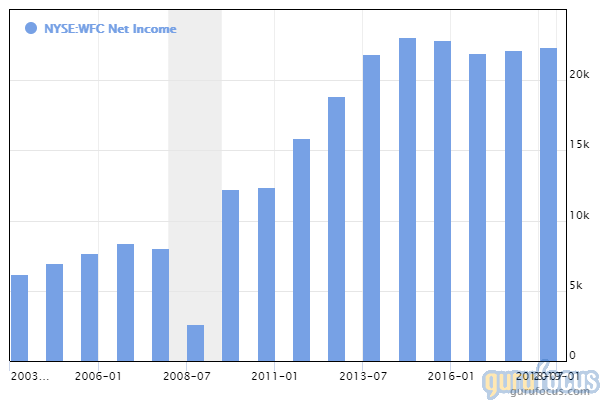

Chief Financial Officer John Shrewsberry said the bank reported $4.6 billion in net income, or 92 cents per diluted share, during the quarter, driven by strong growth in loans and net deposits both quarter over quarter and year over year.

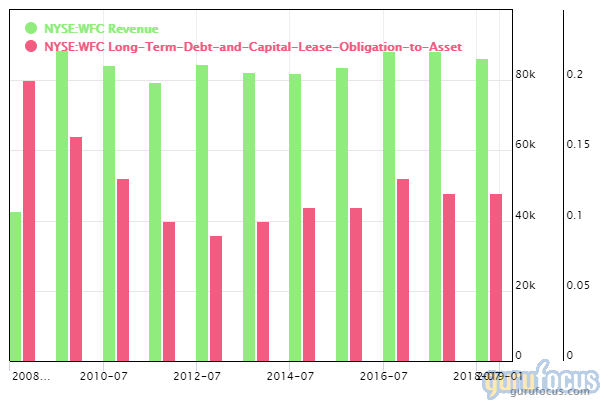

According to GuruFocus, Wells Fargo's cash-to-debt ratio of 0.42 and debt-to-equity ratio of 1.28 are underperforming 62.05% and 71.83% of global competitors. The website warns that Wells Fargo has increased its long-term debt by $533 million over the past three years, a significantly high amount given its cash position.

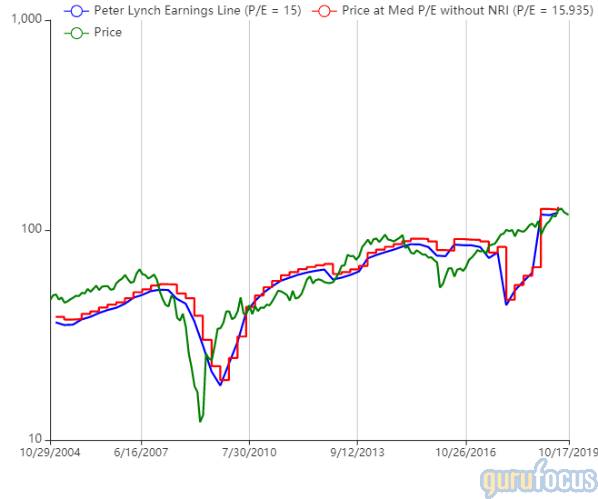

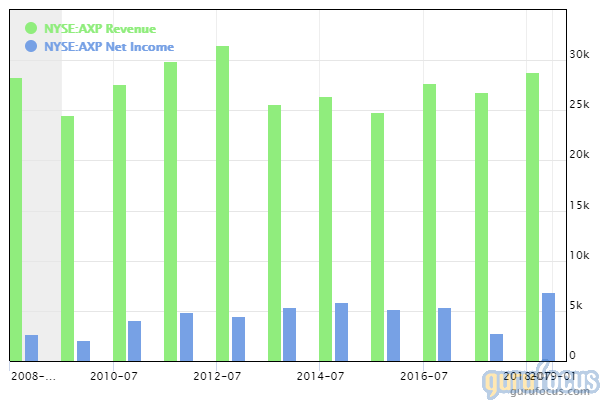

American Express

Shares of American Express closed at $116.76, down 2.01% from Thursday's close of $119.10 despite opening at $119.73, up 0.52% from the prior close.

The New York-based credit card company reported net income of $1.8 billion, or $2.08 per diluted share, compared with $1.7 billion, or $1.88 per diluted share, in the prior-year quarter. Revenues of $11 billion increased 8% on the heels of higher card member spending, net interest income and card fees. CEO Steve Squeri said American Express reported the ninth consecutive quarter of forex-adjusted revenue growth of at least 8%, with quarterly revenues from fee-based products exceeding $1 billion for the first time in the company's history.

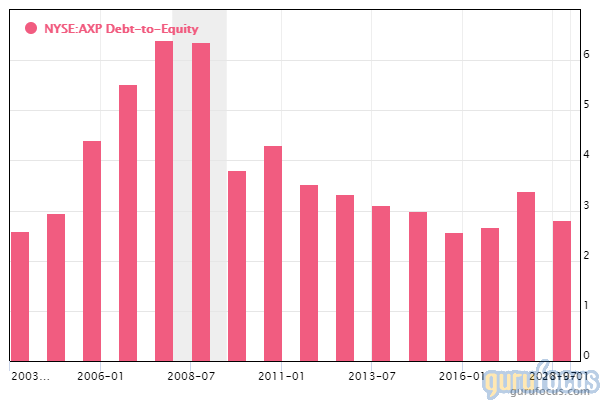

According to GuruFocus, although American Express has a cash-to-debt ratio that outperforms 63.66% of global competitors, the credit card company's equity-to-asset ratio underperforms 86.95% of global peers while its debt-to-equity ratio underperforms 67.81% of global credit services companies. The website also warns that American Express has increased its long-term debt by $7.5 billion over the past three years, further weakening its balance sheet.

Disclosure: No positions.

Read more here:

Hennessy Japan Fund's Top 5 Buys in 3rd Quarter

Spiros Segalas' Top 5 Buys in the 3rd Quarter

Third Avenue Value Fund's Top 5 Buys in the 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.