Best Stock Traits to Look for as Markets Tumble

As February draws to a close, U.S. markets continue their downslide as fears of the new coronavirus (Covid-19) abound. In midday trading as of Feb. 28, the S&P 500 is down 13.09% from the previous week, marking the fastest correction since the financial crisis in 2008.

While stock prices inevitably take a hit during market corrections and recessions, their underlying companies may not all suffer as much as the general investing public fears. For example, people may buy fewer luxury goods in financially lean times, but few (if any) are going to stop buying essentials like food, toothpaste and toilet paper.

Each company has its own unique set of advantages and disadvantages, but in general, a stock is more immune to declining economic conditions if it has a good balance sheet, is valued fairly, supplies essential products that need to be frequently purchased and has little or no connection to whichever factors triggered said declining economic conditions.

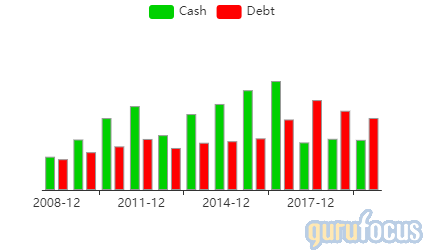

Good balance sheet

Debt is cheap in the U.S. It's been that way since the financial crisis in 2008, when the Federal Reserve lowered interest rates to stimulate the flagging economy. When the economy strengthened, the Fed kept on lowering interest rates in order to stave off the next crisis for as long as possible, which sent companies on a decade-long debt binge that has destroyed their balance sheets.

When debt is cheap, it's easy to get caught in the trap of borrowing as much as you can in order to make your business prosper. Even if your business prospers, however, it might not be enough to make ends meet, in which case you can just take on more cheap debt in order to pay the bills. This is why the balance sheets of U.S. companies are looking worse than ever, and it is also why increasing numbers of billion-dollar investment firms are taking huge stakes in companies that they would have rejected decades ago for being free cash flow negative.

The problem here is that debt acts as leverage. When a company prospers, borrowing money can multiply profits, but as soon as the market takes a sharp enough turn for the worse, that borrowed money will multiply losses instead. One of the best examples of this is the collapse of the subprime mortgage market that triggered the Great Recession, in which the ownership of debt that had been so profitable in the past sent giants like Lehman Brothers and Washington Mutual straight to Chapter 11 bankruptcy.

Thus, the companies that will see their profits take the least hits during market downturns are those whose balance sheets are in good shape. An easy way to find such companies is to utilize GuruFocus's All-in-One Screener, a Premium feature, which allows users to screen for companies based on factors such as interest coverage, cash-debt ratio, Altman Z-score, financial strength rating and more.

One example of a company with good financial strength is Johnson & Johnson (NYSE:JNJ), a major drug manufacturer and supplier of consumer health products, which has a GuruFocus financial strength score of 7 out of 10. The cash-debt ratio of 0.61 is above average for the industry, while the interest coverage of 63.14% indicates the company has plenty of funds to pay interest on its debt. The current ratio of 1.26 means that it can pay off short-term debt, while the Altman Z-score of 4.25 indicates longer-term financial stability.

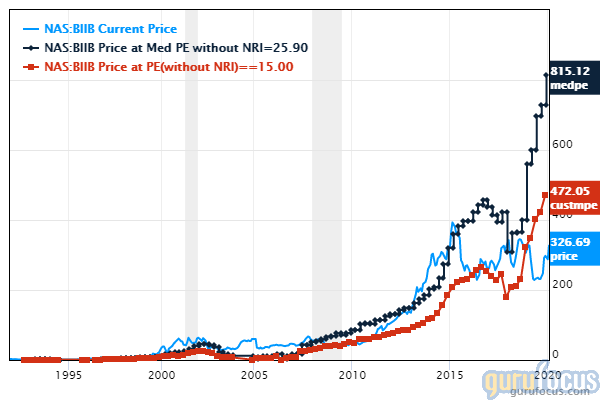

Valued fairly

Another factor that can leverage losses during market downturns is overvaluation. When stocks are trading higher than what their underlying companies are worth, they are more likely to see their share prices take a significant hit as the optimism that they were built on crumbles.

Take Tesla Inc. (NASDAQ:TSLA), for example. The electric vehicle and clean energy company skyrocketed to infamy in the investing world after posting its second consecutive quarter of net profits for the fourth quarter of 2019. Speculators bid shares up from $300 to over $900 in less than two months, only to see them trade down to around $650 on worries that the coronavirus-related closure of the company's Shanghai Gigafactory will push net income back into the red.

The foundation of value investing is to not buy shares of a company if they are trading above their intrinsic value, a metric which can sometimes be difficult to assess. The price-earnings ratio is often considered the rule of thumb, but there are many exceptions. For example, cyclical companies such as Ford Motor Co. (NYSE:F) and other automobile manufacturers often trade near their lowest price-earnings ratios right before the end of a cyclical upswing.

One sign of an impending market correction is the overvaluation of the stock market in general. As the U.S. economy has climbed toward a record overvalued range on the wings of cheap debt, finding stocks that are trading near or below their intrinsic value has become more difficult.

Even renowned value investor Warren Buffett (Trades, Portfolio) has been sitting on a cash pile of $128 billion for the past year due to the lack of big value opportunities. "Prices are sky-high for businesses possessing decent long-term prospects," Buffett wrote in his 2019 annual letter to shareholders.

A potential U.S. value opportunity could be Biogen (NASDAQ:BIIB), a biotech company that develops drugs for the treatment of neurological and neurodegenerative diseases and disorders. It has a GuruFocus valuation rating of 8 out of 10 and, according to the Peter Lynch chart, the stock is trading below what its earnings are worth.

