Boeing and T-Mobile's Credit Set to Follow in Kraft Heinz's Footsteps

In the first couple of months of 2020, the U.S. economy has continued to see a corporate credit situation that would have been impossible to imagine a few decades ago. To stave off the next economic recession for as long as possible after the 2008 financial crisis, the Federal Reserve has fought fire with fire, cutting base interest rates in order to make debt cheaper for the increasing number of financially struggling corporate giants.

Increasing junk debt

After some companies saw their credit ratings increase at the end of 2019, the market as a whole is continuing on its decade-long trend to higher numbers of businesses whose bonds are no longer investment grade. According to Moody's (NYSE:MCO), the total value of speculative-grade bonds maturing over the next five years will be around $1.2 trillion, which marks a new record and a 19% increase from the year-ago amount.

One business that has recently been downgraded is The Kraft Heinz Co. (NASDAQ:KHC), a Warren Buffett (Trades, Portfolio) holding that was relegated to the junk pile by Fitch Ratings and S&P Global Ratings on Feb. 14. After struggling (and failing) to keep up with changing consumer tastes, the food company's high debt and other financial red flags lost it its investment-grade status.

Increasing amounts of low-credit debt are considered to be the proverbial canary in the coal mine for economic distress. However, given the low interest rate environment, the recent downgrade doesn't have as much of an effect on Kraft Heinz's ability to take on more debt as it might have in the past. In fact, some analysts consider the junk market to be more resilient than ever, even though the junk default rate rose to 3.3% in 2019, which is well above the non-recession average of 2.4%.

In other words, the corporate debt binge is likely to continue as long as interest rates remain low, even as more and more companies take on enough debt and miss enough payments to have their credit downgraded.

However, not everyone remains bullish on companies with junk debt. Companies that have a lot of debt and higher interest rates on that debt compared to their competitors are far more likely to hurt during a recession. Just like any other form of leverage, corporate debt can magnify losses just as much as it magnifies profits.

"We think risks are elevated," Collin Martin, an analyst with Charles Schwab (SCHW), said about the issue. "We are concerned about the level of corporate profits. We think too many people are reaching for yield."

In light of more and more companies having their credit downgraded, investors might want to keep an eye on Boeing Co. (NYSE:BA) and T-Mobile US Inc. (NASDAQ:TMUS). These companies are both set to plunge deeper into debt into the near future, potentially downgrading their credit and making them more vulnerable to an economic downturn.

Boeing

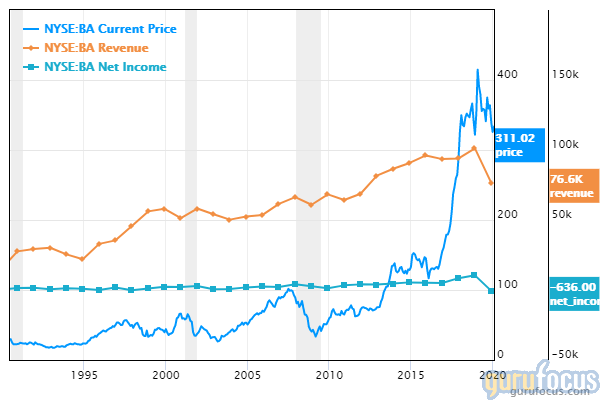

The aircraft giant's profits and reputation have taken a massive blow from the continued grounding of its 737 Max aircraft, which is not yet back in service following two deadly crashes caused by the plane's malfunctioning anti-stall system.

"Moody's considers that the longer the grounding runs, the greater the risk to Boeing's already blemished reputation," said a representative from Moody's.

The longer the aircraft is grounded, the more debt Boeing will have to take on in order to maintain the company's operations. When (or if) the aircraft is cleared for flight once again, it will also face fears that its issues might not be fixed. Boeing has already seen a number of its 737 Max orders cancelled, so losses might continue even after this problem is resolved.

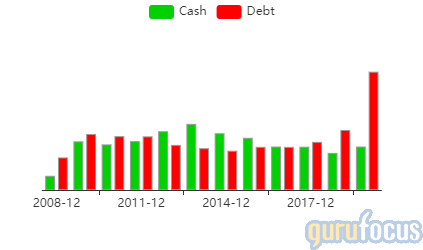

Boeing has a GuruFocus financial strength rating of 3 out of 10 and an Altman Z-score of 1.83, meaning it may have difficulty meeting its long-term financial obligations. The quick ratio of 0.31 shows that the company's most liquid assets are able to pay less than a third of its short-term debt.

