The Biggest Tax Reforms in US History

One thing that’s constant about tax policy is that it’s always changing. In fact, the pace of major tax reform has picked up dramatically in the new millennium. According to the Committee for a Responsible Federal Budget, four of the five largest tax cuts in history (in inflation-adjusted dollars) have occurred since 2001.

Find Out: What Are the 2020-2021 Federal Tax Brackets and Tax Rates?

With the new Biden Administration being installed on January 20, 2021, tax reform looks likely to return. Biden has already proposed a number of changes to tax law, including increasing the top tax rate from 37% to 39.6%, imposing the 12.4% Social Security tax on incomes above $400,000 and raising capital gains taxes.

Last updated: Jan. 14, 2021

The First Federal Income Tax

For almost 100 years after the U.S. was founded, there was no federal income tax. But in 1861, the U.S. needed money to pay for fighting the Civil War, so a 3% tax was imposed on incomes over $800. It was during this time that the Internal Revenue Service was created.

However, because incomes were so low, few Americans actually had to pay the federal income tax, and only 10 years later, the tax was repealed. Congress created a flat-rate income tax in 1894, but the Supreme Court ruled it to be unconstitutional because the tax wasn’t levied in proportion to each’s state population.

Discover: Most Popular Things To Do With Your Tax Refund — and How To Do It Smarter

16th Amendment Gives Congress Legal Authority to Tax Income

In 1913, the 16th Amendment was ratified to remove the constitutional clause that required income tax to be levied proportionally to population. Congress then levied a 1% tax on personal income over $3,000 and a 6% surtax on incomes more than $500,000. This was also when the Form 1040 was introduced, according to the Internal Revenue Service.

Stay Safe: How To Protect Your Tax Refund From Being Stolen

World War I Revenue Acts

The first reform to the U.S. income tax system came with the Revenue Act of 1916. Congress raised the individual tax from 1% to 2% on incomes over $3,000, raised the corporate tax from 1% to 2% and introduced an estate tax to help fund World War I, according to the Tax History Project.

The next year, Congress raised income tax rates again. The 2% income tax was applied to income over $1,000 and a surtax with a top rate of 63%. That helped boost tax revenue into the billions.

Learn More: 9 Legal Tax Shelters to Protect Your Money

Revenue Act of 1932

The Revenue Act of 1932 controversial biggest it was one of the biggest tax increases in U.S. history during peacetime, and it came during the Great Depression. The top marginal rate – which had been lowered after World War I – was increased from 25% to 63%.

America’s wealthiest taxpayers were hit hardest by this change to the tax law — perhaps setting a precedent for the modern practice of finding tax loopholes to save thousands.

What’s Yours? Here’s the Average IRS Tax Refund Amount

Roosevelt Tax Reform

If you think taxes are high now, you might be shocked by how high they were in the 1940s. President Franklin Roosevelt set out to tax the rich more heavily by raising the top tax 79% — though it’s important to note that the top tax rate had first been raised from 25% to 63% by the Hoover administration, according to historian Joseph Thorndike.

Revenue acts enacted during Roosevelt’s presidency attempted to close tax loopholes used by the wealthy and raise both individual and corporate tax rates. But the wealthy weren’t the only ones hit by high tax rates. Income taxes also increased on the middle class, and tax withholding from paychecks was introduced.

Tax rates increased again to help fund World War II. By 1944, the top income-tax rate for individuals was 94%. But that rate was lowered to 86.45% by the Revenue Act of 1945, which reduced tax revenue by approximately $6 billion.

Tax Cut of 1948

The Revenue Act of 1945 offered little relief to taxpayers, so the Republican majorities in the Senate and House of Representatives fought for more tax cuts in 1948 – largely to win favor among voters. After three vetoes by President Harry Truman, Congress pushed through $6.5 billion in tax cuts in the Revenue Act of 1948; similarly, in modern times, major tax cuts like Donald Trump’s cost trillions of dollars.

But the tax cuts didn’t help Republicans hang onto their majority. Democrats took control of the House and Senate during the 1948 election.

