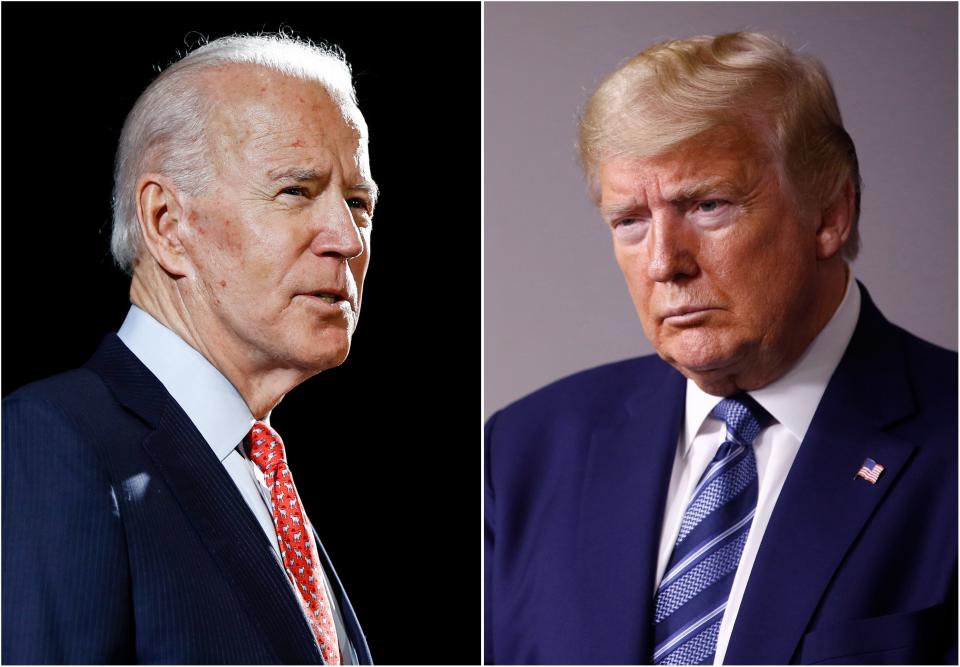

Biden vs Trump: Dow futures fluctuate as Wall Street awaits presidential election results

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

U.S. stock futures gyrated early Wednesday morning as the race for president in key battleground states remained close, signaling a tight contest.

Futures for the Dow Jones industrial average climbed 125 points after briefly dropping more than 300 points. The blue-chip average had surged about 555 points Tuesday to close at its best day since July.

S&P 500 futures briefly dipped 0.5%, giving up early gains as President Donald Trump and Democratic nominee Joe Biden were in a tight race in some battleground states. Futures for the broad index were currently up 0.5%.

Trump was projected to win Florida, where 29 electoral votes were up for grabs, Ohio, a must-win state on his path to reelection, as well as Iowa. Other hotly contested states including Georgia, Michigan, Wisconsin and Pennsylvania were up in the air.

Biden has 223 electoral college votes and Trump has 174 as of 12:45 a.m. ET.

Biden won California, Oregon and Washington. Earlier, he picked up New Hampshire, Colorado, the District of Columbia, New Mexico, New York, Virginia, Vermont, Rhode Island, New Jersey, Massachusetts, Maryland, Illinois, Delaware and Connecticut.

Meanwhile, Trump secured Idaho, Utah, Kansas, Missouri, Nebraska, Louisiana, Wyoming, North Dakota, South Dakota, Kentucky, West Virginia, Indiana, South Carolina, Oklahoma, Tennessee, Mississippi, Alabama and Arkansas.

Here's what life abroad is like for expats: Some Americans say they want to leave if Trump wins again

Trump or Biden: Who would boost growth, restore jobs faster? Here’s an Election Day guide on the economy

Nasdaq futures jumped 2.7%.

When it started to look like Trump was more competitive in Florida, futures briefly sold off, likely because investors were unwinding bets for a potential Democratic big blue wave that would usher in a stimulus package in 2021, according to Andrew Mies, chief investment officer at 6 Meridian, a registered investment adviser.

Then futures for the tech-heavy Nasdaq Composite bounced higher on expectations that a Trump win could mean more of the "status quo," and less likely for there to be regulation on large technology companies.

The offshore Chinese yuan dropped more than 1% as the race for the White House remains tight. Investors have been betting that Biden will be less likely to restart a trade war than Trump, analysts say. But the currency sold off overnight as Trump stayed competitive in the race.

“The betting markets are signaling that Trump is much more likely to win than previously thought,” says Mies. “That’s not good for trade, and that hurts the yuan.”

