Binance recorded an all-time high spot trading volume in Q3

Crypto exchange Binance hit an all-time high spot trading volume in the third quarter of 2020, according to The Block Research.

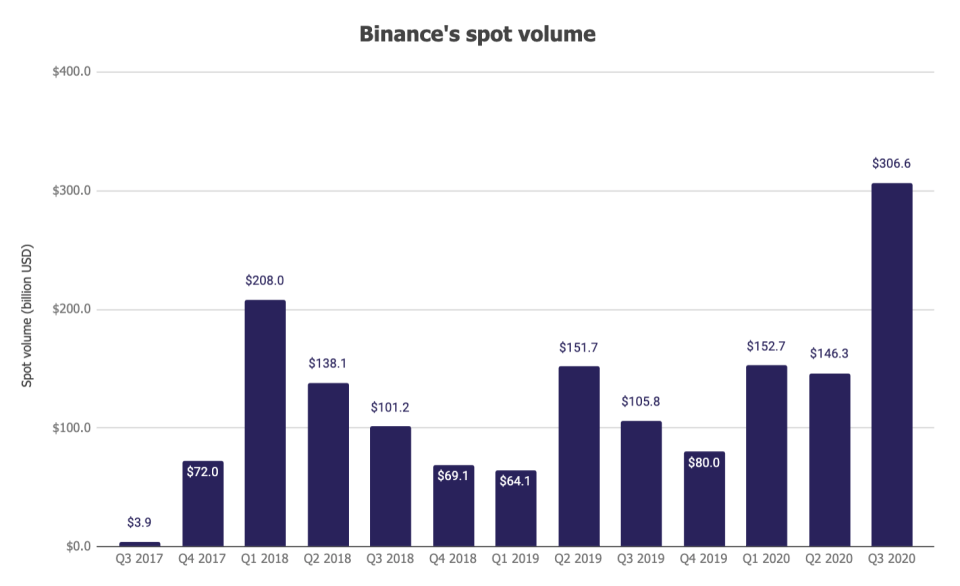

The exchange grew its spot trading volume by nearly 110% to a whopping $306.6 billion in Q3 compared to $146.3 billion in the previous quarter. The growth suggests that more retail investors are flocking to Binance for trading cryptocurrencies.

Source: The Block Research, CryptoCompare

Binance's futures trading platform has also been growing consistently. In Q3, the exchange's futures volume crossed the $483 billion mark, rising 43.5% quarter-over-quarter.

In Q3, Binance also had its largest BNB burn in terms of dollar value. The exchange burned $68 million worth of its native token from circulation, a 12.4% increase from the previous quarter. Binance burns BNB based on its crypto-to-crypto trading volumes.

Historically, Binance's revenue has been mainly transactional, meaning that it has relied on spot trading volumes and fees charged. According to The Block Research, the exchange now also makes money from other core offerings, such as derivatives trading, lending, and peer-to-peer trading in China.

To read the full analysis of Binance's record-breaking Q3 and more such data-driven stories, subscribe to The Block Research.

© 2020 The Block Crypto, Inc. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.