Beyond Meat vs Kellogg vs Restaurant Brands: Which is the Better Buy?

Investors might be wondering what Beyond Meat (BYND), Kellogg (K) and Restaurant Brands International (QSR) all have in common. The answer is that each wants to control the plant-based meat segment of the market.

With Barclays predicting that plant-based product sales will reach $140 billion in the next decade, it’s no wonder food companies are expanding their product offerings to include meatless alternatives.

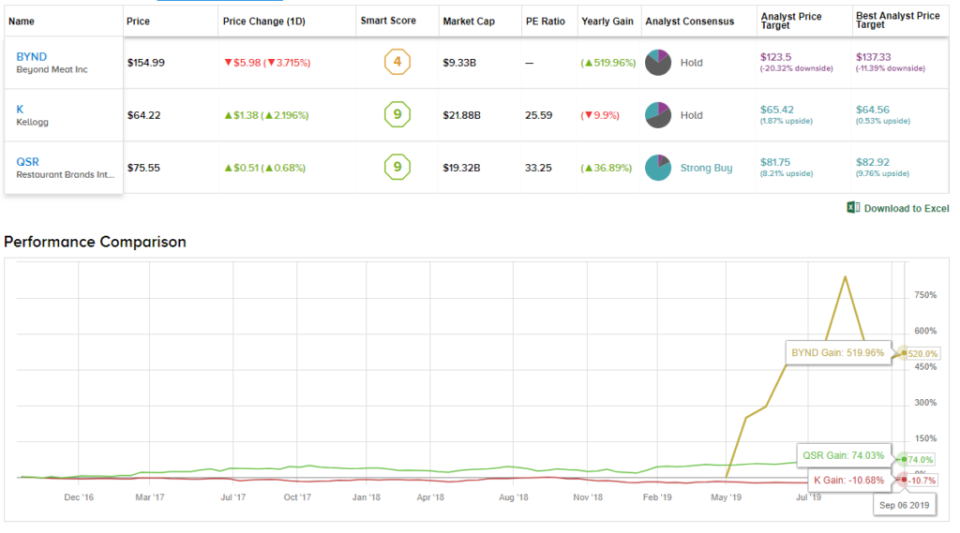

Bearing this in mind, we used the TipRanks Stock Comparison tool to see which stock serves up the most compelling investment opportunity.

Let’s get started.

Beyond Meat Inc. (BYND)

It’s no question that Beyond Meat has disrupted the vegan food market. The first plant-based meat producer has skyrocketed 136% since its May 2 IPO.

BYND already boasts Dunkin (DNKN) and Kentucky Fried Chicken (YUM) as partners, with its products also appearing in many grocery stores. That being said, analysts aren’t convinced that BYND has what it takes to outperform in the long-run.

The fact is, plant-based meat isn’t a patented technology, with several companies following BYND’s lead by adding their own vegan meat options. Kroger (KR) announced on September 5 that it was launching plant-based deli meats and sausages under its Simple Truth brand.

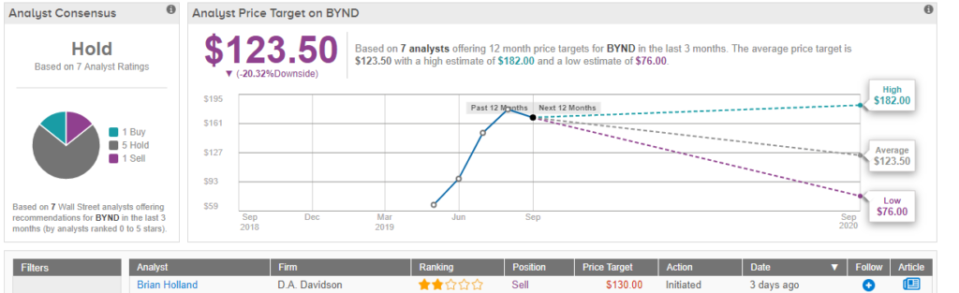

One analyst argues that its fast-growing retail presence, attractive placement and favorable media impressions won’t be enough to shield BYND from the competition. D.A. Davidson’s Brian Holland states that its larger competitors have the resources and pricing power that BYND just doesn’t have.

It doesn’t help that BYND has a valuation problem. “We estimated EV/Sales on fiscal 2024 estimates of $1.2089 billion and discounted back. This multiple is already a 50% premium to Beyond Meat's Growth Staples peers and compares to the stock's current multiple of 29.5 times NTM revenue,” Holland noted.

Based on all of the above factors, the analyst initiated coverage with a Sell and set a $130 price target on September 5. He thinks that share prices could drop 16% in the next twelve months.

All in all, Wall Street analysts deem BYND a ‘Hold’. Its $124 average price target indicates 20% downside potential.

Kellogg (K)

Kellogg is one of the many companies trying to take market share from BYND.

The company announced on September 4 that it is launching its plant-based meat, Incogmeato, in early 2020. These burgers will be released under the MorningStar brand and are different from its existing veggie burgers as they are fully plant-based. K will also start selling plant-based chicken nuggets and tenders.

