Brazil Traders Brace for Jan. 6-Style Turmoil Tied to Election

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- It certainly isn’t likely. It definitely isn’t the base-case scenario. Oddsmakers would call it a long shot at best.

Most Read from Bloomberg

Russia Privately Warns of Deep and Prolonged Economic Damage

Indian Billionaire Closes In on Bezos With 1,000% Stock Surge

Ukraine Latest: US Says Russia Seeks Munitions From North Korea

California Skirts Blackouts With Heat Wave to Test Grid Again

And yet, a growing number of Brazilian traders have started to position themselves for the possibility of turmoil following next month’s presidential vote. The concern, born partly out of the Jan. 6 riots in the US, is that President Jair Bolsonaro and his backers might reject results that show him losing by a small margin and try to use violence to keep him in power.

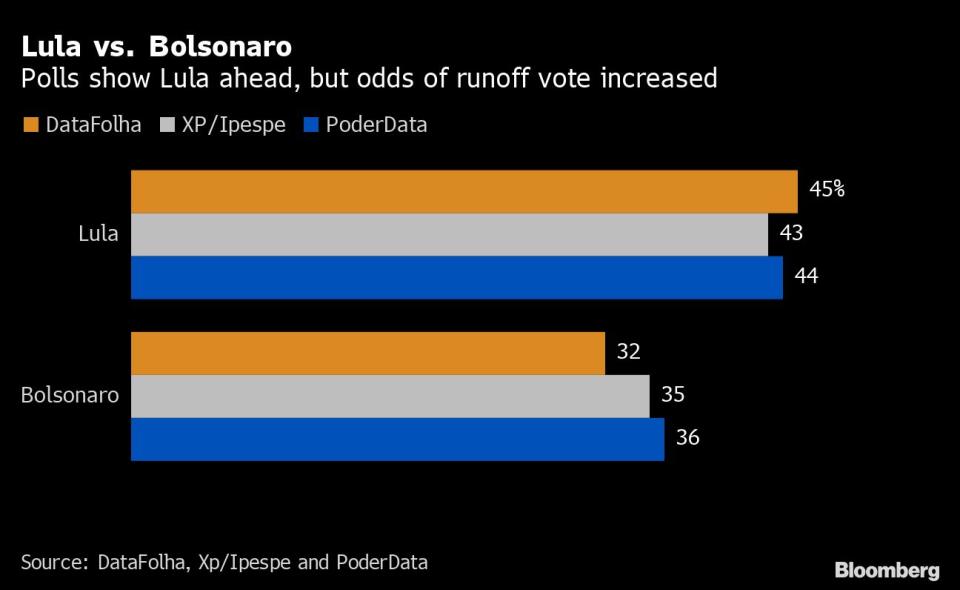

The idea has been circulating for months among everyday Brazilians, particularly the socially progressive contingent that is most stridently opposed to Bolsonaro’s brand of populist politics. But now it’s bubbling up on the trading floors of Sao Paulo and in the hedge-fund offices of Rio de Janeiro’s Leblon neighborhood, especially as polls show Bolsonaro narrowing his deficit with challenger Luiz Inacio Lula da Silva, suggesting a closer race than had been expected a few months ago.

Hedge-fund manager Luis Stuhlberger, a legend in Brazilian investing circles because of the 20,000% gains for his flagship fund over the past two decades, may have been the first prominent money manager to mention it publicly. He called it Brazil’s “banana republic” scenario at an event last month.

“Right now, there’s a risk I don’t exactly know how to price in for Brazilian assets -- that is Lula beating Bolsonaro by a small margin,” Stuhlberger said in an address to other portfolio managers and retail investors. He imagines a tumultuous scenario that could last for two or three weeks after the election.

Like other traders who spoke to Bloomberg News -- most refusing to go on the record for fear of wading into a politically delicate topic -- Stuhlberger made clear in his public remarks that he expects the vote to proceed in an orderly manner. But he’s unwilling to go all in on bets that interest rates will fall or the currency will strengthen “due to fearing that small margin.”

Bolsonaro’s supporters call this all nonsense, and suggest even mentioning the idea is a way to undermine their candidate as he seeks a second four-year term. His office didn’t respond to requests for comment for this story. But critics say the president has stoked much of the fear himself by sowing doubt about the integrity of electronic voting and the justice system. He’s pledged to accept the results “as long as the elections are clean.”

