No-deal Brexit would cripple 'generation' of dairy farmers and drive up cheese prices

A no-deal Brexit would wipe out “a whole generation” of UK dairy farmers and drive up the cost of many popular cheeses, according to farming and retail experts.

Many dairy products leaving and entering Britain would face enormous disruption to trade, according to several industry figures who spoke to Yahoo Finance UK and an analysis of dairy industry data and UK and EU trade policy.

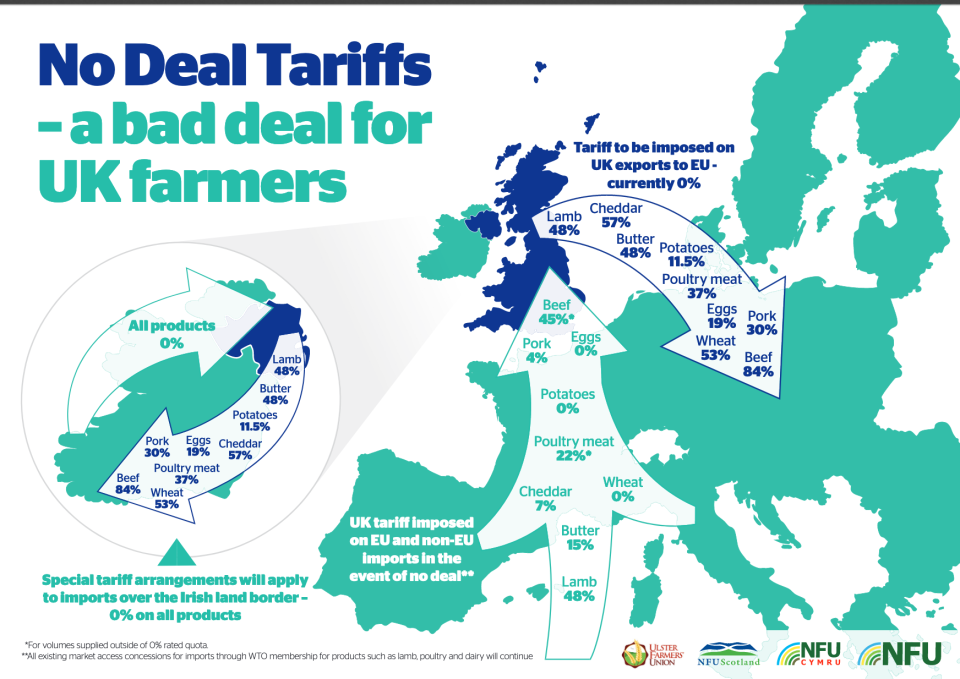

National Farmers’ Union (NFU) dairy board chairman Michael Oakes warned the EU would slap crippling tariffs, a form of import tax, on UK dairy products in a no-deal scenario, pricing them out of the European market.

The vast majority of Britain’s cheese, butter, cream and milk powder exports are currently sold in Europe, but research shows EU buyers could be forced to pay an average of 54% more through tariffs. Some products would be almost twice as expensive, deterring many consumers.

Meanwhile Britain would slap its own new tariffs on certain EU dairy imports, making previously duty-free French, Italian, Greek and other cheeses up to 9% and butter up to 18% more expensive.

READ MORE: How new Brexit deal could hit your wages, the UK economy and public spending

Ray Gaul, a retail expert at Kantar, said that would trickle into higher prices for UK consumers, suggesting producers and retailers would not absorb all the costs.

But Oakes, who milks 200 cows at his own Worcestershire farm, said the UK’s proposed tariffs were still not high enough to serve their purpose of protecting farmers like him from EU competition at home.

Both UK and EU dairy producers would face further disruption from new customs and animal product checks, according to Gaul. Fresh cheese or milk could spoil while stuck waiting at ports.

A recent academic study also suggests EU taxes could still hit UK dairy exports even if Britain does leave with a deal. It found most free trade agreements of the kind proposed by UK prime minister Boris Johnson “do not involve duty-free access of dairy products.”

The UK’s 800-year-old cheddar industry

The Somerset village of Cheddar has been making the cheese of the same name since the 12th century, and Britain has been producing cheese since at least the Roman era.

The country now boasts “one of the most successful cheese markets in the world,” according to a recent UK government press release celebrating China’s growing taste for British cheese.

More than 700 varieties are produced in modern Britain but cheddar is the most valuable one abroad, making up almost half of the UK’s £665m ($843m) of exports last year.

The makers of cheddar and other UK dairy products currently sell freely in Europe, their biggest market, but this would likely change overnight under a no-deal Brexit.

