Biden’s mad green energy and electric vehicle plans are falling apart

- Oops!Something went wrong.Please try again later.

Beset by a United Auto Workers (UAW) strike that threatens to expand in the coming days, the US auto industry finds itself in a crisis – much of it dictated by the policies of the Biden administration.

The Ford Motor Company CEO Jim Farley admitted the industry’s conundrum in considering the union’s demands when asked by reporters last week.

“There’s a fine line here that we won’t go past, which is we want everyone to participate in our success,” Farley said, as quoted by Fox Business. “But if it prevents us from investing in this transition to EVs and in future products like the ones we have now, like the new F-150, best-selling vehicle in the world – in the US, then everyone’s job is at risk if we don’t invest.”

Let’s be honest: it’s unlikely Ford would be committing to the levels of investment running into the billons in new plant, equipment and supply chains for electric vehicles were it not for the Biden policies that subsidise such investments, while simultaneously forcing traditional internal combustion (ICE) cars off the market with stricter fleet mileage standards and tailpipe emissions restrictions.

ICE cars are Ford’s hugely profitable bread and butter. Meanwhile, Farley admitted to investors on his Q2 2023 earnings call that the company’s EV division is expected to lose $4.5 billion even accounting for all the federal subsidies.

Ford is far from alone. The entire US auto industry finds itself in the same boat, cranking out new electric models while projecting far more robust production next year, even as car dealership lots overflow with electric cars that consumers have proven reluctant to buy. This uncertainty makes the labour union’s demands even more difficult to comply with: they’re seeking a piece of the pie that Biden and his regulators have already gobbled up.

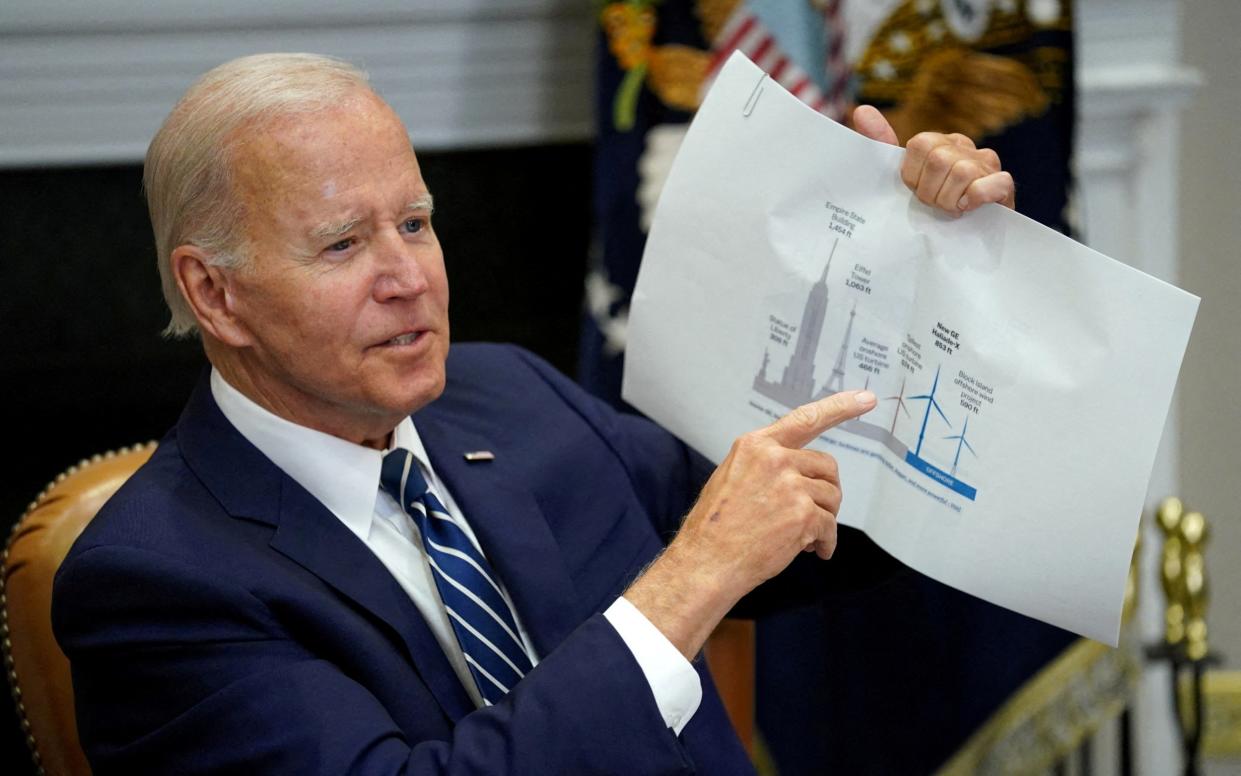

The US offshore wind industry finds itself in a crisis of its own. The recent federal lease sale targeting the Western Gulf of Mexico, off Texas and Louisiana, was a miserable failure. Louisiana waters attracted just a single bid totalling just over $5 million, and the seas off the Texas coast drew no bids at all.

Wind developers that had been expected to bid cited exploding costs for their projects as the major impediment, and pointed to the absence of any state subsidy programs being offered by Texas as the reason for the lack of interest. Louisiana does have a subsidy in place in the form of an arbitrary offshore wind target, but it was deemed insufficient by most operators.

At the same time, offshore wind developers in the Northeast face the same cost challenges, and are now also beset by allegations that the increased ship traffic and seismic surveys associated with their projects are responsible for the uptick in whale deaths in the area. The Marine Mammal Commission has stressed that there is no known link between offshore wind development and whale deaths.

Since last fall, more than 60 whale carcasses, many of them endangered species, have washed up onto the shores of adjacent states like New Jersey, New York and Massachusetts. The commercial fishing industry is also pressing the federal and state governments to recognise the deleterious impacts the networks of massive wind towers and subsea infrastructure of the projects will have on their operations.

Offshore wind developers, supported by an administration dedicated to ensuring their success by any means necessary, simply deny any impacts despite an expanding body of evidence. At the same time, the Big Wind operators demand more subsidies from the feds and higher guaranteed payments from state utilities for the electricity their projects will provide, threatening to cancel their projects unless the eager public officials obsessed with the ability to virtue signal about being “green” accommodate them.

Like the auto industry, the offshore wind industry in the US is teetering on the edge of disaster, thanks in no small part to the short-sighted lunacy of the Biden administration. We haven’t even gotten to the biggest looming crisis for the chosen industries of this ill-conceived energy transition: the need for critical energy materials like lithium, cobalt, copper, and nickel in the production of EVs and stationary batteries.

Even transition boosters like the International Energy Agency admit that supplying these minerals in volumes needed for the simultaneous rapid growth of chosen industries will require the most prolific expansion of the global mining industry in world history. With supply chains for these minerals already discombobulated and dominated by one country, China, this inevitable next phase of the crisis is only beginning to present itself.

If you think things for these insatiable rent-seeking industries are tough now, just sit back and wait. As Bachman Turner Overdrive once sang, you ain’t seen nothing yet.

David Blackmon had a 40 year career in the US energy industry, the last 23 years of which were spent in the public policy arena, managing regulatory and legislative issues for various companies. He continues to write and podcast on energy matters