Stocks powered higher Tuesday as investors hope the end of a bruising U.S. presidential campaign may soon lift the heavy uncertainty that’s sent markets spinning recently. The last two days of gains for Wall Street have helped the S&P 500 recover roughly half its 5.6% loss from last week, which was its worst since the market was plunging in March.

Stocks have typically fared well on Election Day. Tuesday was the second-best Election Day ever for the S&P 500 with a 1.8% gain, according to LPL Financial. In fact, it was the fifth time in a row that stocks were higher on Election Day and the eighth time in the past 10.

This week’s rebound on Monday and Tuesday could be reflecting a slightly higher probability that Wall Street may avoid a contested election result, some analysts say. Though volatility could continue in the near term if there’s a contested result, the added.

Investors and economists have been clamoring for a renewal of stimulus since the expiration of the last round of supplemental benefits for laid-off workers and other support approved earlier by Congress.

“The ultimate outcome for president and Congress will have an influence on the speed and complexion of a fiscal aid package as well as potential tax changes, but the passing of election uncertainty will enable the market to shift its sights back to the health of the economic recovery,” Angelo Kourkafas, investment strategist at investment firm Edward Jones, said in a note.

If Biden ends up winning, as polls suggest, the thought is that could open the door to a big support package for the economy, particularly if the Democrats also take control of the Senate. Some areas of the market that would benefit from a large stimulus effort and spending on infrastructure rose more than the rest of the market Tuesday, including stocks of smaller companies and industrial businesses.

If Trump were to win and the Senate stays under Republican control, it would likely lead to less stimulus than under a Democratic sweep, according to Chris Zaccarelli, chief investment officer at Independent Advisor Alliance, a registered investment adviser. A Biden win and Republican Senate would be least beneficial to stocks, meanwhile, because it would mean the lowest chance for stimulus.

While the election is dominating investors’ attention, plenty of other market-moving events are looming this week. The Federal Reserve is meeting on interest-rate policy and will announce its decision on Thursday. Its earlier moves to slash interest rates to record lows and to step forcefully into bond markets to push prices higher have helped Wall Street soar since March.

Hanging above it all is the continuing coronavirus pandemic. Several European governments are bringing back restrictions on businesses in hopes of stemming worsening virus counts. In the United States, where infections are also rising at a troubling rate, the worry is that fear alone of the virus could depress sales for companies.

“Investors want something before January, especially as we head into what may be an acute COVID-19 phase in both Europe and the United States,” says Eric Freedman, chief investment officer at U.S Bank Wealth Management in Minneapolis. “Lots of increased concern about targeted shut-ins and the possibility of Europe having to extend their lockdowns.”

The Labor Department is also releasing its jobs report for October on Friday, where economists expect to see another slowdown in growth.

Is the stock market is rooting for Trump or Biden?: The answer may surprise you

Stocks have typically thrived under legislative gridlock in Washington, and a split Congress has historically been the best scenario for investors.

Since 1950, the average annual stock return for the broad S&P 500 stock index was 17.2% under a split Congress, according to LPL Financial. It falls to 13.4% when Republicans control both the House of Representatives and the Senate, and drops to 10.7% when Democrats control both chambers.

That suggests that markets may prefer divided power because it would make it harder for lawmakers to undo policy measures already in place, experts say. The Republicans currently control the Senate and Democrats the House.

“The Senate matters more to the stock market than who takes the White House,” Zaccarelli said in a note.

“The big surprise in 2016 was that the polls were wrong in the presidential election, but we believe the big surprise in 2020 is not that the polls are wrong in the presidential election, but that they will prove wrong in the Senate elections,” Zaccarelli added.

When broadening the scenario to include the presidency, the best situation for stocks since 1950 has historically been a Democratic president and Republican Congress, while a Republican president and Democratic Congress has been the weakest, according to Ryan Detrick, senior market strategist at LPL Financial.

Portfolio managers have been advising clients to be cautious on selling stocks based on the election outcome alone because they could miss out on future gains.

Investors selling just prior to President Barack Obama taking office would have missed out on a 26% total return year in 2009 and the kickoff to the second-strongest bull market in history, according to data from SunTrust Private Wealth Management. And investors selling just prior to President Trump taking office would have missed out on a 22% return in 2017, the figures showed.

“We don't think investors should shift their long-term strategy based on the election,” says Kourkafas. "A broader view of market performance can be helpful in avoiding the temptation to make knee-jerk reactions to election volatility."

Contributing: The Associated Press

This article originally appeared on USA TODAY: Trump vs Biden: Dow futures up as Wall Street awaits election results