Boston Properties (BXP) Beats on Q2 FFO, To Acquire 3 Properties

Boston Properties Inc.’s BXP second- quarter 2021 funds from operations (FFO) per share of $1.72 beat the Zacks Consensus Estimate of $1.61. The quarterly figure also exceeded the mid-point of the company’s second-quarter guidance by 12 cents, reflecting an improved portfolio performance, and better-than-projected parking, hotel, retail and termination income.

Quarterly revenues from lease came in at $684 million, exceeding the consensus mark of $674.3 million.

The quarterly FFO per share increased 13.2% from the year-ago quarter’s $1.52. The revenues from lease climbed 8.6% year on year.

Concurrent with the earnings release, Boston Properties announced management’s plan for the expansion of its footprint with acquisitions. In an attempt to establish a new market in Seattle, it has agreed to acquire Safeco Plaza, an 800,000-square-foot Class A office building for a gross purchase price of $465 million. The deal is expected to close in September 2021, and BXP expects to acquire this property in a joint venture (JV) and own up to a 51% interest in the JV.

The company has also agreed to acquire 360 Park Avenue South , an office property in the Midtown South submarket of Manhattan, NY, for roughly $300 million, as well as Shady Grove Bio+Tech Campus in Rockville, MD for $116.5 million.

Inside the Headline Numbers

During the second quarter, the company signed roughly 1.2 million square feet of leases with a weighted-average lease term of 7.5 years. This marks leasing volume of more than double the total square feet of leases executed during first-quarter 2021.

As of Jun 30, 2021, Boston Properties’ portfolio comprised 197 properties, covering 51.5 million square feet of space. This included nine under-construction/redevelopment properties.

Liquidity

Boston Properties exited second-quarter 2021 with $557.3 million of cash and cash equivalents, down from $1.67 billion at the end of 2020.The company has amended and restated its credit agreement and as a result, its credit facility now offers borrowings of up to $1.5 billion through an unsecured revolving credit facility and will expire in June 2026.

Outlook

The company projects third-quarter 2021 FFO per share of $1.68-$1.70. The guided range lies above the Zacks Consensus Estimate of $1.65.

Boston Properties currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

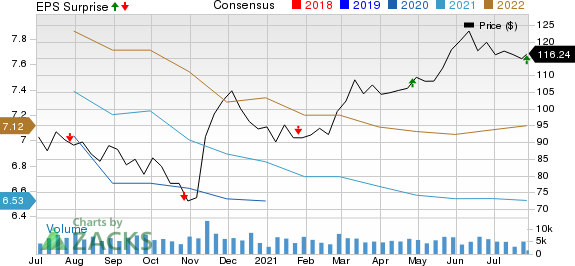

Boston Properties, Inc. Price, Consensus and EPS Surprise

Boston Properties, Inc. price-consensus-eps-surprise-chart | Boston Properties, Inc. Quote

We now look forward to the earnings releases of other REITs like Cousins Properties Incorporated CUZ, Kimco Realty Corporation KIM and Digital Realty Trust, Inc. DLR. All three REITs are slated to report second-quarter numbers on Jul 29.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Properties, Inc. (BXP) : Free Stock Analysis Report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

Cousins Properties Incorporated (CUZ) : Free Stock Analysis Report

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research