In addition to its foray into the plant-based food space, Kellogg has pivoted away from its legacy cereal-first approach with it shifting focus towards the snack segment of its business. In January, the company started selling Cheez-It Snap’d as well as launched Pop-Tart Bites and Rice Krispie Treat Poppers in 2018.

Not to mention the company already added protein bars to the product lineup with its $600 million acquisition of RXBAR in 2017.

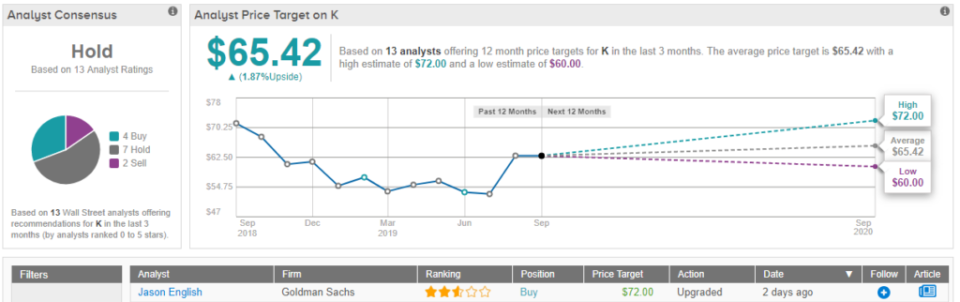

While some analysts think K's upside has already been factored into the share price, Goldman Sachs analyst Jason English argues that these positive developments could drive a profit margin improvement as well as stronger organic sales. “A number of changes have occurred at the company in recent years that we believe will sustain a faster growth trend at K than the company has been able to historically achieve; primarily a strategic pivot to snacks (vs. its legacy cereal-first approach) and completed M&A (albeit at lofty valuations) which has bolstered its EM exposure,” he explained. As a result, he upgraded the stock from a Hold to a Buy while raising the price target from $58 to $72 on September 6. The new price target demonstrates his confidence that shares could surge 12% over the next twelve months.

Wall Street isn’t as bullish on Kellogg. 4 Buy ratings versus 7 Holds and 2 Sells assigned over the last three months add up to a ‘Hold’ analyst consensus. Its $65 average price target suggests 2% upside potential. While this upside is minor, K still boasts better growth prospects than BYND.

Restaurant Brands International (QSR)

The last stock on our list is known as the force behind Burger King, Tim Hortons and Popeyes, with it also hoping to ride the vegan wave.

In the beginning of August, Burger King launched its plant-based burger at over 7,000 U.S. locations. The Impossible Whopper is the product of its partnership with Impossible Foods, a top Beyond Meat rival.

According to Cowen & Co. analyst Andrew Charles, the Impossible Whopper could drive 6% same-store sales growth in the third quarter at Burger Kings located throughout the U.S. The plant-based burger is convincing consumers to spend more as orders with the Impossible Whopper cost $10 or higher, compared to Burger King's average check of $7.36 in 2018.

“While data is limited, our check suggests Impossible Whopper is attracting new and lapsed users to the brand that skew younger and affluent, as well as driving high rates of repeat orders," Charles added.

Investors have more reason to be excited about QSR thanks to its new Popeye’s chicken sandwich launch. After its widely successful August 12 launch left several locations sold out, management stated it blew through the inventory of chicken filets a month ahead of schedule thanks to intense social media buzz.

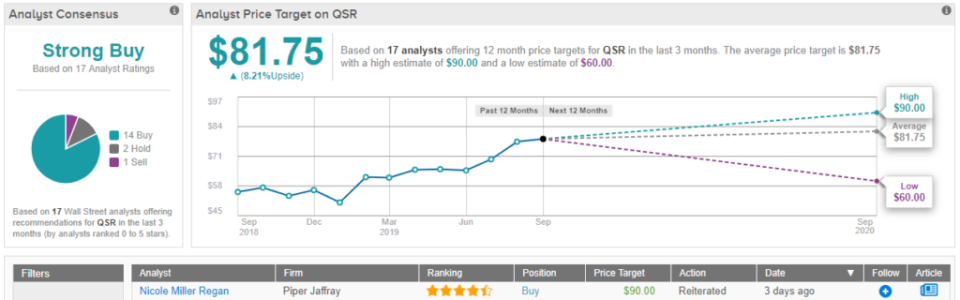

All of this played into Charles’ conclusion that QSR is poised to soar. As a result, the five-star analyst reiterated his Buy rating and $85 price target on August 29. He believes shares could gain 13% over the next twelve months.

Wall Street appears to mirror the analyst’s sentiment. QSR boasts a ‘Strong Buy’ analyst consensus and an $82 average price target, implying 8% upside potential.

The Bottom Line

The results are in and according to Wall Street analysts, QSR is the top pick. While the Stock Comparison tool shows that BYND's gain was the largest, QSR is the long-term winner as it comes out on top in terms of both analyst consensus as well as upside potential.

Find Wall Street’s most loved stocks with the Top Analysts’ Stocks tool