This bond fund should make almost 10pc a year and you can buy it now without stamp duty

- Oops!Something went wrong.Please try again later.

Investment trusts gave up selling new shares to investors last year during the stock market funk over rising interest rates and inflation, so the offer this week of £15m of new shares by Invesco Bond Income Plus, often known by its stock exchange ticker of BIPS, has drawn attention to the listed bond fund.

Created by the merger in 2021 of two other bond trusts run by Invesco, BIPS’ name is a play on “bp”, which means “basis point”.

Pronounced “bip”, bp is used in the City to mean a 100th of a percentage point, a useful measure for the small but significant movements in interest rates and bond yields. For example, a quarter-percentage-point change in Bank Rate can also be called a 25bp move.

With an aim of generating a high dividend yield, currently 6.8pc, and capital growth, BIPS holds nearly three quarters of its assets in high-yield bonds issued by companies with chequered credit histories, or from banks that shore up reserves of capital to use in a crisis.

The remaining 28pc of the fund’s money goes into lower-yielding, but safer, “investment-grade” bonds, mostly rated “BBB”. These rank below the top credit ratings of “A” or “AA” but are still considered good.

After rapid rises in the past two years, the Bank Rate stands at 5.25pc. That means the fund’s lead manager, Rhys Davies, doesn’t have to take too much risk to generate the income for BIPS’ 11.5p per share dividend target this year.

Davies, who worked on both of BIPS’ predecessors, City Merchants High Yield and Invesco Enhanced Income, concentrates on higher-quality “BB”-rated bonds within the high-yield segment. Only 3pc goes into the riskiest “CCC”-rated bonds.

Cautious about the possibility of a recession and the strains on company finances from higher interest rates, Davies and his co-manager Edward Craven have spread BIPS’ assets widely.

They hold 237 bonds from 160 issuers, which reduces the impact of individual companies defaulting on loans. Its largest corporate exposure is 3.4pc of the fund to Lloyds Banking Group.

Outside bank bonds, which account for more than a quarter of the portfolio, BIPS allocates 8pc to insurers, 7pc to car manufacturers and 5pc apiece to gaming and telecoms companies.

BIPS’ share issue, the first by an investment trust this year, is timed to attract former shareholders in the Henderson Diversified Income trust, who are receiving £54m from its merger with Henderson High Income.

Other investors can also apply for the shares, which can be bought free of the usual 0.5pc stamp duty through a stockbroker. The offer closes next Wednesday at midday.

The new shares will be priced at 0.75pc above their net asset value (NAV) on Feb 5. This makes them slightly cheaper than BIPS existing shares, which stood at a 2pc premium to NAV when the issue was announced, and whose purchase would incur stamp duty.

Unlike many of the trusts tipped here, BIPS shares don’t trade at a discount. However, Davies says there is an investment opportunity because the prices of BIPS’ high-yield bonds have been depressed by interest rate rises.

Many bonds issued at £100 trade today at about £90-£92 because high interest rates made their fixed income less attractive. Their price had to fall to raise their yield above that of government bonds. Now that interest rates are thought to have peaked, that pressure should reverse.

Meanwhile, the bonds will benefit from a “pull to par” effect that should see their price gradually revert to £100 as the bonds’ maturity dates approach over the next five years or so.

Together with the interest paid on the bonds, that should generate an annual total return of about 8pc, which the managers can lift to about 9pc by increasing their market exposure through gearing, or borrowing. This share offer is worth taking up.

Questor says: buy, take up share offer

Ticker: BIPS

Share price at close: 170.25p

Update: Digital 9 Infrastructure

This trust, a struggling investor in assets that form the “backbone of the internet”, will wind down and return capital to shareholders.

Launched three years ago, the fund was hamstrung by high debts and expensive acquisitions. After a 64pc share price crash and a scrapped dividend last year, the trust has decided to sell four of its five remaining assets.

At 24.9p the shares offer some potential, if with great uncertainty. Hold for more information at the next update due later this month.

Questor says: hold

Ticker: DGI9

Share price at close: 24.9p

Gavin Lumsden is editor of Citywire’s Investment Trust Insider website

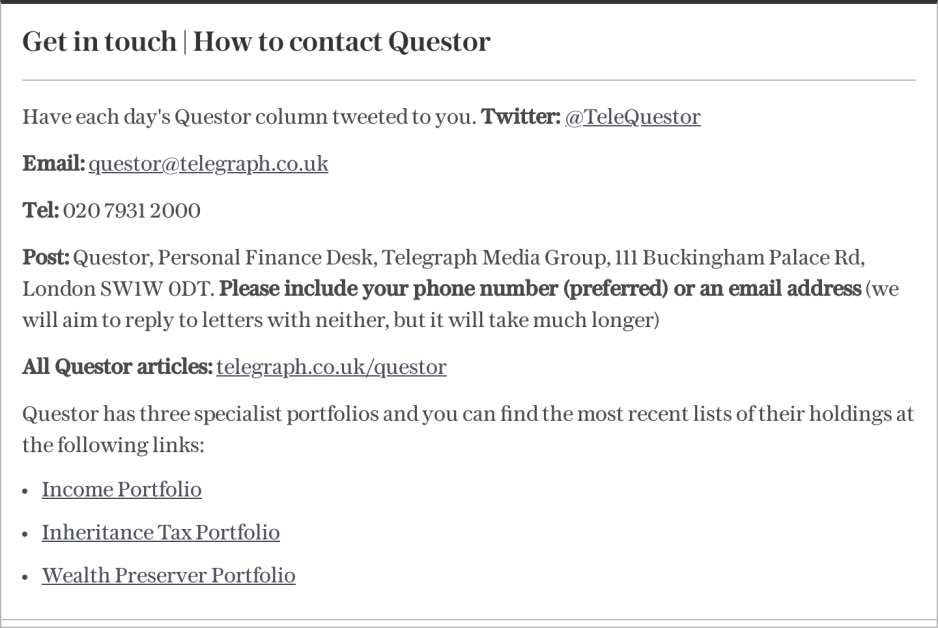

Read the latest Questor column on telegraph.co.uk every Monday, Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips