Berlin’s Housing Slump Is Over as Shortage Lures Investors

(Bloomberg) -- At a new housing development in northwest Berlin, the first apartments were ready for tenants in August and a short time later an investor from abroad was ready to collect the rent checks.

Most Read from Bloomberg

Largest Covid Vaccine Study Yet Finds Links to Health Conditions

Trump Keeps NY Empire Intact as Judge Rescinds Asset-Sale Order

Wall Street’s Moelis Bet Big on the Middle East. Now He’s Cashing In

Record US Stock Rally Is Under Threat From a World in Turmoil

Click here for a German version. Subscribe to our German newsletter.

Located near the Siemensstadt industrial district, Halske Sonnengärten — a project with 1,000 units from one-room studios to family-sized flats — was snapped up by Dallas-based CBRE Group Inc. in November as part of a €357 million ($382 million) deal. The property package, which included two other sites, is a sign of how Berlin’s housing market is attracting buyers and defying the drag of higher financing costs.

While prices across Germany are slumping, a steady influx of residents to the capital and lagging home construction have combined to intensify a shortage. That creates the prospect of higher rents, and deep-pocketed investors are eager to take advantage.

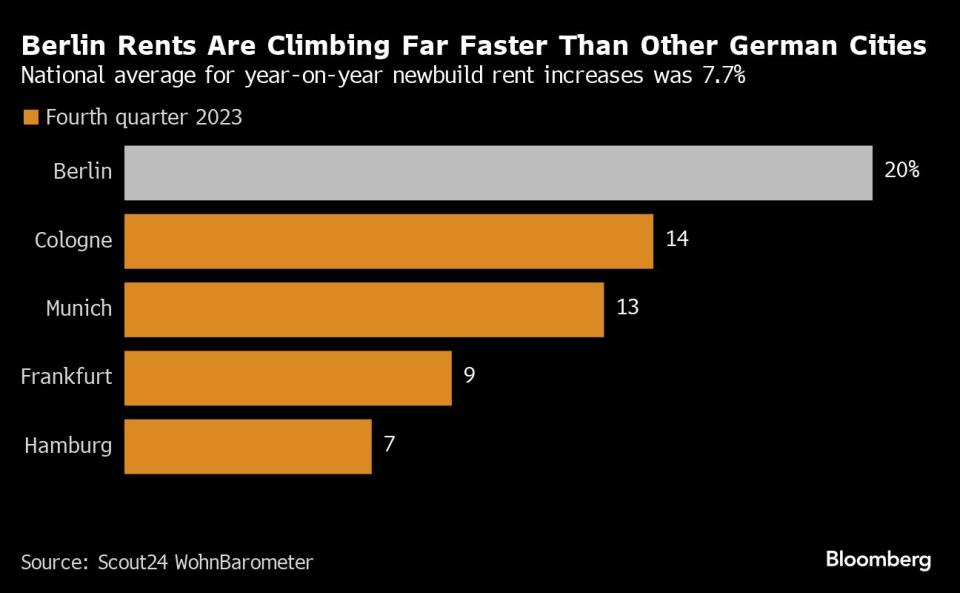

After a dip following rate hikes, Berlin’s housing prices rose for four consecutive months, according to data from online real estate broker Immowelt. The capital was the only big German city where home costs grew by more than 1% in the last quarter of 2023 — in contrast to declines of 2.6% in Frankfurt and 0.5% in Munich.

“International investors are looking very closely at Berlin,” said Andreas Polter, who leads real estate manager JLL’s residential investment team in the city. On top of prospects of further rent hikes, he said the lure is that it’s relatively cheap for a European capital and has a large rental market — only 15% of Berliners live in their own home.

