The Blossomvale Holdings (ASX:BLV) Share Price Is Down 78% So Some Shareholders Are Rather Upset

Some stocks are best avoided. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding Blossomvale Holdings Ltd. (ASX:BLV) during the five years that saw its share price drop a whopping 78%. Furthermore, it's down 11% in about a quarter. That's not much fun for holders.

See our latest analysis for Blossomvale Holdings

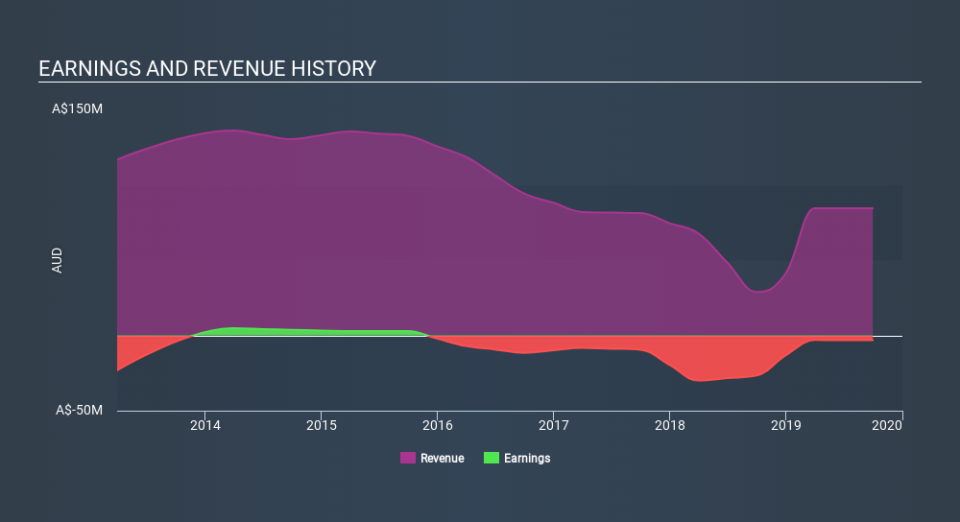

Given that Blossomvale Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over half a decade Blossomvale Holdings reduced its trailing twelve month revenue by 18% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 26% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Blossomvale Holdings's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Blossomvale Holdings's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Blossomvale Holdings shareholders, and that cash payout explains why its total shareholder loss of 73%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Blossomvale Holdings shareholders have received returns of 25% over twelve months, which isn't far from the general market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 23% over the last five years. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with Blossomvale Holdings (including 1 which is doesn't sit too well with us) .

We will like Blossomvale Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.