A key gauge for the risk is coming: Brazil’s national Independence Day holiday on Sept. 7, when Bolsonaro supporters plan rallies in several cities. The annual affair has turned raucous since Bolsonaro took office. On Tuesday, he urged Brazilians to celebrate peacefully while at the same time heavily criticizing top court justices for allowing Lula to run in the election and for authorizing probes into the spread of fake news by his supporters.

Last year, he appeared at a rally on Sao Paulo’s main thoroughfare to bash a top court judge. The bellicose comments -- and what they implied about the president’s respect for the law -- sent Brazilian assets plunging in the following days.

“There might be some noise following the election and these Sept. 7 demonstrations will be a good test for how relevant that issue might become for markets,” said Jose Tovar, the chief executive officer of Truxt Investimentos, a Rio-based hedge-fund operator with about 18 billion reais ($3.5 billion) of assets.

Reinaldo Le Grazie, a former central bank director who’s now a partner at asset manager Panamby Capital, says his firm is betting against Brazilian stocks in part due to concerns about inflation, but also because of the risk of a tumultuous election.

“Bolsonaro has mimicked Trump in nearly everything, so of course there’s a risk of him copying what happened on January 6 as well,” Le Grazie said in an interview. “The election will be very tense and both sides are very belligerent. And if the election is decided by a small margin, the risk gets bigger.”

What to Know About Bolsonaro-Lula Showdown in Brazil: QuickTake

Sao Paulo-based money manager Safari Capital is partially hedging its Brazil stock portfolio using options because of similar concerns.

“Post-election turmoil isn’t our base case, but there’s some risk stemming from politics,” said founding partner Marcelo Cavalheiro.

While investors broadly agree that election-related turmoil would be a negative for Brazilian assets, as well as Brazil, they’re split as to whether a Lula or Bolsonaro presidency would be better for investors. Lula would be expected to exert more state control over the economy, but his better standing internationally could lure inflows to local markets.

Major opinion surveys have shown Lula, who previously served as president from 2003 to 2010, holding onto a significant lead over Bolsonaro, although his advantage has shrunk since the beginning of the year. The chances of Lula winning Brazil’s presidential election outright on Oct. 2 have diminished and a runoff vote has become the most likely outcome, according to money managers. The most recent DataFolha poll had Lula at 45% of the first-round vote and Bolsonaro at 32%.

Investors at Legacy Capital, a Sao Paulo-based hedge-fund operator, will be watching the marches Sept. 7 for a gauge of Bolsonaro’s popularity.

“There’s a chance of a strong showing in favor of Bolsonaro, which would be supportive for his odds in the race,” said Gustavo Pessoa, a partner at the firm.

Even if there is election-related chaos, it isn’t entirely clear what the market reaction might be. The S&P 500 Index gained on Jan. 6, 2021, and in the two days that followed the assault on Congress by Donald Trump supporters. Brazil is a younger, more fragile democracy, however, and its markets tend to be more volatile.

Bolsonaro’s Brawl With a Top Justice Tests Brazil’s Democracy

Even as the election poses risks, foreigners have added to optimistic Brazil bets over the past month, pouring $3.2 billion into Brazilian stocks in August. Local and foreign funds reduced their long dollar positions by $1.3 billion each in the same period, signaling some willingness to bet on a rosier outcome no matter who wins the October vote.

Still, that doesn’t mean global investors are oblivious to the risk of turmoil.

“Bolsonaro isn’t just about economic issues, but also personal issues -- it’s the way people react to him,” said Richard Hall, a sovereign analyst at T. Rowe Price, which has $13 billion in emerging-market fixed-income assets under management. “I’m more worried about the aftermath of the election now.”

(Adds Bolsonaro’s comments in eighth paragraph.)

Most Read from Bloomberg Businessweek

Startup Wants to Chart Path to More Equitable Urban Development

Women Who Stay Single and Don’t Have Kids Are Getting Richer

Russia’s Conspiracy-Theory Factory Is Swaying a Brand-New Audience

A New Contaminant Found in Popular Drugs Could Cost Big Pharma Millions

©2022 Bloomberg L.P.