Billions of dollars potentially at stake for consumers, taxpayers in new probe of PBM fees

- Oops!Something went wrong.Please try again later.

In a surprise move, a top federal regulator promises to delve into extensive fees assessed on pharmacies by drug-chain middlemen in what could be the first nation-wide crackdown on pharmacy benefit managers.

At stake are billions of dollars in prescription drug costs born by consumers and taxpayers.

The probe by the Centers for Medicare and Medicaid Services (CMS) will center on huge increases in direct and indirect remuneration fees that PBMs charge pharmacies on Medicare prescriptions. These DIR fees were implemented as a way to incentivize U.S. pharmacies collecting millions of Medicare dollars to do more than simply push pills.

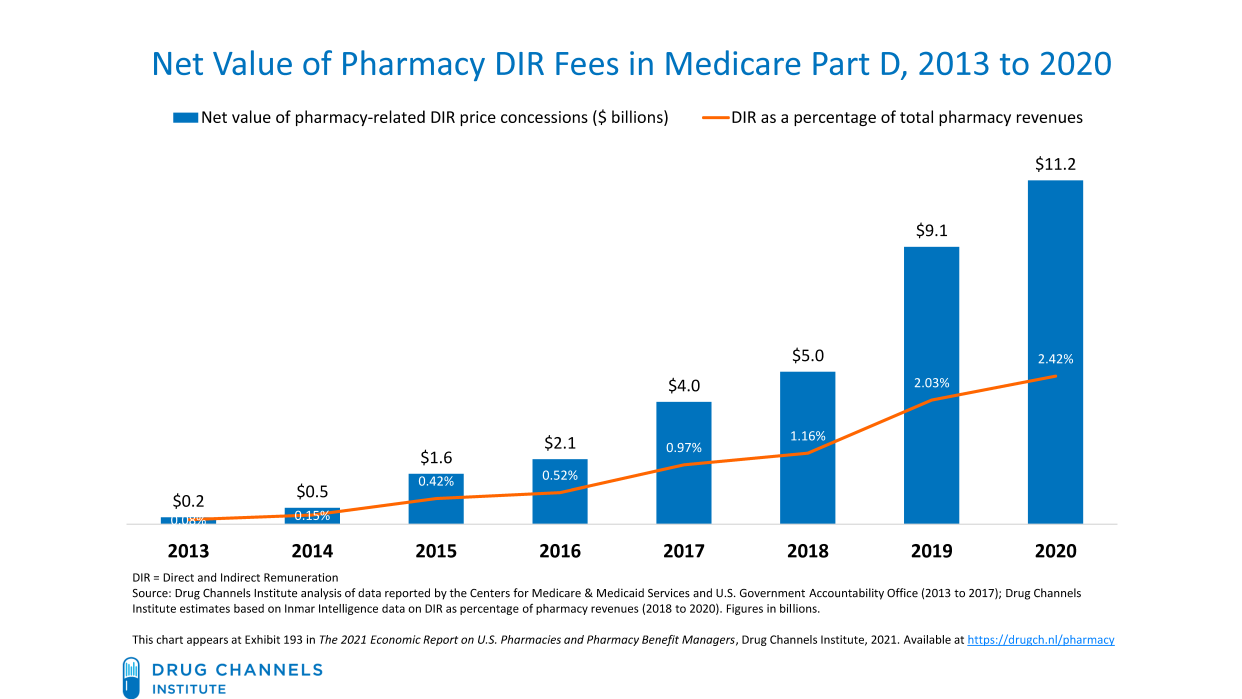

But the assessment — charged well after a prescription drug sale is supposedly complete — evolved into a system that today offers pharmacies only penalties through higher and higher fees, even if every PBM performance standard is achieved. The fees now total $11.2 billion a year, up from $200 million in 2013

Administrator Chiquita Brooks-LaSure said in a four-paragraph letter Tuesday that "CMS agrees that the significant growth in DIR amounts is troubling and is planning to use our administrative authority to issue proposed rulemaking addressing (pharmacy) price concessions and DIR."

A stunning 91,500% increase in DIR fees from PBMs over just nine years

"I am cautiously optimistic," said Scott Knoer, CEO of the American Pharmacists Association, the largest pharmacist group in the U.S. "Them acknowledging it publicly is a big deal. With all the PBM lobbying money it’s always a challenge."

Ted Okon, executive director of the Community Oncology Alliance, said, "On the surface, it’s certainly a positive that CMS has awoken and realized that the 91,500% increase in DIR fees from 2010 to 2019 more than suggests that there is a problem. However, what they intend to do about it will only be clear when the agency releases a proposed rule.

