Breaking Down the Timeline: How Long Does It Take to Become a CPA?

AI was used in the creation of this article. The article was reviewed, fact-checked and edited by a content review team. We might earn a commission if you make a purchase through one of the links. McClatchy newsrooms were not involved in the creation of this content.

Becoming a Certified Public Accountant (CPA) shows a strong commitment and a drive for excellence in accounting. This path typically unfolds over eight years and begins with the foundational step of earning a four-year bachelor’s degree. Aspiring CPAs then navigate through additional education to accumulate a total of 150 semester hours, a requirement that can extend the educational timeline by another one to two years.

The rigorous Uniform CPA Examination is a significant milestone, with the American Institute of CPAs (AICPA) reporting an average pass rate of about 50%. This highlights the exam’s challenging nature. Beyond the examination, candidates are tasked with securing one to two years of relevant experience under the mentorship of a licensed CPA.

Below, we’ll look at the process in detail.

Key Takeaways

Education Requirement: The journey to becoming a CPA spans about eight years, starting with a bachelor’s degree in accounting or a related field.

Credit Hour Requirement: To meet the 150 semester hour requirement, additional education, such as a master’s degree or extra undergraduate courses, is typically required.

Practice Experience: Gaining practical experience, which usually spans one to two years, is a crucial step toward CPA licensure.

CPA Exam Preparation: Preparing for the CPA Exam is essential, with an average pass rate of approximately 50%. This process typically takes 18 to 30 months.

CPA Licensure Application: Applying for CPA licensure involves completing an application, submitting required documents, and meeting state-specific requirements, culminating in obtaining the CPA license.

Timeline: Yearly Breakdown to Becoming a CPA

Becoming a CPA is a structured journey that spans several years, combining education, examination, and practical experience. Here’s a yearly timeline that outlines the typical path from starting college to achieving CPA licensure that accounting professionals follow:

Years 1-4: Bachelor’s Degree

Focus: Major in accounting or a related field like business administration.

Key Activities: Complete foundational courses in financial accounting, business law, and tax law. Engage in internships to gain early exposure to the accounting profession.

Years 5-6: Additional Education

Focus: Achieve the 150 semester hours required for CPA eligibility, often through a master’s degree in accounting or additional undergraduate courses.

Key Activities: Deepen knowledge in specialized accounting, such as advanced financial accounting, auditing, and business strategy. Prepare for the CPA exam.

Years 5-6: Gaining Relevant Experience

Focus: Fulfill the experience requirement under the supervision of a licensed CPA.

Key Activities: Work in roles that involve auditing, financial reporting, tax preparation, or other relevant accounting functions. Document experience and skills gained to submit to the state board of accountancy.

Years 7-8: CPA Exam Preparation and Examination and Applying For Licensure

Focus: Dedicate time to studying for the Uniform CPA Examination and applying for licensure.

Key Activities: Choose a review course that has updated its curriculum to align with the new CPA exam structure. These courses now include materials on the three core sections — Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (REG) — as well as the chosen discipline-specific section, reflecting the exam’s evolution. Most states require aspiring CPAs to pass all sections within 18-30 months.

This timeline provides a general framework for the journey to becoming a CPA. Individual experiences may vary depending on factors such as the pace of study, exam preparation, and the specific requirements of the state Board of Accountancy.

CPA Requirements: Education

The answer to “How long does it take to become a CPA?” starts with educational requirements and how quickly you complete your accounting coursework. For most CPAs, this begins with an educational foundation spanning the initial four years, focusing on obtaining a bachelor’s degree in accounting or a related field such as business administration.

Keep in mind that there is no “CPA degree.” However, there are degree program paths that make it easier to complete educational requirements.

Common degree paths include:

Bachelor of Science in Accounting degree

Bachelor of Business Administration (BBA) with a concentration in Accounting

Bachelor of Science in Finance with an emphasis on Accounting

Bachelor of Science in Business Administration (BSBA) with a focus on Accounting

Bachelor of Commerce (B.Com) with a specialization in Accounting

Bachelor’s Degree: The First Four Years

Certified Public Accountants usually study financial accounting, business law, and tax law during undergraduate school. These courses lay the groundwork for understanding the preparation of financial statements, the legal environment of business, and the complexities of tax regulations.

Year 1-2: The focus is on general education courses and introductory accounting and business courses. This phase is about building a broad knowledge base to support more advanced studies in later years.

Year 3-4: Students delve deeper into specialized accounting courses, such as intermediate and advanced financial accounting, managerial accounting, auditing, and taxation. This period is also ideal for engaging in internships, which are invaluable for gaining practical experience and understanding the real-world applications of accounting principles.

