Predictions: From stocks to politics to Twilight

Market forecasting is a very useful tool in sizing up likely campaign and election outcomes--but it is by no means confined to the political world. As we at The Signal continue to cover the many shifts in perception and momentum over the 2012 election cycle, we'll also remind you of the other events and movements that the global predictions markets handicap--everything from sporting events to movie debuts to financial bailouts.

In professional football, for instance, the Green Bay Packers are undefeated half way through the 2011 season--and forecasters in the prediction markets give them a 27.8 percent likelihood of winning the Super Bowl. The new Twilight movie, The Twilight Saga: Breaking Dawn Part 1, opens next weekend--with the markets predicting a huge opening weekend box office receipt of about $152.9 million, with a running total of $318.5 million over the first four weekends the movie is out. There is about a 25-30 percent likelihood that the global energy and contracting firm Halliburton will see its stock price top $40 per share in a month's time. (It's currently trading at 37.21.) And in the global political arena, the markets give Ali Abdullah Saleh, the president of Yemen, a 25 percent likelihood of losing power before the end of the year.

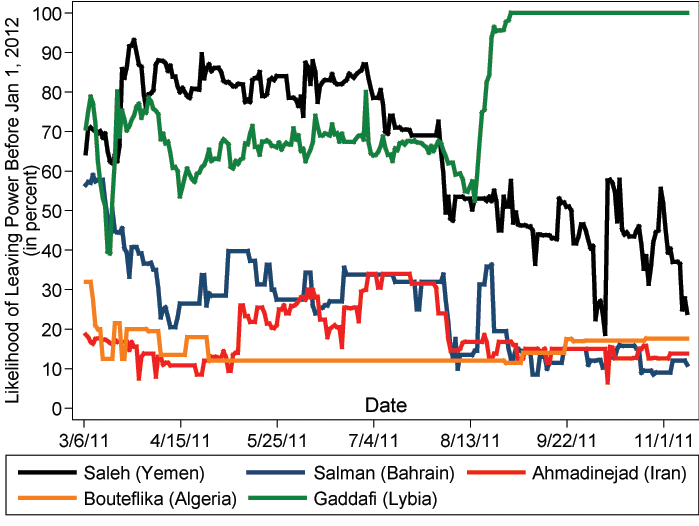

Below is a chart showing, for several world leaders, their likelihood of losing power before January 1, 2012. Naturally, as the number of days remaining in 2011 decreases, it becomes less likely that a ruler will lose power.

All four of these above predictions are derived from different markets. The sports prediction from Betfair, the box office prediction from the Hollywood Stock Exchange, the stock prediction from the options market, and the political prediction from Intrade. All of these markets have different trading protocols, which can produce distinctive quirks in their prediction models. Among other things, different transaction costs shift incentives (and Hollywood Stock Exchange does not use real money) and different accounting procedures require different methods of calculating probabilities from pricing.

Yet all these markets share a core defining function: They aggregate valuable information about an upcoming event. For example, legions of people connected with the entertainment industry follow box office outcomes; some of them crunch historical data while others have a general feel of the buzz that is building behind various new movies. The market for box office receipts brings their dispersed information together. This is exactly the same way that options traders on Wall Street work: They connect their understanding of their market with information provided by major players in a given research field or commercial enterprise, generating a grid of options prices that gauge the value of their pooled information in future economic conditions. Predictions markets in sports and politics work on the same model.

Markets share the same continuity of method when it comes to apportioning the likelihood of a given outcome in their domain. In other words, from the perspective of prediction markets, the 25 percent likelihood of Halliburton's stock reaching $40 per share is no different from the 25 percent likelihood that Saleh loses power in Yemen. And both likelihoods match up in similar fashion to the 25 percent likelihood that the Democrats will retain control of the Senate after the 2012 election.

Similarly, in the world of sports, market traders give the Philadelphia Phillies roughly a 20 percent shot at winning the 2012 World Series--the same chance that they give the Brazilians to win the 2014 World Cup. If there were 100 replicas of the 2012 baseball season, complete with the random events that occur along the way, the Phillies would win 20 of them; this is no different than soccer, where if there were 100 replicas of the next World Cup, complete with the random events that occur along the way, Brazil would win 20 of them.

At The Signal we are determined to provide readers with the most compelling data in the markets we cover. But we think it's equally important to make sure that the information we share is meaningful. We aim to make the logic behind the market's predictions clear to you and explain in direct and accessible terms how those forecasts will make a difference in your world.

David Rothschild is an economist at Yahoo! Research. He has a Ph.D. in applied economics from the Wharton School of Business at the University of Pennsylvania. His dissertation is in creating aggregated forecasts from individual-level information. Follow him on Twitter @DavMicRot and email him at

thesignal@yahoo-inc.com.

Other popular Yahoo! News stories:

A sneak peek of Rick Perry's appearance on Letterman

Perry plummets in prediction markets after debate gaffe

Occupy protesters interrupt Michele Bachmann speech in South Carolina

Want more? Visit The Signal blog or connect with us on Facebook and follow us on Twitter.