Blackstone set for £900m bet on Butlins

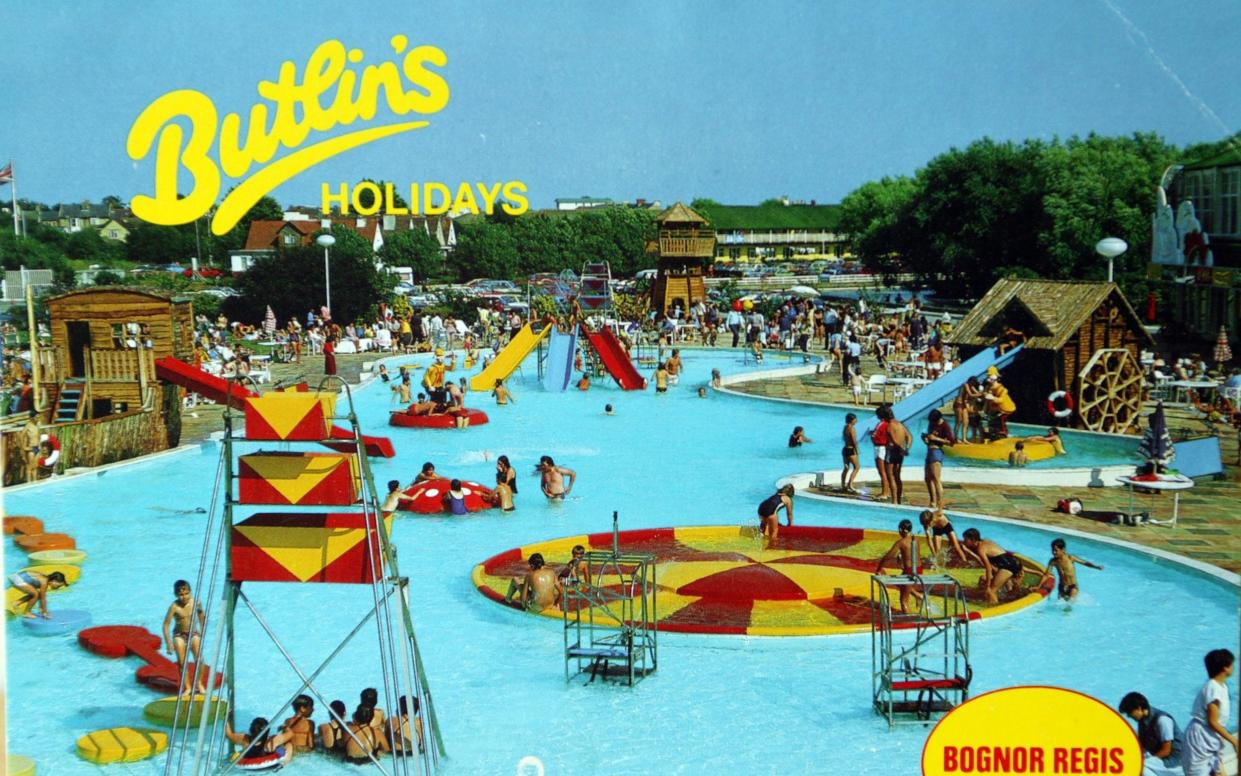

One of the world’s biggest investment firms is closing in on a deal to buy the owner of Butlins, the cherished holiday park that provided a springboard for the TV careers of the likes of Des O’Connor and Johnny Ball.

US buyout giant Blackstone is said to be in exclusive talks to invest about £900m in Bourne Leisure, the privately owned company that also owns the Haven holiday chain, Warner Leisure Hotels and dozens of caravan parks.

Bourne is Britain’s biggest leisure firm and employs about 14,000 staff at peak seasonal periods, attracting more than 4m families a year before the pandemic struck.

An investment from Blackstone would help safeguard thousands of jobs, many of which are in deprived parts of the country.

Talks are continuing but not thought to be at an advanced stage, meaning a deal may not be announced imminently, according to a source close to the negotiations.

“Blackstone is probably thinking of what has a chance of a good comeback after the pandemic and Bourne Leisure has always been a company with a strong balance sheet,” the insider said.

Bourne Leisure is still owned by three families that founded the company in 1964. It has been passed on to the second generation who are understood to remain closely involved in its operations.

The Cook, Harris and Allen families would retain a significant stake in the business following a sale. The Times first reported the negotiations.

The potential deal comes as the travel sector has ground to a near-standstill due to coronavirus, with resorts closed as lockdowns prohibit even domestic tourism.

Last month Bourne Leisure said it would no longer sell through travel agents and take only direct bookings, saying at the time that it had to make “difficult choices” in recent months.

The move by Blackstone will be seen as another vote of confidence in post-Brexit Britain. The UK tourism market is set to rebound strongly once vaccines bring the virus under control with millions of people eager to go on holiday once more.

A takeover of Bourne Leisure would add to Blackstone's list of leisure assets in the UK, which include the Legoland theme parks, Madame Tussauds and the London Eye owned by Merlin Entertainments.

In 2019 the private equity firm took Merlin - the world’s second largest operator of visitor attractions - private along with a consortium led by Lego’s founding family, in a $7.5bn deal.

The company had been listed on the London stock exchange six years earlier but its shares struggled to made significant gains.

UK firms remain vulnerable to approaches from overseas investors, with the global crisis, and fears over Brexit weighing on the value of those listed on the London Stock Exchange.

Betting companies have proved particularly popular, with US casinos taking advantage of expertise as their home sports betting markets are liberalised.

William Hill struck a deal to be acquired by Caesars Entertainment and MGM Resorts is circling Ladbrokes owner Entain.

Firms outside the leisure sector have also proved popular. GIP, the US fund that previously owned Gatwick airport, is vying with Blackstone and another private equity firm, Carlyle, to acquire FTSE 250 private jet services company Signature Aviation.

G4S agreed a takeover from US peer Allied Universal and roadside services firm the AA this week finalised a deal to be bought by private equity duo Warberg Pincus and Towerbrook. Bourne Leisure and Blackstone declined to comment.

Bourne Leisure and Blackstone declined to comment.