Pursuing Additional Education for CPA Eligibility

To sit for the CPA exam, candidates must meet the 150 semester hour requirement, which exceeds the typical 120 hours earned through a bachelor’s degree. Many aspiring CPAs pursue a master’s degree in accounting or taxation to fulfill these additional hours. This helps meet the educational requirement and deepens their knowledge and expertise in the field while understanding the real-world applications of accounting principles.

AICPA Ethics Exam Requirement

The AICPA Ethics Exam is a crucial component of the CPA licensure process in many states. It assesses CPA candidates’ knowledge of ethical standards and professional conduct within the accounting profession. The exam’s content covers a range of essential topics, including independence, objectivity, integrity, confidentiality, and professional competence, as outlined in the AICPA Code of Professional Conduct.

Purpose: The primary purpose of the AICPA Ethics Exam is to evaluate candidates’ understanding and application of ethical principles in real-world accounting scenarios.

State Requirements: While some states mandate passing the AICPA Ethics Exam as part of the CPA licensure process, others may have their own ethics exam or ethics education requirements. Candidates need to be aware of their specific state’s regulations.

Gaining Practical Experience

Fulfilling the experience requirement is critical to becoming a fully licensed Certified Public Accountant. While the specific requirements vary from state to state, gaining practical, hands-on experience under the supervision of a licensed CPA is usually a must.

Duration of Experience: Most states typically mandate CPA candidates complete at least one to two years of relevant work experience, although the exact duration may differ.

Supervision by a Licensed CPA: As a general rule of thumb, candidates must work under the supervision of a licensed CPA who can attest to their competency and adherence to professional standards.

Nature of Experience: States often specify the types of roles or functions that qualify as relevant experience. These may include auditing, financial reporting, preparing financial statements, tax preparation, or other accounting-related activities.

Part-Time vs. Full-Time Work: Some states permit candidates to fulfill their experience requirements through part-time employment, while others may require full-time engagement.

Specific Tasks and Responsibilities: Certain states may outline specific tasks or responsibilities that candidates must undertake to meet the experience requirement. This could include responsibilities related to financial analysis, financial planning, internal control assessment, or other areas of accounting practice.

Verification and Documentation: Candidates must maintain detailed records of their work experience, documenting the tasks performed and skills acquired during their employment. This documentation is crucial when applying for licensure.

Passing the CPA Exam

As you approach the end of your journey to becoming a CPA, your focus shifts to a pivotal phase: preparing for and passing the Uniform CPA Examination.

The updated CPA exam is designed to assess not only the foundational knowledge in the three core sections — Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (REG) — but also your expertise in a discipline-specific section of your choice. This new format allows you to tailor your examination to align with your career aspirations, making the CPA credential even more valuable and relevant to your interests.

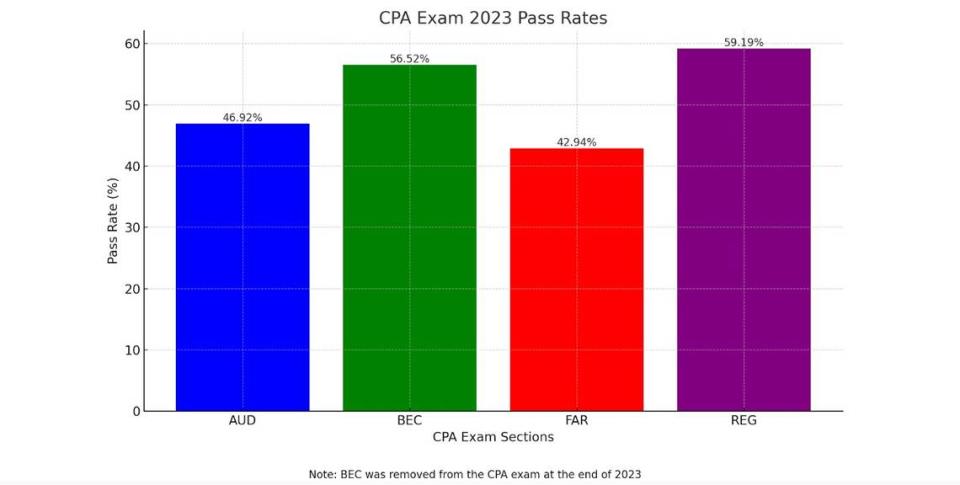

Here are the pass rates for the CPA exam in 2023, according to the AICPA & CIMA.

There isn’t a set amount of time that you must study for the exam. However, the first-hand accounts below show what other aspiring CPAs have done:

“Took me 11 months. Just passed my last one.”

“I studied for 4.5 months total to pass all 4 last year.”

“End of this year makes one year.”

“6.5 months total study time. At roughly 35-45 hours per week.”

“I spent 18 months for all four parts. I took my time and passed each one on the first attempt. I took much longer than most folks, but it was what worked for me. So don’t feel obligated to take a test after only studying for a month because someone else said they passed them all in six weeks. Do what’s best for you and your sanity.”

Preparing for the CPA Exam

Successful CPA exam preparation is essential to passing all sections within the 18- to 30-month timeframe.

Here’s how to approach this critical phase:

Enroll in a CPA Online Review Course: Choose CPA study materials that have updated its curriculum to align with the new CPA exam structure. These courses now include materials on the three core sections — Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (REG) — as well as the chosen discipline-specific section, reflecting the exam’s evolution.

Join Study Groups: Collaborate with peers preparing for the new CPA exam format. Study groups can offer support and insights as you navigate the updated content areas and the discipline-specific section of your choice.

Complete Practice Exams: Practice exams are more crucial than ever, as they now include simulations and questions designed to test knowledge in the three core areas and the chosen discipline-specific section. These practice exams will help you familiarize yourself with the exam’s new format and timing.

Stay Informed: Keep up with updates and announcements from the National Association of State Boards of Accountancy (NASBA) regarding the CPA exam. Note that NASBA now provides 30-month extensions for candidates, offering more flexibility in exam completion.

Timeline and Flexibility

While the CPA exam is challenging, it’s essential to remember that the new format aligns with the changing landscape of the accounting profession. The extended 18- to 30-month window, provided by NASBA, offers candidates greater flexibility in managing their exam preparations, helping to accommodate work and life commitments.

CPA Licensure

Applying for CPA licensure is the final milestone, and the process involves several key steps:

Prepare Your Application: Complete the application for CPA licensure provided by your state board of accountancy. This application typically includes personal information, educational background, exam scores, and details about your work experience.

Submit Required Documents: Along with your application, you must submit supporting documents, including transcripts, letters of experience from your supervising CPA(s), and any other materials specified by your state board.

Pay Application Fees: Be prepared to pay the required application fees, which vary depending on your state.

Pass Background Checks: Some states may require background checks or fingerprinting as part of the application process. Ensure you comply with these requirements.

Wait for Approval: After submitting your application, you will need to wait for your state board to review and approve it. This process may take several weeks to months, so plan accordingly.

Take the Oath: Once your application is approved, you may need to take an oath or commit to uphold ethical and professional standards as a CPA.

The timeline for this phase can vary, depending on the processing times of your state board and the completeness of your application. However, by Year 8, you should be well on your way to obtaining your CPA license, marking the culmination of your dedicated journey toward becoming a licensed CPA.

Conclusion

Becoming a CPA typically spans about seven or eight years, reflecting the comprehensive journey from education to licensure. This includes obtaining a bachelor’s degree, navigating through state-specific requirements, dedicating time to CPA exam preparation, and completing the necessary practical experience. The exact timeline can fluctuate based on individual circumstances and the specific mandates of each state’s board of accountancy.

The CPA credential not only demands a significant investment of time but also a deep commitment to professional excellence and ethical standards. Achieving this status is a testament to one’s expertise in accounting, readiness to uphold the profession’s integrity, and ability to handle complex financial scenarios. It opens doors to advanced career opportunities on your CPA career path and is a mark of credibility and respect in the field of accounting.

FAQ

How long does it take to become a CPA?

Becoming a CPA can take about eight years in total. This includes earning a bachelor’s degree, additional education to meet the 150 semester hours requirement, gaining practical experience, preparing for the CPA exam, and applying for licensure.

What are the educational requirements for becoming a CPA?

Educational requirements involve obtaining a bachelor’s degree in accounting or a related field. Many CPAs pursue further education through a master’s degree or additional undergraduate courses to meet the 150-semester hour requirement.

How do I prepare for the CPA Exam?

To prepare for the CPA exam, enroll in a CPA online review course, join study groups, complete practice exams, and schedule and take the exam sections. Stay informed about updates and extensions provided by NASBA.

What is the AICPA Ethics Exam, and why is it important?

The AICPA Ethics Exam assesses knowledge of ethical standards and professional conduct in accounting. Passing this exam demonstrates a commitment to ethical conduct, a core value in the accounting profession, and is essential for CPA licensure in some states.

What are the requirements for gaining practical experience?

Gaining practical experience usually involves working in auditing, financial reporting, or tax preparation roles under a licensed CPA’s supervision. Requirements vary by state but generally span 1 to 2 years.

Is a master’s degree necessary to become a CPA?

A master’s degree is not mandatory, but many CPAs pursue it to fulfill the 150-semester hour requirement and deepen their expertise. It’s a common route, but additional undergraduate courses can also be sufficient.

Can I work part-time to fulfill the experience requirement?

Some states permit part-time work to meet the experience requirement, while others may require full-time engagement. Check your specific state’s regulations for clarity.