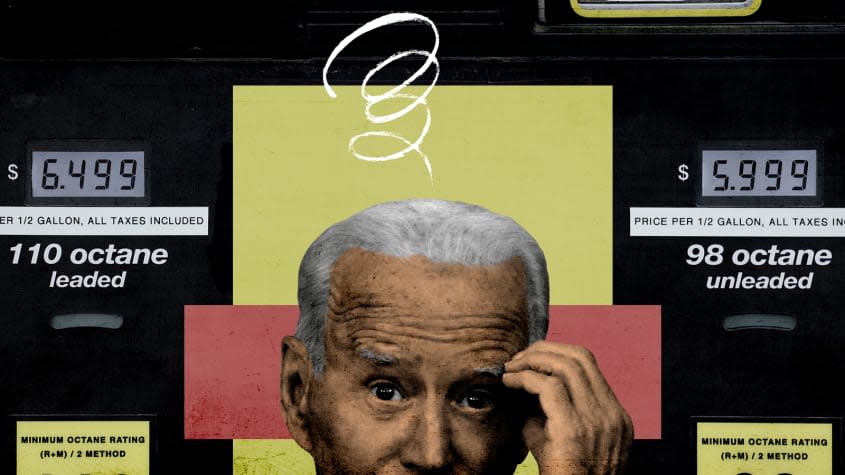

Biden's fight with oil companies over high gas prices

- Oops!Something went wrong.Please try again later.

President Biden on Wednesday sent a letter to leading oil refiners calling for them to produce more gasoline and dial back record profits to help bring down fuel prices, which have been soaring since Russia invaded Ukraine in February. Biden said oil companies' profits have tripled since the war triggered sanctions against Russian oil and disrupted global supply. "The crunch that families are facing deserves immediate action," Biden wrote. "Your companies need to work with my administration to bring forward concrete, near-term solutions that address the crisis."

Just days earlier, the national average climbed above $5 per gallon, adding to broader concerns about high inflation. The Commerce Department reported Friday that consumer prices had risen 8.6 percent in May, compared to a year earlier, marking the worst inflation in four decades. Biden noted that gas prices were 75 cents per gallon lower last year when oil prices were roughly the same as they are today, around $120 per barrel, and he put part of the blame on refiners' high profits. The American Petroleum Institute responded with a statement saying U.S. refinery capacity has fallen as the Biden administration pushed to reduce fossil-fuel use as part of its effort to fight climate change. Is Biden right to scold oil executives for the pain Americans are feeling at the pump?

It's fair to call out oil companies

Biden's burdens on refineries and his canceling of the Keystone XL pipeline might hurt production in the future, says Will Daniel at Fortune, but that's not why pump prices are rocketing up now. The current problem is due to a "pandemic-driven mismatch of supply and demand," oil-market disruption due to Russia's invasion of Ukraine, obstacles to cranking up oil production, and, yes, "record profit margins from oil and gas companies," which Jay Hatfield, chief investment officer of Infrastructure Capital Management, says account for $1-per-gallon in the current run-up at the pump.

Actually, Biden's the one to blame

What "a lot of drizzly nonsense," says Ed Morrissey at Hot Air. Refiners' profit margins are modest. Marathon's was 3.8 percent in the first quarter. ExxonMobil's was 6 percent. BP had a loss. The real reason for rising gasoline costs, according to industry groups, is "regulatory hurdles that prevent any expansion of refining capacity, along with policy hostility that keeps scaring off investors." If Biden really wants to help, he should rescind his Executive Order 13990, which canceled the Keystone XL pipeline and directed federal agencies to review every Trump-era regulation that conflicted with Biden's climate agenda, making it nearly impossible for refineries to expand operations.

Recognizing the need for more refineries is a first step

Maybe this call to jumpstart refineries means Biden is realizing what's sending gas prices sky-high, says The Wall Street Journal in an editorial. "At least he's finally noticed the dearth of refining capacity to process crude, which some of us have warned about for years." U.S. refining capacity plunged by one million barrels a day in the coronavirus pandemic, and even with a few new refineries in Asia, the International Energy Agency says global capacity dropped by 730,000 barrels a day last year. "A major culprit is U.S. government policy," which has forced some older refineries to shut down because "companies couldn't justify spending on upgrades as government forces a shift from fossil fuels."

There is a better way to fight inflation

"Biden can't flip a magic switch to increase the gasoline supply or otherwise bring down prices at the pump," says Eric Boehm at Reason. Pumping more oil and increasing refinery output "takes time and money," and energy companies aren't going to make that investment while the government's long-term goal is reducing fossil fuel use. "But there is one magic switch that Biden could flip tomorrow to save the average American household about $800 annually: He could repeal the tariffs imposed by former President Donald Trump on steel, aluminum, solar panels, and many other goods imported from China." That won't won't solve the inflation problem — that will take higher inflation rates or a "debilitating recession" — but tariffs are contributing to high prices and eliminating them will help.

You may also like

The Ezra Miller accusations, explained

Senate gun bill talks stall over definition of 'boyfriend,' distribution of 'red flag' incentives

Vince McMahon steps aside as WWE CEO amid misconduct investigation