‘It wouldn’t take much for farmers to pack up’

A no-deal Brexit means Britain leaving the EU’s tariff-free trade zone. World Trade Organisation (WTO) rules would oblige Brussels to slap the same tariffs on Britain it applies to other countries it has no trade deals with.

Such tariffs are eye-wateringly high on many imports where the EU tries hard to protect its own producers, including dairy, meat and wheat.

“Dairy is one of the EU’s most protected areas, as high-quality domestic milk is considered a must-have,” said Gaul. “It’s a myth the EU is a free-trade organisation. It is on in the inside, but not out.”

British cheddar sold in the EU would suddenly face a 57% tax rate, costing European buyers an extra £143 for every 100 kilos currently imported tax-free.

Cheshire, Wensleydale, Lancashire and Double Gloucester cheeses would face a 45% tariff, while some unripened cheeses would almost double in cost in Europe with a 92% tax rate.

Oakes of the NFU said the risk could prove existential for many cheese, butter, beef, poultry, pork, lamb and wheat producers. “There’s not the resilience for many farmers to get through. It wouldn’t take much for it to be catastrophic for the industry, and dairy farmers to pack up.”

More protection for consumers than farmers

Governments typically respond in kind when other countries slap tariffs on their goods, as China and the EU have taxed US products in retaliation against US president Donald Trump.

Such responses typically damage trade ties and escalate tensions, but also protect producers suffering from lost exports and send a defiant message. The NFU has called on the government to pledge such reciprocal tariffs.

But the UK is only planning only much lower taxes on some EU dairy products, to limit food price inflation.

“The government can protect consumers by keeping food prices low, or protect farmers through tariffs. They can’t do both,” one Brexit supply chain consultant told Yahoo Finance UK.

Oakes agreed, saying the government did not want an “unhappy electorate.”

READ MORE: Pound steady ahead of another crunch Brexit vote

He added: “We’d need protection to make sure we don’t lose a whole generation of farmers. EU tariffs would mean products have to stay in the UK, but our tariffs wouldn’t provide any protection for UK dairy. We’re getting hit twice.”

Exporters of high-value British cheddar, for example, could not count on domestic demand as typically cheaper, lower-value cheddar from Ireland would remain competitive in Britain despite tariffs, according to Oakes. Potential over-supply could see them forced to drop domestic prices to unsustainable levels.

Oakes said UK producers could also be “shut out” of growth markets elsewhere in Asia and Africa until the government negotiates replacements for its global trade deals signed via the EU.

Fears of price hikes for European cheeses

The UK’s planned tariffs on imported dairy may end up too low to satisfy farmers, but still high enough to frustrate shoppers by making some products pricier.

The tariffs range from 3-9% for cheeses and 12-18% on butter if Britain leaves without a deal, according to the Agriculture and Horticulture Development Board (AHDB).

It estimates almost one in five dairy imports to Britain would face tariffs, versus around one in 500 imports last year.

“The main category which will definitely be disrupted is dairy,” said Gaul, who expects price hikes to filter down to shoppers.

READ MORE: Johnson urged to back allotment boom to feed post-Brexit Britain

Fears of price hikes and shortages of imported vegetables have dominated much of the debate over a no-deal Brexit. But the retail analyst said Britain was less reliant in colder months than if it had left the EU earlier this year, with more winter vegetables locally grown.

By contrast dairy import levels are more similar all year round, according to Gaul, who added: “The amount of dairy sourced from overseas is massive.”

The UK is particularly vulnerable to EU dairy tariffs, with one of the largest trade deficits in the world, according to ADHB analysis, importing far more than it exports.

The imbalance reflects UK demand for European cheeses like mozzarella, brie, feta, parmesan, and Irish cheddar, as well as UK producers targeting overseas markets.

Crisis of the countryside if milk prices ‘collapse’

But Oakes said the single biggest impact of no-deal Brexit would be the upheaval to dairy supply chains across the new EU-UK border in Ireland, and its spillover effects for all British farmers.

“It’s almost one country in terms of dairy. We’ll have an oversupply of 800 million litres of milk that can’t go from north to south to be processed.”

Experts fear EU tariffs and restrictions on non-EU dairy goods will make it difficult if not impossible for many Northern Irish farmers to keep selling in Ireland.

“Northern Ireland produces more than it can use itself. Ireland wouldn’t be able to pay for it. So we’d have a surplus of milk kicking around the rest of the UK, totally undermining the market,” said Oakes.

“The worst-case scenario is at the farm gate, the milk price would collapse. Even the most efficient farms would get a price below production costs,” he said.

