Bipartisan support emerges for bill to lower Texas sales tax rate

- Oops!Something went wrong.Please try again later.

Though often at odds with one another when it comes to the bills winding through the Texas Legislature, state lawmakers from both sides of the aisle have voiced support for legislation aimed at cutting the sales tax rate in Texas.

SB 1000, introduced by state Sen. Royce West, D-Dallas, in mid-February, calls for dropping the state sales and use tax rate from 6.25% to 5.75%.

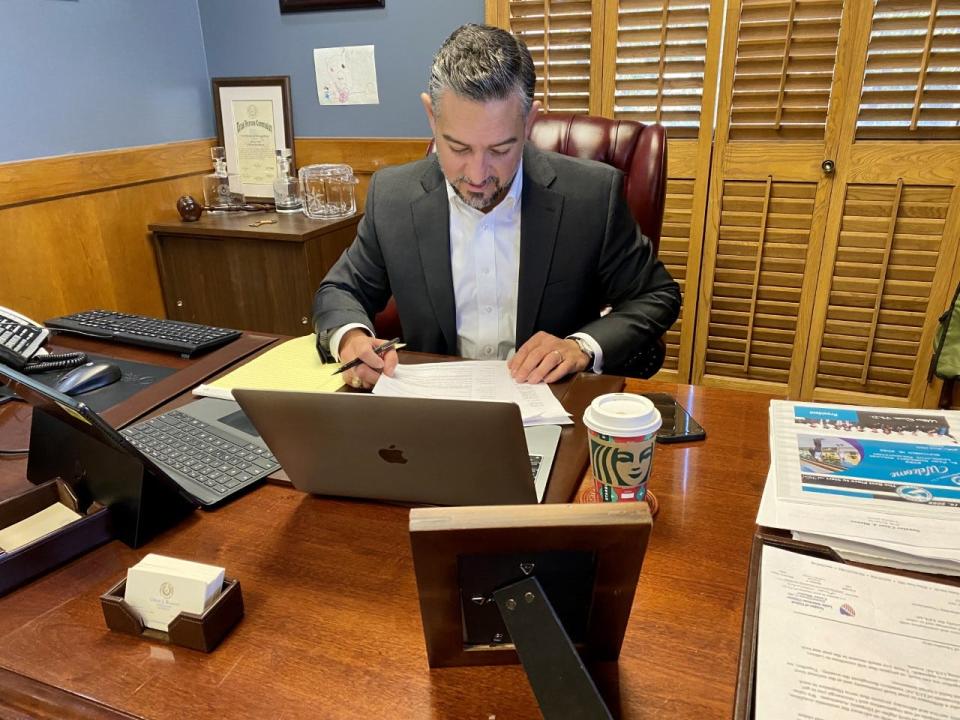

Among the bill's bipartisan contingent of co-sponsors is state Sen. César Blanco, who believes the bill will be a boon for Texans who have been feeling the pinch due to rising costs for groceries, gas and other necessities.

"Senate Bill 1000 is a bipartisan proposal to cut the sales tax rate by half a cent in an effort to provide Texas families some financial relief," Blanco, D-El Paso, said in an emailed response to questions about the bill. "Sales taxes hit low-income communities the hardest since the tax takes a larger percentage of their income. The sales tax reduction is an equitable vehicle to deliver tax relief for everyone, including our low-income communities, homeowners, renters, and mom-and-pop small business owners alike."

Blanco noted that Texas currently has the nation's ninth-highest sales tax rate in the nation and any decrease would mean more spending power for Texas families, particularly low-incomes families who continue to suffer the worst effects of rising costs and stagnant wages.

"By lowering the sales tax rate, Texas can not only level the playing field and provide relief to families who are having to work multiple jobs and long hours to put food on the table for their families," Blanco said. "This bill will stimulate spending, attract more businesses, help us create good-paying jobs, and strengthen our local and state economies."

While Blanco concedes that dropping the state's sales tax rate would come with its own drawbacks ‒ a report from the Texas Comptroller's Office found that, if passed, the bill would result in a loss of $7 billion in revenue ‒ he believes the state "can easily anticipate that money being reinjected locally and strengthening our local economy."

For Blanco, reducing the sales tax rate is just another step in his mission to provide financial relief across the state, which gained traction with Senate passage of two of his bills last week. SB 3 calls for increasing the homestead exemption to $70,000, and $100,000 for homeowners older than 65, and SB 5 establishes an inventory tax credit and a universal tax exemption of $25,000 of the appraised value of a business' personal property.

A Closer Look:Bills championed by El Paso lawmakers advance through Texas Legislature

"(Recently), we passed Senate Bill 3 and Senate Bill 5 which will provide $4.3 billion in property tax relief and $1.5 billion in small-business tax relief," Blanco said. "While substantial and much-needed, these bills only help property owners and mom-and-pop small businesses. By reducing the sales tax rate, we can also help the 6 million Texans who rent. The sales tax rate reduction is just an additional vehicle to providing sweeping tax relief across the board."

The bill is awaiting approval from the Senate Finance Committee. If it gets the greenlight, the bill will then have to pass through the Texas House of Representatives before landing on the governor's desk to be signed into law.

This article originally appeared on El Paso Times: Bipartisan support emerges for bill to lower Texas sales tax rate