Biden invokes Defense Production Act for EV battery materials: How it impacts automakers

- Oops!Something went wrong.Please try again later.

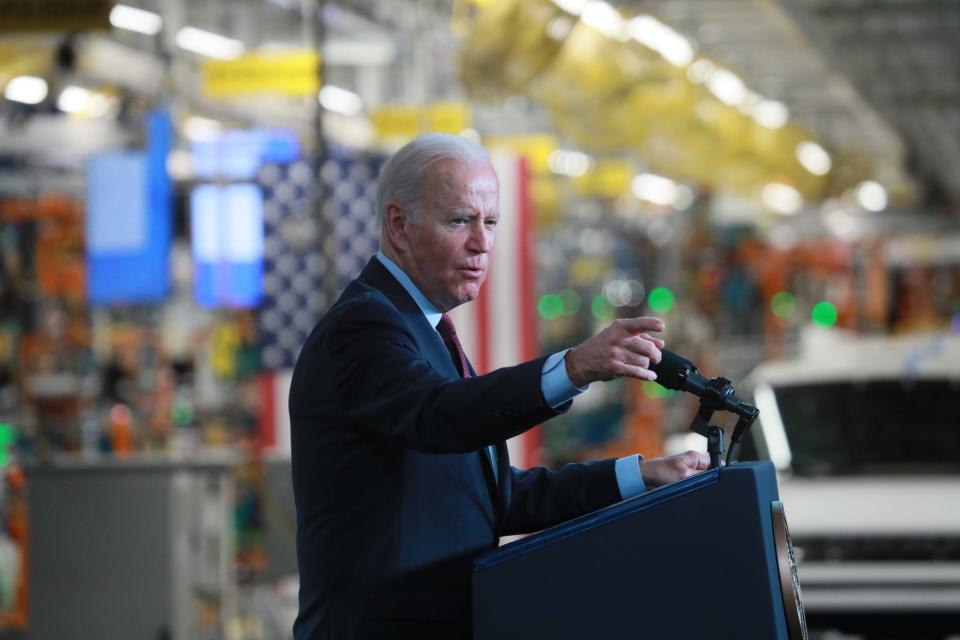

President Joe Biden said Thursday he will invoke the Defense Production Act to boost domestic mining and production of key minerals used in electric vehicles, a big move to help the Detroit automakers transition to EVs.

It was part of a broader announcement addressing gasoline prices.

The move means that battery materials will be added to the list of items covered by the 1950 act, which former President Harry Truman invoked to make steel for the Korean War and which President Donald Trump called on to boost mask production amid the COVID-19 pandemic.

The Detroit Three are investing billions in an all-electric future including building new factories to assemble batteries for the EVs. As for Biden, he is acting on his promise to help accelerate the adoption of EVs.

“We need to end our long-term reliance on China and other countries to supply the inputs” used in U.S. electric vehicles, Biden said.

By invoking the Defense Production Act to provide incentives for companies to mine and process more minerals for EVs, it will help the U.S. tackle climate change and it will lead to the creation of new jobs.

“It will also save your family money,” Biden said, citing studies that indicate a typical driver will save about $80 a month by not having to pay for fuel.

Price of EVs

Domestic production of the materials that go into EVs will give all automakers a more secure supply chain and lower manufacturing costs.

There would also be fewer production disruptions.

"Right now, our supply chains for raw materials are coming from Australia, South Africa, South America, Russia and China. Most of the (refining) of these raw materials is being done in China," said Carla Bailo, CEO for Center for Automotive Research in Ann Arbor. "Because of political strife, we have to remove some of that dependence on other countries."

Bailo agreed that Biden's move will likely create jobs as more mining companies spring up. It will also bring down the cost of shipping, but compared with the cost of raw materials, logistics expenses are "a drop in the bucket."

That means the sticker price on EVs won't go down for car buyers in the near term.

"It makes sense on paper to control the supply chain, but it doesn’t mean it’ll help the consumer," said Joe McCabe, CEO of auto industry advisory firm AutoForecast Solutions. "It's going to help lower the manufacturing costs, which will help the profit margins of the electric vehicle manufacturers. But we’re still trying to convince a consumer to spend $50,000 and much more on electric vehicles."

Detroit Three reaction

Still, the only way to get a significant uptick in electrification is to control more of the costs and the domestic production of the core ingredients in EVs, McCabe said.

"Then we’ll be able to drop the manufacturing cost of EVs," McCabe said. But he also noted sticker prices will remain high. "The manufacturers can’t afford to lose money on every vehicle for the sake of a carbon footprint and those general economic problems of running a business are still there."

The Detroit Three know the cost of transitioning to a future of all electric vehicles.