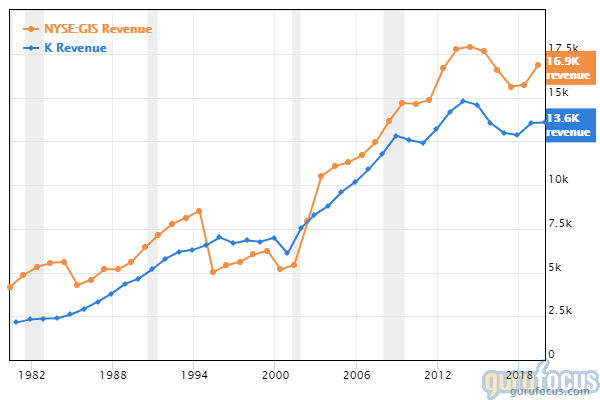

Essential products

Perhaps the most reliable predictor of steady profits is when a company sells products that customers must buy regularly, either out of necessity or in order to keep up a basic standard of living quality. No matter how bad the economy gets, people are unable to stop buying food and extremely unlikely to give up things like toothpaste, toilet paper and soap.

Companies in this space tend to have strong financials as well, with the exception of food companies. Johnson & Johnson and Procter & Gamble (NYSE:PG), which both sell a wide variety of daily necessities, both have high financial strength ratings from GuruFocus.

The packaged foods industry can also provide a source of stable, recession-proof stocks. General Mills (NYSE:GIS), for example, saw its revenue grow steadily through the past three recessions.

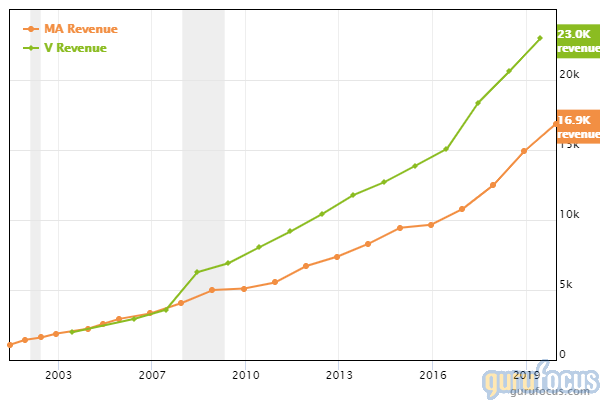

Though not a physical product, the services of payment processing companies like Mastercard (NYSE:MA), Visa (NYSE:V) and PayPal (NASDAQ:PYPL) can also be defined as essential for the U.S. It's easier to pay with a card than cash, and online purchases almost always must be made by card. However, it should be noted that in the case of a full-blown recession, it is possible that any increase in profits may be mitigated by consumers spending less money overall. While this did not happen to Mastercard or Visa during the last recession, it becomes more of a possibility as a higher percentage of payments are processed electronically.

No connection to triggers

Lastly, whenever trouble starts to boil in the economy, it's typically best to stay out of investments that have a significant stake in whatever triggered the problems, at least until more information becomes available. When the situation is still unclear, it is easier to make a miscalculation.

On the surface level, we see that far fewer people were buying tech stocks after the dotcom bubble burst, and no one wanted bank stocks after the mortgage crisis. With the outbreak of the new coronavirus, investors are now pulling their money out of the stocks of companies that have supply chains in China, including giants like Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT).

However, many companies that are not so clearly connected could also suffer. Fears of an epidemic bring an increased reluctance to travel, which will negatively impact the profits of companies who rely on travelers for their income. Cruise ship operator Carnival Corp. (NYSE:CCL), for example, expects to see decreased revenue due to port closures in Asia. It may also face additional expenses if it is forced to quarantine one or more of its ships due to an infected passenger.

"While not currently planned, if the company had to suspend all of its operations in Asia through the end of April, this would impact its fiscal 2020 financial performance by $0.55 to $0.65 per share, which includes guest compensation," a Carnival representative said in a statement.

The U.S. and Chinese economies are highly interconnected, perhaps more so than many people realize, making it difficult to find large-cap U.S. stocks that do not rely on China for a significant amount of their production or profits. In addition, if the virus begins to spread in the U.S., and if the U.S. also reacts by shutting down significant portions of its economy, this point may become null.

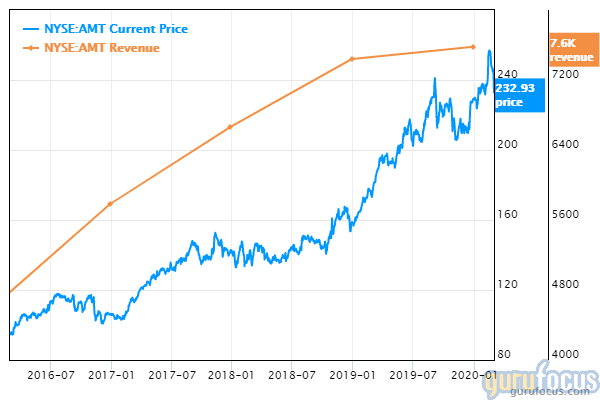

Thus, it is best to look for stocks that will not be as negatively affected by shutdowns and decreases in face-to-face customer interaction. One such company is American Tower Corp. (NYSE:AMT), which is down only 0.9% following coronavirus outbreak. American Tower is a real estate investment trust that owns cell phone towers and other communication infrastructure real estate, and it derives its revenue from the continued use of its properties for communication services.

Payment processing companies such as Mastercard also fit into this category. If anything, the online payments processing industry is likely to get a boost if people become more reluctant to leave their homes due to virus-related fears.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research or consult registered investment advisors before taking action in the stock market.

Read more here:

Boeing and T-Mobile's Credit Set to Follow in Kraft Heinz's Footsteps

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.