Truman Tax Reform

To raise revenue for the Korean War, President Harry Truman pushed for higher taxes. The Revenue Act of 1950 boosted tax revenue by $4.5 billion by increasing individual tax rates up to 20% for the lowest bracket and 91% for the top bracket. The tax rate on large corporations also was increased, but the tax rate on smaller businesses was reduced.

Do You? Here’s the No. 1 Thing Americans Do With Their Tax Refund

Kennedy Tax Cuts

President John F. Kennedy had advocated for tax cuts during his 1963 State of the Union address but was assassinated before he could push legislation through Congress. President Lyndon Johnson followed through and advocated for cuts to spur job growth, according to the Tax Foundation.

The tax cuts in the Revenue Act of 1964 included a reduction in the top individual tax rate from 91% to 70% and the corporate tax rate from 52% to 48%. It also created the standard deduction, which was $300. It was the largest tax cut since World War II as a percentage of income and the federal budget, according to the Tax Foundation.

Reagan Tax Cuts

President Ronald Reagan’s 1981 tax cut was among the biggest in U.S. history. The aim of the Economic Recovery Tax Act of 1981 was to create incentives for economic development and reduce disincentives for savings and investment, according to the Tax Foundation. It included a 23% reduction in individual tax rates over three years and lowered the top rate from 70% to 50%. The law also reduced gift and estate taxes, indexed tax brackets for inflation and created a new cost recovery system for depreciating business assets.

Reagan pushed through another round of tax reforms in 1986 to simplify the tax code. It lowered the top marginal tax rate to 28% and increased the standard deduction for married couples, the personal exemption and the earned income tax credit – which helped exempt low-income households from taxes – but removed several other deductions. It also reduced the corporate tax rate while removing loopholes for businesses and the wealthy.

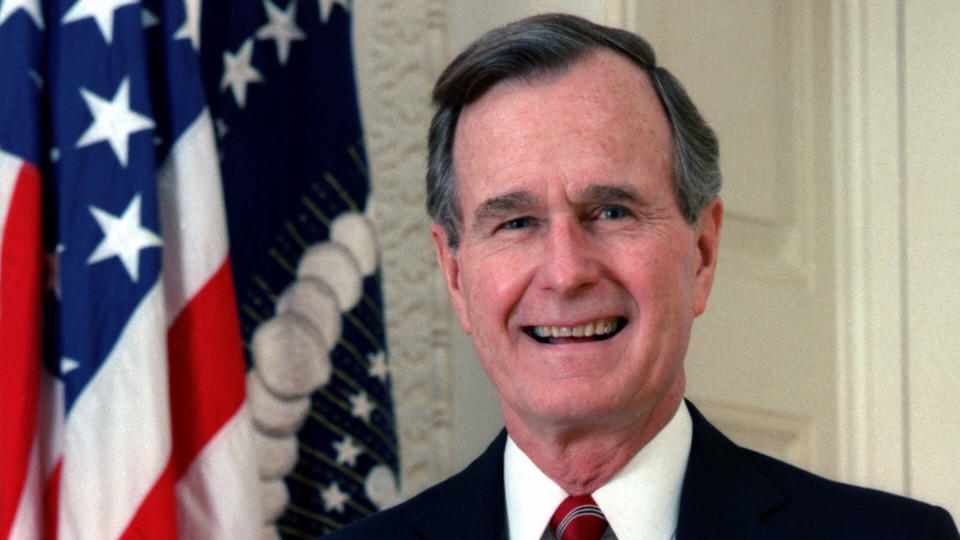

George H.W. Bush Tax Reforms

President George H.W. Bush promised no new taxes but ended up raising them with the Omnibus Budget Reconciliation Act of 1990 to reduce the federal deficit. The top tax rate rose from 28% to 31%, the alternative minimum tax increased from 21% to 24%, the value of high-income itemized deductions shrunk and the cap on taxable wages for Medicare rose.

However, Bush’s tax reform did expand the earned income tax credit and other low-income credits, according to the Tax Policy Center.

Keep Reading: 7 States With No Income Tax

Clinton Tax Reform

Tax rates rose again under President Bill Clinton. The Omnibus Budget Reconciliation Act of 1993 increased the top two tax rates to 36% and 39.6%. It also raised the corporate tax rate on income above $10 million to 35%. And it increased the taxable portion of Social Security benefits.

In 1997, though, Clinton signed the Taxpayer Relief Act, which included several tax breaks. It introduced a child tax credit of $500 and the HOPE and Lifetime Learning education credits. It also reduced the capital gains tax rates from 28% to 15% and 20% to 10%, repealed the alternative minimum tax for small businesses, increased the estate tax exclusion and created the Roth IRA.

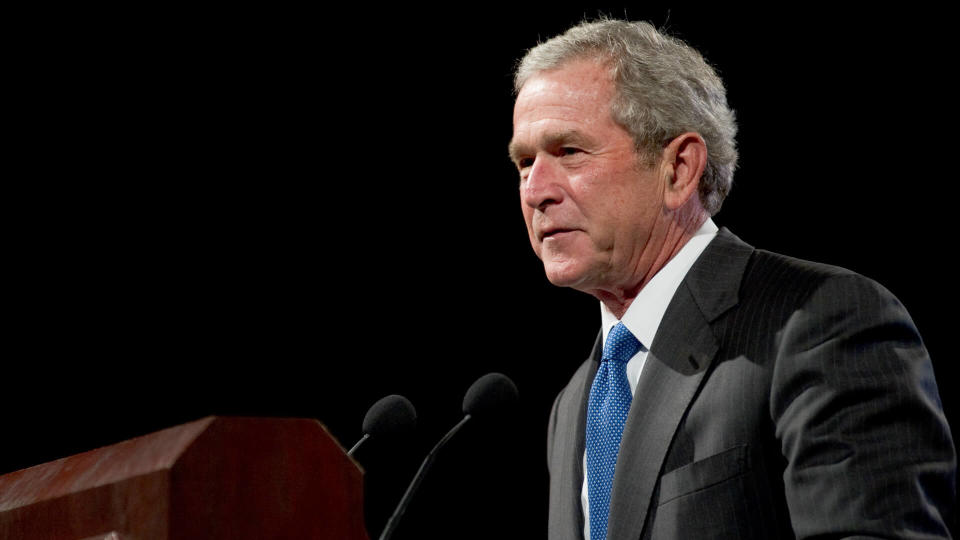

George W. Bush Tax Reforms

President George W. Bush pushed through two big tax cuts in 2001 and 2003. The Economic Growth and Tax Relief Reconciliation Act of 2001 created a new 10% tax rate on the first $6,000 of income for a single person and $12,000 for a married couple and lowered the 28% rate to 25%, the 31% rate to 28%, the 36% rate to 33% and the 39.6% rate to 35%. It also increased the child tax credit, child and dependent care tax credit, expanded tax breaks for education expenses and increased the contribution limits for retirement savings accounts.

The Jobs and Growth Tax Reconciliation Act of 2003 expanded some of the 2001 tax cuts and lowered the capital gains tax rate. The Bush tax cuts benefited high-income taxpayers most. They also lead to increased deficits, according to the Center on Budget and Policy Priorities.

Obama Tax Reform

Bush’s tax cuts were set to expire in 2010, but President Barack Obama extended several of them for another two years with the American Taxpayer Relief Act of 2012. Obama’s Affordable Care Act of 2010 also included changes to the tax law, including tax credits to offset health insurance premiums, a tax penalty for not maintaining minimum health coverage, an additional hospital insurance tax on high-income earners and a Medicare tax on investment income over a certain level.

Related: Best and Worst States for Health Insurance Costs

Trump Tax Reform

President Trump has claimed that his tax cuts are the biggest in history. However, according to the Committee for a Responsible Federal Budget, the Trump tax cut ranks #4 in terms of inflation-adjusted dollars since 1940.

Some of the biggest changes with the Trump tax cuts included a standard deduction that was twice as big and lower tax rates – with the top rate dropping from 39.6% to 37%. The mortgage interest deduction was reduced, as were state and local tax deductions. Some itemized deductions were eliminated entirely. And the corporate tax rate is cut to 21% from 35%. However, the legislation also introduced a deduction of up to 20% of income for pass-through business entities, in addition to various international tax changes.

More From GOBankingRates

John Csiszar contributed to the reporting for this article.

This article originally appeared on GOBankingRates.com: The Biggest Tax Reforms in US History