Boss Resources's (ASX:BOE) Wonderful 350% Share Price Increase Shows How Capitalism Can Build Wealth

Boss Resources Limited (ASX:BOE) shareholders might be concerned after seeing the share price drop 14% in the last quarter. But over five years returns have been remarkably great. In fact, during that period, the share price climbed 350%. Impressive! So it might be that some shareholders are taking profits after good performance. But the real question is whether the business fundamentals can improve over the long term.

Check out our latest analysis for Boss Resources

With just AU$383,397 worth of revenue in twelve months, we don't think the market considers Boss Resources to have proven its business plan. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Boss Resources will find or develop a valuable new mine before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Boss Resources has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

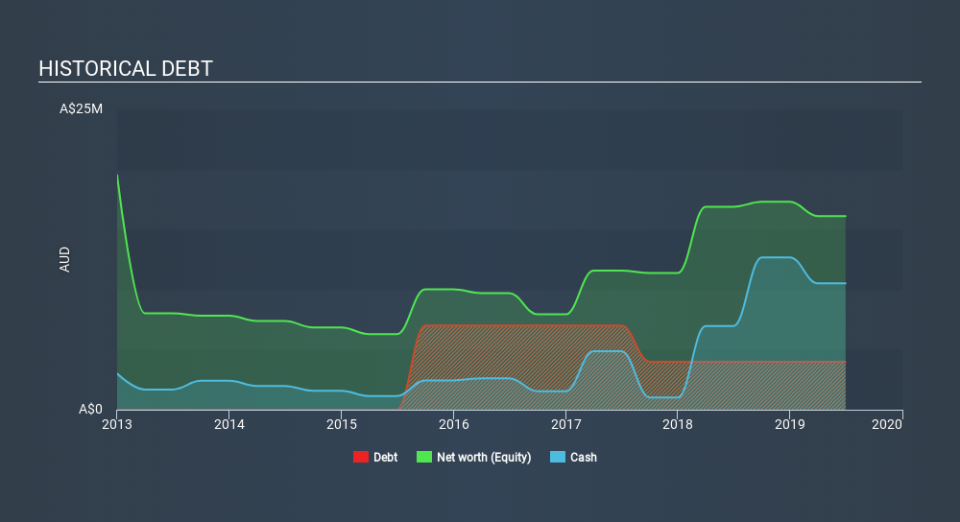

Our data indicates that Boss Resources had AU$3.0m more in total liabilities than it had cash, when it last reported in June 2019. That puts it in the highest risk category, according to our analysis. So the fact that the stock is up 54% per year, over 5 years shows that high risks can lead to high rewards, sometimes. It's clear more than a few people believe in the potential. You can click on the image below to see (in greater detail) how Boss Resources's cash levels have changed over time. You can see in the image below, how Boss Resources's cash levels have changed over time (click to see the values).

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Boss Resources's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Boss Resources's TSR, at 390% is higher than its share price return of 350%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Boss Resources shareholders gained a total return of 3.8% during the year. But that return falls short of the market. On the bright side, the longer term returns (running at about 37% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. Before spending more time on Boss Resources it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.