While Boeing's cash-debt rating of 0.44 is considered in line with the industry average, it is a marked departure from the company's past ability to maintain more cash on hand than debt (see chart below).

On Jan. 13, Moody's put Boeing's debt on review for potential downgrade from its current A3 rating, which is in the lower half of investment-grade ratings. S&P Ratings is also considering lowering its rating for the company, and the reasoning is directly related to the continued failure to get the 737 Max back in the air.

"[The delay] will result in a longer period of cash outflows than we expected for 2020, as well as less debt reduction in the latter half of the year because Boeing will deliver fewer aircraft," wrote an analyst from S&P Ratings.

T-Mobile

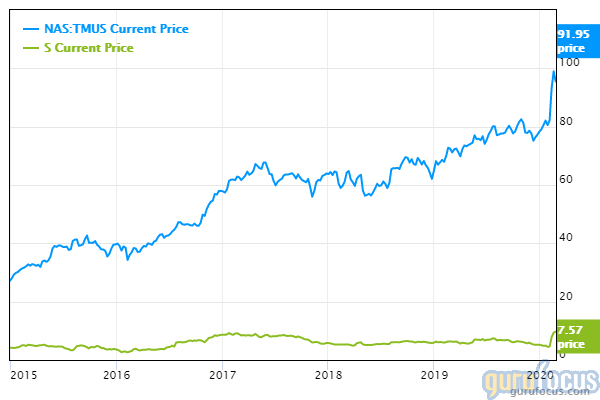

On Feb. 11, U.S. District Judge Victor Marrero delivered his final ruling on the court case preventing T-Mobile from merging with Sprint (S), clearing the last hurdle out of the way for the merger to proceed. The court stated the following:

"T-Mobile has redefined itself over the past decade as a maverick that has spurred the two largest players in its industry to make numerous pro-consumer changes. The proposed merger would allow the merged company to continue T-Mobile's undeniably successful business strategy for the foreseeable future."

The merger of Sprint and T-Mobile will create a telecommunications company that is on the same scale as the other two main U.S. competitors in the space, Verizon (VZ) and AT&T (T). Share prices spiked in response to the news as investors anticipate that the combined broadband will give the "New T-Mobile" a competitive edge.

However, the lawsuit that previously threatened to prevent the merger is one of the key reasons why Moody's upgraded T-Mobile's credit rating to Ba2 from Ba3 on Nov. 10, 2019. Thinking that the corporate action would be blocked in the end, Moody's said that the merger "could have pressured T-Mobile's credit metrics." In other words, if Moody's analysts believed that the merger had a chance of being approved, they likely would not have upgraded the company's credit rating.

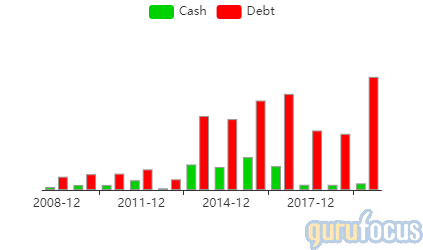

T-Mobile has a cash-debt rating of 0.06, interest coverage of 5.04% and an Altman Z-score of 1.39, which are already on the low end of spectrum.

The all-stock merger with Sprint, however, will weaken its balance sheet. Sprint's trailing 12-month debt is at $10.87 per share, while its trailing 12-month revenue per share is only $7.93.

Combining the high debt of both companies in a merger meant to precede an aggressively competitive business stance means that T-Mobile is not likely to tidy up its balance sheet anytime soon. If anything, it may take advantage of the low interest rate environment and its recently upgraded credit rating to borrow more, which seems likely to result in its debt being thrown back to the bottom of the junk bin.

Conclusion

At a price of $305.59 per share as of Feb. 26, Boeing may seem undervalued. Similarly, T-Mobile may look like a rarely seen opportunity to profit from a merger that will create explosive growth.

However, both companies will need to continue increasing their debt in order to maintain planned operations. Boeing needs the shot in the arm to keep from going bankrupt, which shouldn't harm it too much in the long run given its current A3 rating. On the other hand, T-Mobile, which is already junk, will only see its debt increase as it merges with Sprint and enters an expansion phase. Thus, investors might want to stay away from these companies until they stop bleeding debt.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.