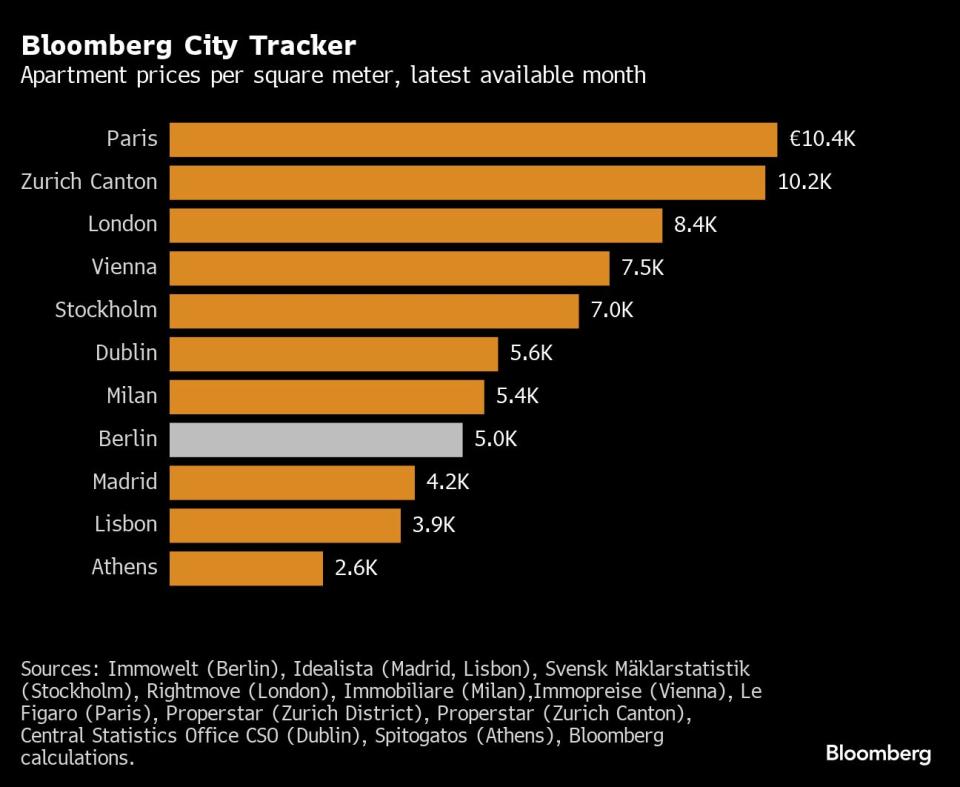

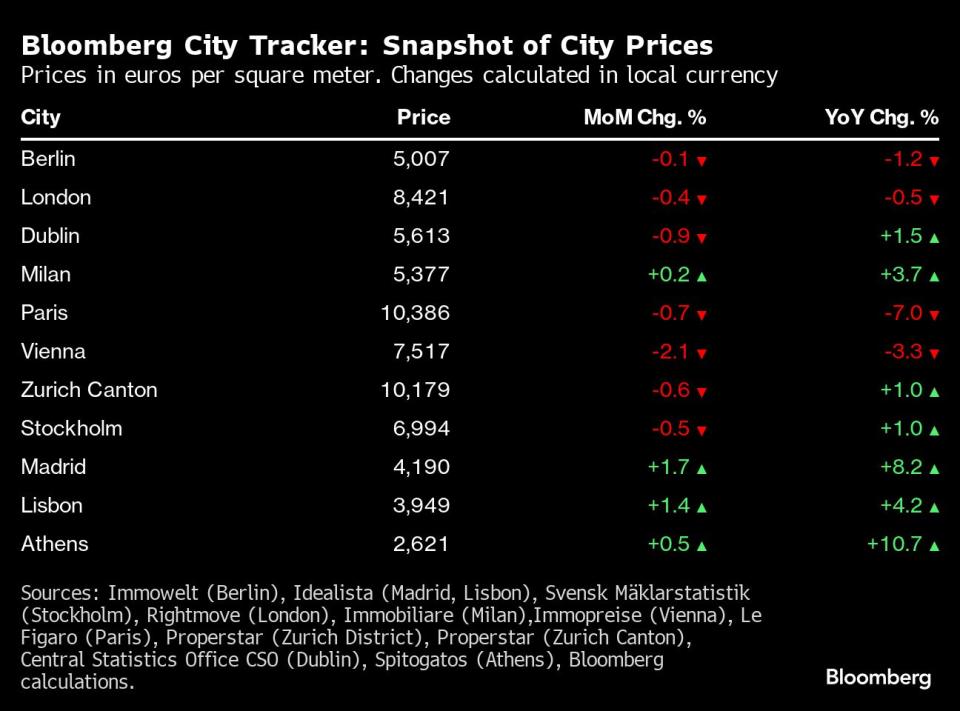

Berlin’s rebound is in line with other major cities squeezed by a lack of supply. Stockholm was a focal point of Europe’s housing crisis, but the Swedish capital has seen eight straight months of year-on-year increases, according to data in the Bloomberg City Tracker.

Seven of the eleven markets monitored by Bloomberg are showing gains, according to monthly data compiled from a range of providers. Some are asking rates and indicative levels, while others are official figures on transactions. Athens, Madrid and Lisbon are the strongest, while Paris and Vienna are slumping.

Click here to subscribe to City Tracker stories.

Berlin prices are down on a year-on-year basis and edged lower month-on-month in January, a traditionally slow period.

Housing has become a tense topic in Germany and across many advanced economies as the lack of affordable accommodation fuels frustration. Chancellor Olaf Scholz’s ruling coalition has failed to deliver on a promise of building 400,000 homes year, and all three parties have fallen behind the far-right Alternative for Germany in the polls.

“The housing completion numbers are deeply concerning,” said Aygül Özkan, managing director of the German Property Federation. “By 2025, there could be a shortfall of 750,000 apartments.”

Berlin is at the epicenter of Germany’s housing dilemmas. Considered “poor, but sexy” two decades ago when the city’s debt prompted a selloff of social housing, a booming tech industry and sluggish building has long ended that era.

Read More: Berlin’s Barren Housing Market Is Putting Its Tech Boom at Risk

Finding affordable living space is the biggest hurdle newcomers now have, said Niklas Almerood, head of relocation firm IRC Relocation. “There are simply more people moving to Berlin than there are apartments available.”

Political frustration is high across the city, but especially tense in trendy, former working-class neighborhoods like Kreuzberg, where many locals have been squeezed out. In 2021, a referendum passed calling on authorities to expropriate large landlords to replenish public housing stock. The grassroots movement was in part a reaction to a failed effort to freeze rents in 2020.