UK self-sufficient for a ‘large amount’ of dairy

Official advice to all firms on the UK government’s website is now that Britain “could still leave with no deal on 31 October,” which remains the legal default unless or until parliament approves a deal or the EU grants an extension this week.

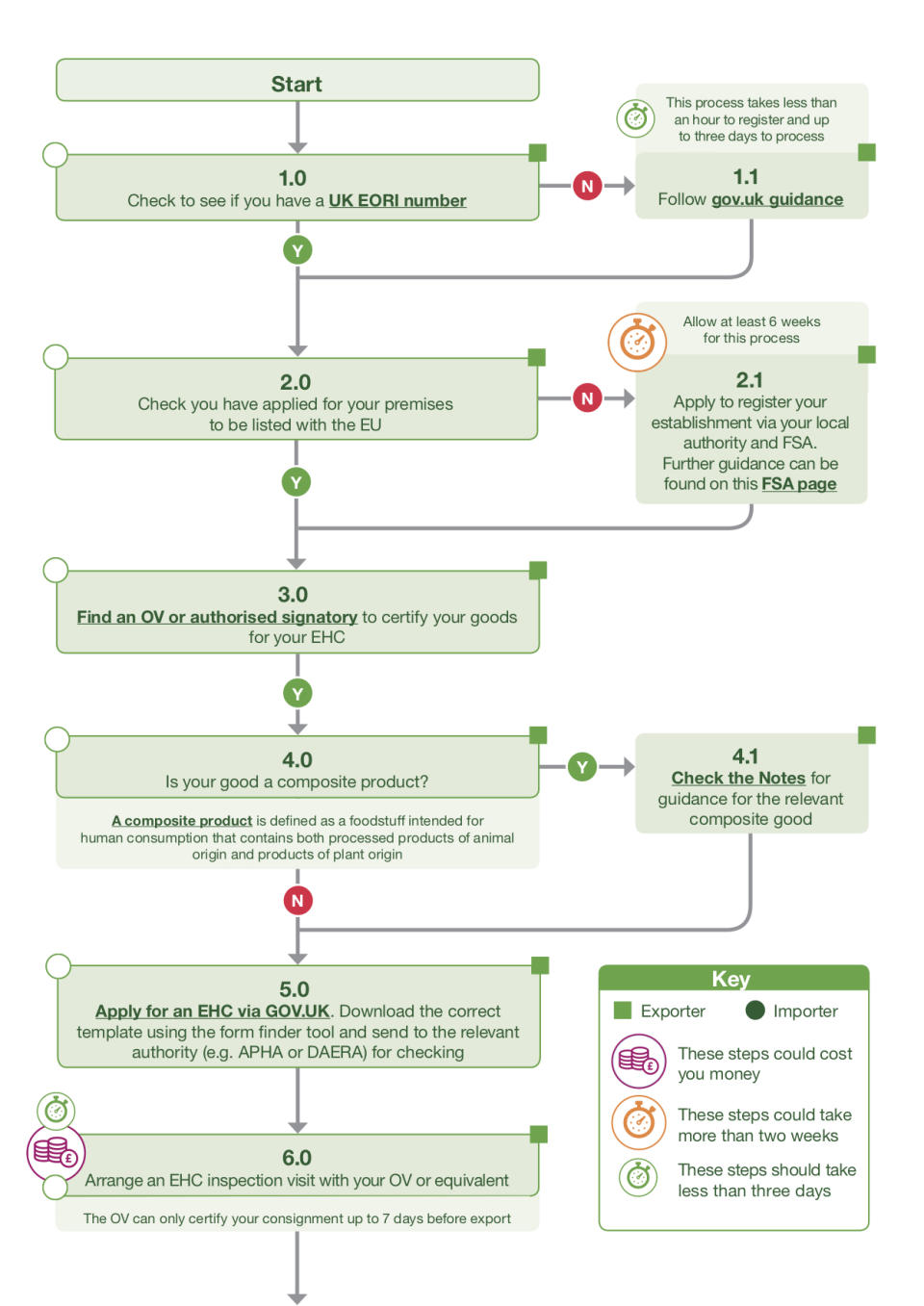

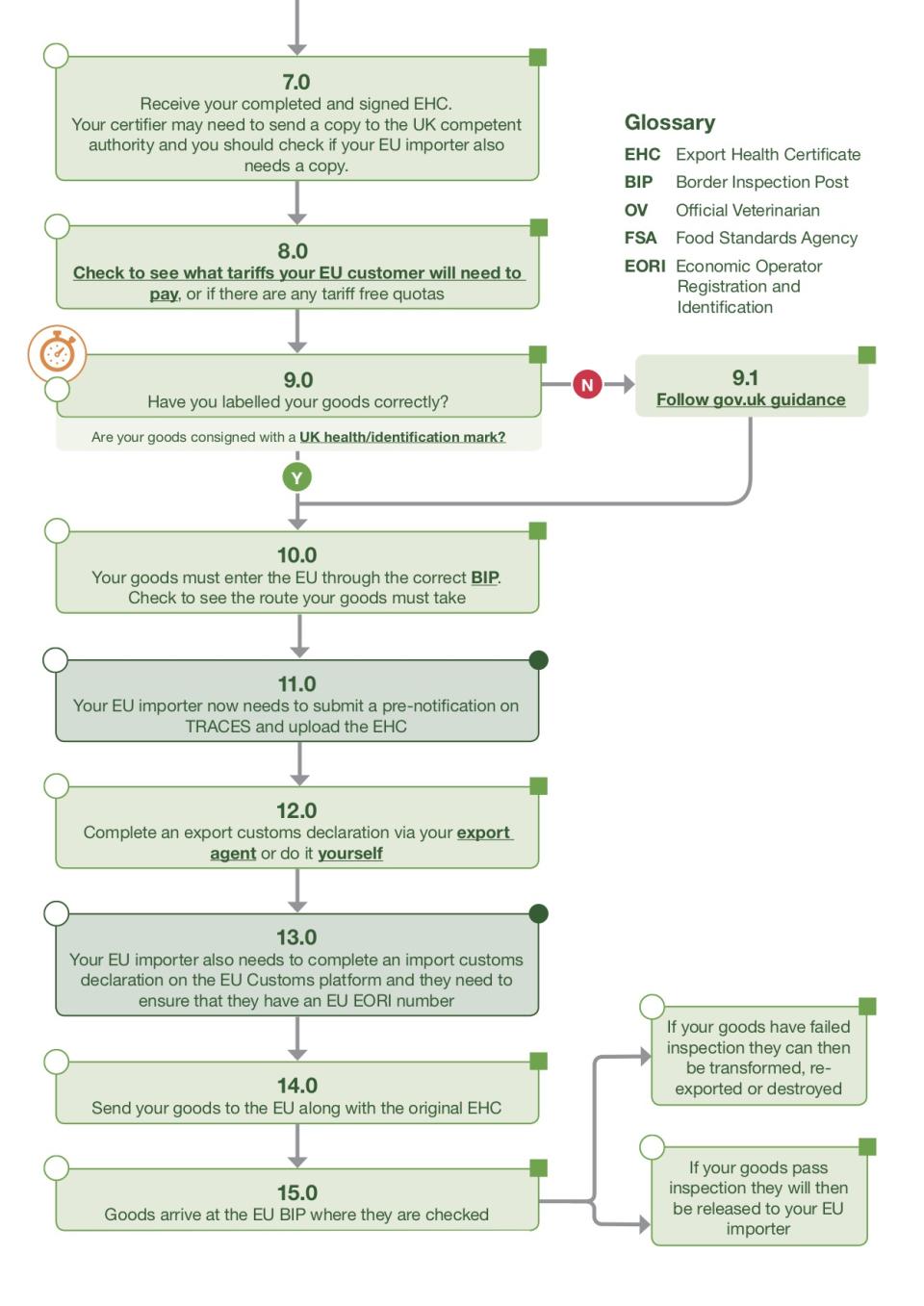

The government recently published no-deal Brexit advice for dairy exporters, highlighting a huge potential increase in bureaucracy.

A 15-point checklist includes researching their own tariff bills, registering their premises and passing inspections by EU-authorised vets, completing customs declarations and facing new border checks.

A spokesman for the UK’s department for the environment, food and rural affairs said officials were meeting regularly with firms to help them prepare.

He added: “We already have a highly resilient food supply chain, and a food industry that is well-versed in dealing with scenarios that can impact food supply.

“Over half of the food we eat is produced right here in the UK and we are already self-sufficient for a large amount of dairy products including fresh milk.”

He also said after Brexit consumers would still have access to a “wide range of high-quality food.”

But for Oakes, a perfect storm of new trade barriers, the Northern Irish milk surplus, the uncertain future of EU farming subsidies and other challenges threatens not just his farm but the countryside as we know it.

“The countryside looks like it does because it’s farmed, but if farmers can’t make a living and walk away, the whole rural infrastructure would be threatened. In the long-term, it’s in no-one’s interest not to get a deal.”

READ MORE: UK delays Brexit rules that will cost wine industry £70m a year