I Bonds drop to 4.3% but have new higher fixed rate

Rates on I Bonds issued now have fallen to 4.3%, thanks to a drop in inflation. But many savers who still plan to buy more I Bonds got a welcome surprise anyway.

The Treasury Department's Bureau of Fiscal Service has announced that I Bonds bought from May through October now will carry a higher fixed rate of 0.9% that applies to the 30-year life of the bond. That's up considerably from the 0.4% fixed rate that remains on I Bonds bought from November 2022 through April.

The inflation-adjusted rate, which changes every six months, is added on top of the fixed rate.

For I Bonds issued now through October, an annualized inflation-adjusted rate of 3.38% is added on top of the fixed rate. Interest is added monthly and compounded semiannually.

I Bonds had far more of a rock star quality recently. For a chunk of last year, savers had a chance to lock in an annualized rate of 9.62% for six months after the bond was issued. That rate applied to I Bonds issued from May 2022 through October 2022.

If you bought I Bonds issued from November 2022 through April, you locked in the attractive 6.89% that applies for six months after your purchase.

More: Savers see last-chance in April to get I Bond rates at nearly 7%

More: Buy I Bonds before May to lock in rate before it's gone

Savers won't be too excited about 4.3% for I Bonds. But they shouldn't ignore that 0.9% fixed rate.

Don't ignore a 0.9% fixed rate

The fixed rate is too often an overlooked part of the inflation-indexed U.S. savings bonds. But remember, the inflation adjusted rate is added on top of any fixed rate, which lasts for the life of the bond.

When I Bonds were first introduced in September 1998, for example, the fixed rate was an extremely attractive 3.4%. Savers who bought I Bonds through the early 2000s had some solid fixed rates and wouldn't want to rush to cash in those bonds.

If we see negative inflation, known as deflation, the net return for a given six-month period could go below that fixed rate. Negative inflation occurred twice in 25 years, Daniel Pederson, a Michigan-based savings bond expert and founder of www.BondHelper.com, noted, once for a six-month period that began in May 2009 and then in May 2015. But the I Bond will never go below 0%.

The higher fixed rate being offered on new I Bonds now gives savers more incentive to sock away cash into I Bonds for the long run. You'd essentially be getting a rate of nearly 1% above inflation for 30-years, said Pederson.

The higher fixed rate gives savers a "much better long term play with I Bonds," Pederson said.

I Bonds issued from May 2008 and later all had much lower fixed rates. For example, I Bonds issued in all of 2021 and much of 2022 had fixed rates of 0%.

Fixed rates have not been consistent at all throughout the nearly 25 years that I Bonds have been issued. Savers need to pay careful attention to when they bought their I Bonds and take time to research what fixed rate applies to their bonds. Go to TreasuryDirect.gov to see rate charts.

Some I Bonds issued in 2009, for example, have fixed rates that can be 0.1% or 0.3% or 0.7%, depending on when they were issued.

Short-term savers might opt for CDs

Giving a boost to the fixed rate now means that I Bonds issued in the next six months could be more competitive with some rates being offered on one-year certificates of deposit at area banks and credit unions.

"The 0.9% fixed rate was a pleasant surprise," said Ken Tumin, who founded DepositAccounts, which is now part of LendingTree. The site tracks and compares bank rates.

Many had expected that the fixed rate would be closer to the previous 0.4% rate or slightly higher.

"The new higher fixed rate is great news to long-term I Bond investors," Tumin said.

The fixed rate is the most important factor, he said, if you keep an I Bond for many years because an inflation-adjustment is added onto the rate and you'd earn more interest in the long run.

The new, higher fixed rate isn't going to move the needle for savers looking to make a quick buck.

Many savers can find short-term annual rates of 4% to 5% — if they shop around — on a one-year certificates of deposit or Treasury Bill.

If inflation drops further, I Bond savers could see a smaller inflation adjustment when that next rate is announced in November for the following six months.

"Based on a May purchase, an I Bond that’s redeemed in a year will likely earn less interest than a top short-term CD or T-bill that matures next year," Tumin said.

You must hold onto an I Bond for 12 months before being able to cash it in. If you cash it in before five years, you lose the most recent three months of interest. However, if inflation was super-low, you'd lose a minimal amount of interest.

An individual can buy up to $10,000 in I Bonds each calendar year. Savers can buy I Bonds for as little as $25 at TreasuryDirect.gov and the bonds are held in an online account.

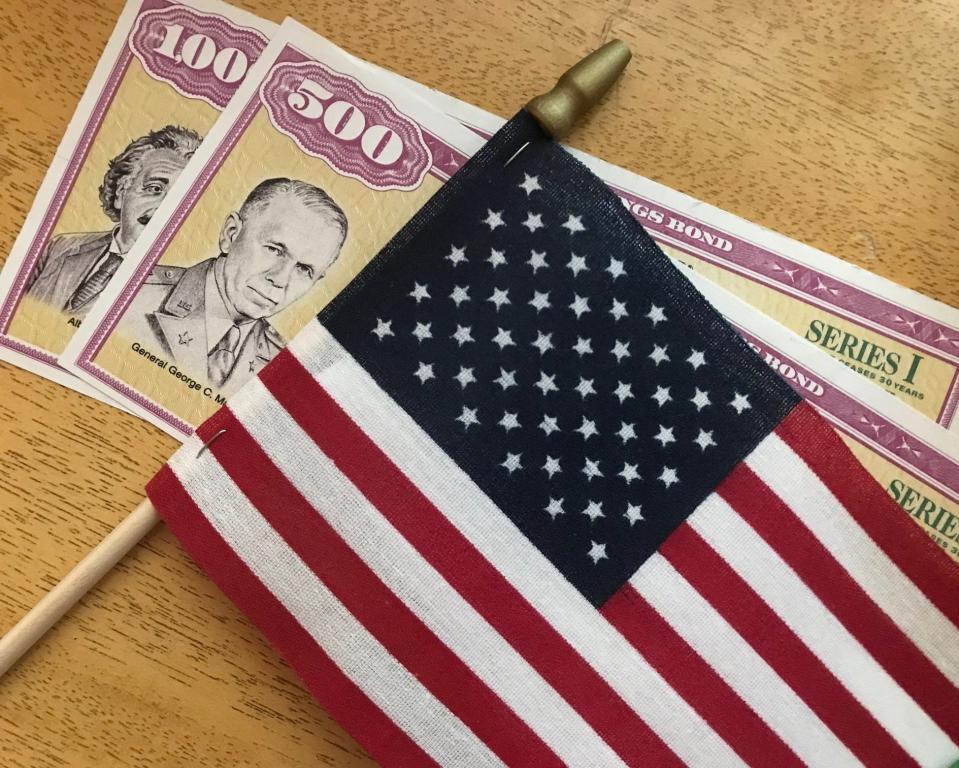

In addition, savers are allowed to buy up to $5,000 in paper I Bonds each year directly if they're receiving a tax refund when they file their returns. The $5,000 limit is the same if you're filing as a single taxpayer or married filing a joint return. You file Form 8888 and complete Part 2 to request that your tax refund be used to buy paper bonds.

Contact Susan Tompor: stompor@freepress.com. Follow her on Twitter @tompor. To subscribe, please go to freep.com/specialoffer.

This article originally appeared on Detroit Free Press: I Bonds drop to 4.3% but have new higher fixed rate