Do BII Railway Transportation Technology Holdings's (HKG:1522) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in BII Railway Transportation Technology Holdings (HKG:1522). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for BII Railway Transportation Technology Holdings

How Fast Is BII Railway Transportation Technology Holdings Growing Its Earnings Per Share?

Over the last three years, BII Railway Transportation Technology Holdings has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, BII Railway Transportation Technology Holdings's EPS shot from HK$0.019 to HK$0.042, over the last year. You don't see 117% year-on-year growth like that, very often.

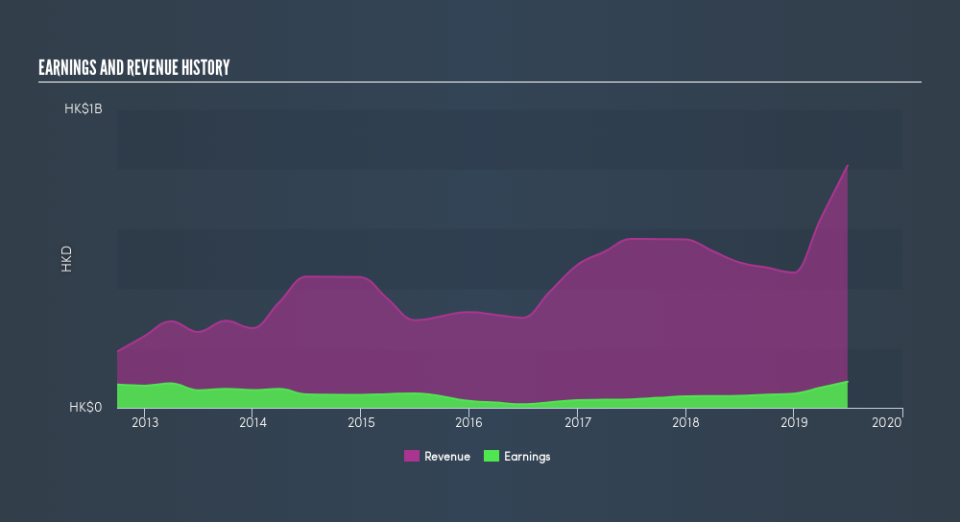

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that BII Railway Transportation Technology Holdings is growing revenues, and EBIT margins improved by 5.6 percentage points to 8.3%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

BII Railway Transportation Technology Holdings isn't a huge company, given its market capitalization of HK$1.3b. That makes it extra important to check on its balance sheet strength.

Are BII Railway Transportation Technology Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The first bit of good news is that no BII Railway Transportation Technology Holdings insiders reported share sales in the last twelve months. But the really good news is that CEO & Executive Director Jing Xuan spent HK$2.6m buying stock stock, at an average price of around HK$0.64. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

The good news, alongside the insider buying, for BII Railway Transportation Technology Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold HK$155m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 12% of the company; visible skin in the game.

Does BII Railway Transportation Technology Holdings Deserve A Spot On Your Watchlist?

BII Railway Transportation Technology Holdings's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest BII Railway Transportation Technology Holdings belongs on the top of your watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if BII Railway Transportation Technology Holdings is trading on a high P/E or a low P/E, relative to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of BII Railway Transportation Technology Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.