"And if they intend to do anything meaningful, the PBMs will fight it in the courts. Their business model is a house of cards and if DIR fees are taken away, or even moderated, the house of cards will come tumbling down."

I can promise independent retail pharmacies & medical practice facilities that we'll fight these extortive #PBM #DIRfees harder than ever in 2022. I don't know if @CMSGov will do anything meaningful. But with the administration & Congress we need collective voices on DIR fees!

— Ted Okon (@TedOkonCOA) December 16, 2021

One major question remains unanswered: Will CMS take a look at another PBM retroactive billing: clawbacks? That's a cousin of DIR fees, collected via convoluted PBM "effective rate" contracts. Ohio Medicaid Director Maureen Corcoran has acknowledged that those charges occur after the transaction is recorded by the state, and thus are not included in drug spending data sent to the federal government.

But since those false data are included in calculations to set rates charged to taxpayers, she says taxpayers nationwide likely are being overcharged for Medicaid prescription benefits.

Sen. Sherrod Brown part of bipartisan group that sparked new federal review

The new look at PBM fees was sparked by a letter Oct. 14 from Ohio Democratic Sen. Sherrod Brown and fellow Democratic Sen. Jon Tester of Montana, along with GOP Sens. Shelly Moore Capito of West Virginia and James Langford of Oklahoma.

Noting the huge fee increases, the bipartisan quartet wrote: "These astounding DIR increases are contributing to higher senior out-of-pocket costs and to the permanent closure of 2,200 pharmacies nationwide between December 2017 and December 2020. These trends are unacceptable and cannot continue."

Rural pharmacies are essential, yet small pharmacies are being hit with hidden fees by corporate middlemen that are driving up costs for Montana seniors and families.

I'm glad the Administration has agreed to work with me to address these fees and lower prescription drug costs.— Senator Jon Tester (@SenatorTester) December 16, 2021

Brown said Thursday, “Pharmacy middlemen should be passing along their negotiated discounts to consumers, not pocketing the difference to pay their CEOs more. I am glad the Centers for Medicare and Medicaid has agreed to take action to address this issue and provide relief to seniors and the pharmacies that serve them.”

Senate Finance Committee Chair Ron Wyden, D-Oregon, sent a separate letter Oct. 20, citing a recent announcement by a regional pharmacy chain that it's begun closing 56 pharmacies in the Pacific Northwest.

In response to the CMS reply, he said, “These developments take an encouraging first step toward reforming unjust practices that undermine patient access to prescription drugs, patient education, management of chronic disease, preventative care and life-saving vaccines.”

PBMs say if their fees are reduced, consumers will pay more for drugs

Charles Cote, spokesman for the Pharmaceutical Care Management Association, trade group for pharmacy benefit managers, said the group looks forward to the CMS review.

"Pharmacy direct and indirect renumeration (DIR) is an important tool for keeping independent drugstores accountable for doing their part to improve beneficiary health outcomes, increase access, and lower prescription drug costs," he said.

"Barring pharmacy DIR in Medicare Part D would increase premiums for seniors and raise costs for taxpayers, while decreasing the quality of pharmacy care for beneficiaries. According to a CMS analysis, eliminating pharmacy DIR will increase Part D premiums by $5.7 billion and taxpayer costs by $16.6 billion over 10 years."

One pharmacy chain pays nearly $5 out of every $100 in revenue to PBMs

Fruth Pharmacy, which operates several outlets in Appalachian Ohio, Kentucky and West Virginia, is part of a lawsuit against the federal government for allow the skyrocketing DIR fees.

A Fruth executive told The Dispatch for a July story on DIR fees that the payments leaped from just under $1 million in 2017 to more than $4.5 million in 2020 — equal to nearly 4.5% its total revenue. That forced Fruth to close five locations since 2014, "all of which were providing essential services to underserved communities with older, sicker populations," the lawsuit says.

Meanwhile, Brown is one of the few Democrats active in attempting to hold PBMs accountable; most others in his party emphasize only the role of major drug manufacturers. Democrats on the House Oversight Committee boycotted a hearing earlier this fall spotlighting PBMs' questionable practices.

In 2019, Brown helped add provisions in the bipartisan drug-pricing bill passed by the Senate Finance Committee that would have increased transparency requirements for PBMs and banned the practice of “spread pricing.” In June, he proposed a bipartisan measure that would prevent PBMs from retroactively assessing fees on pharmacies.

drowland@dispatch.com

@darreldrowland

This article originally appeared on The Columbus Dispatch: PBM fees that affect drug costs for consumers, taxpayers under review