Berry Global (BERY) Tops Q3 Earnings Estimates, Updates View

Berry Global Group, Inc. BERY reported better-than-expected results for third-quarter fiscal 2021 (ended Jul 3, 2021). Its earnings surpassed estimates by 0.7%, this being the eighth consecutive quarter of a beat. Also, the quarter’s sales beat estimates by 14.6%.

The company’s adjusted earnings in the reported quarter of $1.53 per share surpassed the Zacks Consensus Estimate of $1.52. Also, the bottom line rose 0.7% from the year-ago number of $1.52.

Revenue Details

In the quarter under review, Berry Global’s net sales were $3,675 million, reflecting year-over-year growth of 26.3%. The improvement was driven by $533 million contributions from higher selling prices, 5% growth in organic volumes and favorable impacts of $147 million from movements in foreign currencies. Divestitures had an adverse impact of $62 million.

Also, the top line surpassed the Zacks Consensus Estimate of $3,207 million.

The company reports results under four segments — Consumer Packaging–International, Consumer Packaging–North America, Health, Hygiene & Specialties, and Engineered Materials. A brief snapshot of fiscal third-quarter segmental sales is provided below:

Consumer Packaging–International’s sales were $1,095 million, up 21.1% from the year-ago quarter. Organic volume growth of 5% was driven by gains from organic growth investments and improvement in some end markets. It accounted for 29.8% of the quarter’s net sales.

Consumer Packaging–North America’s sales were $847 million, increasing 31.5% year over year. Recovery in some end markets drove 6% growth in organic volumes. It accounted for 23.1% of the quarter’s net sales.

Revenues generated from Health, Hygiene & Specialties amounted to $828 million, up 23.8% year over year. Organic volumes in the reported quarter increased 1%. It accounted for 22.5% of the quarter’s net sales.

Revenues from Engineered Materials grew 30.6% year over year to $905 million. Organic volumes grew 8% as operations in some markets recovered from the pandemic woes. Organic growth investments too aided results. It accounted for 24.6% of the quarter’s net sales.

Margin Profile

In the fiscal third quarter, Berry Global’s cost of goods sold increased 34.2% to $3,049 million. It represented 83% of net sales compared with 78.1% in the year-ago quarter. Selling, general and administrative expenses rose 4.5% to $207 million and represented 5.6% of net sales.

Operating earnings before interest, tax, depreciation and amortization (EBITDA) was $565 million, down 2.8% year over year. EBITDA margin was at 15.4% versus 20% in the year-ago quarter.

Adjusted operating income in the quarter decreased 5% year over year to $359 million. Adjusted operating margin came in at 9.8%, down 320 basis points year over year. Interest expenses were $76 million, down 30.9% year over year.

Balance Sheet & Cash Flow

Exiting third-quarter fiscal 2021, Berry Global’s cash and cash equivalents were $804 million, down 4.6% from $843 million in the previous quarter. Current and long-term debt decreased 1.9% to $9,694 million from the previous quarter.

In the first three months of fiscal 2021, the company repaid $3,287 million of borrowings. Its proceeds from borrowings totaled $2,716 million.

In the first three quarters of fiscal 2021, it generated net cash of $912 million from operating activities, down 6.8% from the year-ago period. Capital expenditure in the period totaled $520 million, increasing 24.1% from $4196 million spent in the year-ago period.

Outlook

Berry Global is focused on creating organic growth opportunities and improving the balance sheet. Demand across businesses is expected to be strong in the quarters ahead. For fiscal 2021 (ending September 2021), it increased operating EBITDA guidance to $2.26 billion from the previously mentioned $2.25 billion. Organic sales are predicted to be 5% year over year (maintained).

Free cash flow is predicted to be $875 million in fiscal 2021, at the lower end of the previously mentioned $875-$975 million. Cash flow from operations is expected to be $1,575 million, at the lower end of $1,575-$1,675 million stated earlier. Capital expenditure will likely be $700 million, unchanged from the previous projection.

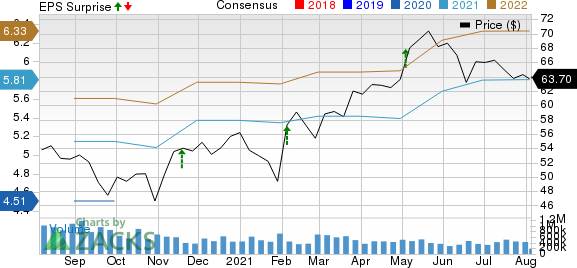

Berry Global Group, Inc. Price, Consensus and EPS Surprise

Berry Global Group, Inc. price-consensus-eps-surprise-chart | Berry Global Group, Inc. Quote

Zacks Rank & Stocks to Consider

With a market capitalization of $8.7 billion, Berry global currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Industrial Products sector are Greif, Inc. GEF, Dover Corporation DOV and Altra Industrial Motion Corp. AIMC. While Greif currently sports a Zacks Rank #1 (Strong Buy), both Dover and Altra Industrial carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for these companies improved for the current year. Further, earnings surprise for the last reported quarter was 1.80% for Greif, 11.96% for Dover and 8.54% for Altra Industrial.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dover Corporation (DOV) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC) : Free Stock Analysis Report

Berry Global Group, Inc. (BERY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research