Biden’s anti-poverty measures are stumbling out of the gate

- Oops!Something went wrong.Please try again later.

When Democrats passed the American Rescue Plan back in March, an analysis from the Urban Institute held that it would cut child poverty by half this year. This figure was widely touted by liberals as being the biggest (albeit temporary) attack on poverty in decades.

But it's clear now that level of impact will definitely not come to pass, unless the Biden administration takes some big steps to fix the stumbling rollout of the ARP, and quick.

The first problem is with the extended boost to unemployment insurance, which was estimated to cut poverty by 1.1 percentage points. Since then, some 25 Republican states have announced they intend to end the program early, and in some places the cuts have already started. As I have detailed before, states are legally allowed to refuse the $300 supplement to benefits, but they are not allowed to cancel the extension of unemployment eligibility, or benefit duration.

Yet the Department of Labor has not taken any legal steps to stop conservative states from illegally denying benefits, and indeed President Biden seems to be conceding their (wrong) arguments that the unemployment boost is causing a labor shortage. That is going to put a sizable dent in the law's anti-poverty effect, because the Urban Institute estimate assumed those payments would go out until the program expires in September.

The more important problem is with the IRS and Biden's expansion of the Child Tax Credit (CTC), which was estimated to cut poverty by 0.9 points by itself — and help with deep poverty especially, because the poorest people in the country are generally single parents. Even before the pandemic, the IRS was struggling to fulfill its duties, thanks to over a decade of repeated budget cuts and staff reductions. Then the pandemic rescue packages loaded another huge burden on its back: the rounds of (mostly) universal checks, which required it to stand up a completely new system that would end up transferring over 160 million payments to addresses or bank accounts. The under-funded and under-appreciated IRS bureaucrats did manage to get most of those checks out eventually (which played no small part in keeping the country on two legs last year), but the lack of resources and heavy workload badly set back the processing of tax returns this year. Today many people are still waiting for their $1,400 check or their tax refund.

The ARP added yet another task for the IRS that is even more difficult — a quasi-child allowance that is structured as an advance payment of the CTC. This is not going very well, particularly when it comes to the poor. As I argued when the law was passed, it is straight-up nonsensical to base monthly payments on eligibility for a yearly tax credit when the year isn't over yet. It means a mountain of paperwork and both under- and over-payments when some future income estimates inevitably turn out wrong.

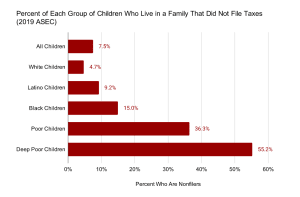

More importantly, most poor people are not required to file their taxes, and a lot of them don't do so. CTC advance payments are supposed to start going out next month, and the agency estimates that it is going to miss about 10 percent of eligible families. As Matt Bruenig and Paul E. Williams write at the People's Policy Project, over a third of children in poverty live in nonfiler households, and over half of children in deep poverty:

Matt Bruenig

(Courtesy People's Policy Project)

So far the only strategy the IRS has rolled out to reach nonfilers is a website apparently built by tax prep company Intuit where people can punch in their information. As Michelle Singletary writes at The Washington Post, the page is English-only, written in dense tax jargon, looks like crap, and worst of all, is not mobile-friendly. As Williams points out, only about half of the poorest people have a desktop computer. It's a pathetic effort.

This website could surely be improved, but realistically speaking, any kind of administrative headache can't help but cause millions of people to fall through the cracks. (Less than three-quarters of poor people have smartphones.) It's the same story with food stamps, WIC, the Earned Income Tax Credit, and everything else that requires impoverished people to fill out a lot of forms. The only way to even theoretically reach everyone who is eligible for the CTC is for the government to do the work of enrollment — setting up a big database with all the nonfiler addresses, income data, and so forth (as the IRS already does for people who do file their taxes), and sending out the payments automatically.

Somebody in the Biden administration needs to get on this — either beefing up the IRS effort, or setting up some external outreach programs to help people get enrolled. Without that, many of the worst-off families won't get the help they need, and potential voters who might have supported Democrats will instead be disillusioned.

You may also like

RNC, without 'a hint of irony,' slams Biden for meeting with Putin

Bernie Sanders wants to know if cannabis reporter is 'stoned' right now