While the legislation was struck down in court, it had the fallout of further dampening supply for tenants. With fewer options available, expectations are that rents will continue to climb, and so more tenants are looking to escape the upward spiral, according to real estate broker Savills.

“Even solvent households find it increasingly difficult to find suitable rental apartments,” said Matti Schenk, Savills Germany’s associate director of research, adding that the shift is helping fuel Berlin’s reversal in home prices.

In 2022, Berlin’s population increased by more than 80,000 people as thousands of Ukrainians fled Russia’s invasion, adding to the steady numbers of students and tech workers. During the same year, the city only built slightly more than 17,000 new apartments. Overall, home construction has failed to keep pace with population growth almost every year over the past decade.

Higher financing costs could also open up opportunities for large investors to grab rental properties like Halske Sonnengärten. The development was sold by a unit of Vonovia SE, Germany’s largest landlord. Many real estate companies piled on debt during the cheap-money era and now have to sell properties to refinance.

Newbuilds are by far more attractive. Prices for older buildings, which often have tenants on cheaper contracts and risk massive renovation costs, were still falling Germany-wide in January, according to a survey by real estate financing platform Europace. In the same period, new projects recorded a slight uptick, widening the gap between the segments.

Embattled Adler Group SA also sold a portfolio of new facilities in Berlin late last year and a recent court ruling over its €6 billion restructuring plan could accelerate disposal plans.

The city is likely to remain high on investor wish lists, according to JLL’s Polter. “Despite all expropriation debates and interventions in the rental market, from an international investor’s perspective, Berlin is still top class,” he said.

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

How Paramount Became a Cautionary Tale of the Streaming Wars

‘Playing God’: This Labor Activist’s Relentless Emails Force Companies to Change

©2024 Bloomberg L.P.