General Motors, for example, is investing $35 billion by 2025 in EV and self-driving technologies. GM said it will bring 30 new EVs to market by that time. It is funding that research off the sales of pricey gasoline-powered pickups and large SUVs.

GM is also part of a joint venture with LG Energy Solution called Ultium Cells LLC. Ultium Cells is building three battery cell plants in the U.S. to help power GM's future EVs. GM is building one of those Ultium Cells plants in Lansing.

More: GM to invest historic $7 billion in 4 facilities across Michigan, creating 4,000 jobs

Late last year, GM started building the 2022 GMC Hummer EV pickup, its first EV off its new battery cell and propulsion platform called Ultium. The Hummer is built at Factory ZERO in Detroit and Hamtramck. This spring, GM will bring the Cadillac Lyriq electric SUV to market. GM just started Lyriq production at Spring Hill Assembly in Tennessee.

Ford Motor Co. has said it will boost spending on electric vehicles to $50 billion, up from the previous $30 billion, through 2026. It offers the Mustang Mach-E SUV and the Ford F-150 Lightning is being launched in coming months.

More: Ford's plan to cut $3B in waste will funnel money from gas vehicles to fund electric, tech

Stellantis and South Korea’s LG Energy Solution say they will invest $4 billion to build an electric vehicle battery plant in Windsor, Ontario. Stellantis has plans for an electric Ram 1500 pickup and Dodge muscle car.

GM, Stellantis and Ford deferred comments on Biden's move to the American Automotive Policy Council.

"We appreciate the Administration’s efforts to help strengthen our nation’s battery supply chains and its recognition that many of these critical minerals are vital to the production of electric vehicles," former Missouri Gov. Matt Blunt, president of the American Automotive Policy Council, said in a statement. "We will continue to study this important policy as additional details become available."

More: With next Stellantis EV battery plant in play, Michigan officials tout ability to compete

The money minerals

McCabe said the U.S. has learned lessons from the pandemic and other world events in recent years, mainly that “reliance on other markets for materials” can disrupt the supply chain and lead to shortages and higher prices.

“We have to find a way to be proactive and not reactive,” McCabe said. “We have to be our own source.”

By adding minerals such as lithium, nickel, graphite, cobalt and manganese to the Defense Production Act's list, it could help mining companies get $750 million under the act's Title III fund, according to a Bloomberg report citing unnamed sources. Biden's move might help in the recycling of battery materials, too.

The act helps fund "production at current operations, productivity and safety upgrades, and feasibility studies. In addition to EV batteries, the directive also would apply to large-capacity batteries," Bloomberg's report said.

MP Materials Corp. is the only U.S. company that produces rare earth metals needed for EVs, analysts said. But the Biden administration has allocated at least $6 billion as part of the infrastructure bill to develop a U.S. battery supply chain.

Currently, China dominates in mining and minerals processing for batteries, experts said.

"Most lithium, which is used in batteries, is mined in South America or Australia and shipped to China for processing and then shipped to other parts of the world to be put in EVs," said Sam Abuelsamid, principal analyst on E-Mobility at Guidehouse Insights in Detroit. "That makes no sense."

Plus, EV batteries are heavy and the cost to transport them around the world doesn’t make sense either, Abuelsamid said, adding, "You’re going to eat up the emissions you save in making these vehicles with the emissions used to ship them around the world."

Short-term squeeze

But Abuelsamid said there is hope for the car buyer's ability to afford an EV in the midterm.

The prices of some key materials such as nickel, lithium and cobalt — all used in EV batteries — have soared this year.

Lithium prices soared on increased demand for EVs, Abuelsamid said. Lithium is widely available all over the world including North America, but there has been little mining for it in North America because of low market demand — until recently.

Contrary to others, Abuelsamid said consumers will eventually see EV sticker prices ease.

"Right now, we’re in a short-term squeeze with these raw materials that are causing prices to rise — in part due to demand and in part due to geopolitical issues," Abuelsamid said.

For example, a notable portion of the nickel produced comes from Russia and that got shut off with the war in Ukraine, Abuelsamid said, "so that price went up in a matter of days."

"But increased local production will help drive down the costs for EVs in the three- to five-year time period and going forward," Abuelsamid said.

Free Press staff writers Phoebe Wall Howard and Eric D. Lawrence contributed to this report.

Contact Jamie L. LaReau: 313-222-2149 or jlareau@freepress.com. Follow her on Twitter @jlareauan. Read more on General Motors and sign up for our autos newsletter. Become a subscriber.

This article originally appeared on Detroit Free Press: Biden invokes Defense Production Act: How it will help carmakers