Bristol-Myers (BMY) Beats on Q3 Earnings & Sales, Tweaks View

Bristol-Myers Squibb Company BMY reported better-than-expected third-quarter 2021 results driven by the solid performance of Revlimid, Eliquis, and Opdivo. The company also upped the lower end of its annual earnings guidance.

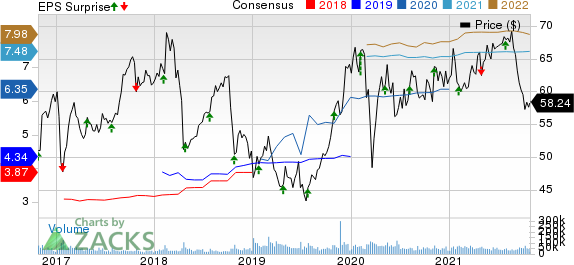

Third-quarter earnings of $2 per share beat the Zacks Consensus Estimate of $1.91 and increased from the year-ago quarter’s $1.63.

Total revenues of $11.6 billion also surpassed the Zacks Consensus Estimate of $11.5 billion and increased 10% from the year-ago period.

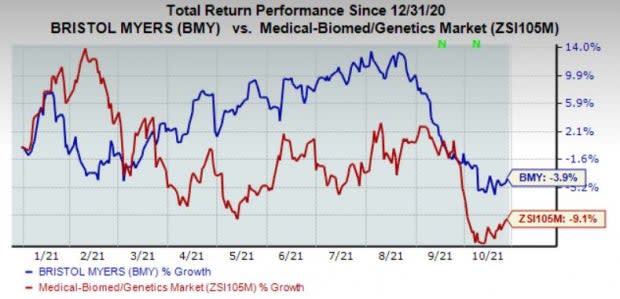

Consequently, shares are up in pre-market trading. However, shares of the company have lost 3.9% year to date compared with the industry's decline of 9.1%.

Image Source: Zacks Investment Research

Quarterly Details

Revenues increased 12% to $7.3 billion in the United States driven by higher demand for Revlimid, Eliquis, Opdivo, and its new product portfolio. Revenues were up 8% outside the country. Ex-U.S. revenues were up 6% when adjusted for foreign exchange impact.

Myeloma drug, Revlimid, contributed $3.3 billion to the top line and was the top revenue generator for Bristol-Myers. Sales were up 11% for the drug year over year.

Eliquis maintained momentum for the company as sales increased 15% to $2.4 billion. We note that Bristol-Myers has a collaboration agreement with Pfizer PFE for Eliquis.

Sales of immuno-oncology drug, Opdivo, approved for multiple cancer indications, were up 7% year over year to $1.9 billion. Sales returned to growth in the second and third quarters after declining in the first quarter. Label expansion of the drug boosted sales.

Sales of rheumatoid arthritis drug, Orencia, were up 5% to $870 million.

Another MM drug, Pomalyst, posted a strong performance and generated sales of $851 million, up 10% year over year.

Leukemia drug, Sprycel, raked in sales of $551 million, up 1% year over year. Melanoma drug, Yervoy, contributed $515 million to the top line, up 15% year over year.

Abraxane generated sales of $266 million, down 22% year over year.

MM drug, Empliciti, recorded sales of $82 million, down 15% year over year.

New drugs like Reblozyl generated sales of $160 million, up 67% year over year. Inrebic generated sales of $22 million. Onureg sales came in at $21 million and Zeposia sales came in at $40 million. CAR T cell therapies Breyanzi sales came in at $30 million and Abecma sales totaled $71 million.

Adjusted research and development expenses in the quarter were $2.4 billion, up 7%. Adjusted marketing, selling and administrative expenses increased 5% to $1.8 billion. Gross margin increased to 81.1% from 80.6% in the quarter.

2021 Guidance Updated

Bristol-Myers now projects 2021 earnings of $7.40-$7.55, up from the previous projection of $7.35-$7.55 per share. The Zacks Consensus Estimate for earnings is pegged at $7.48 per share.

Key Pipeline Updates

In July, the European Commission (“EC”) approved Opdivo (nivolumab) for the adjuvant treatment of adult patients with esophageal or GEJ cancer who have residual pathologic disease following prior neoadjuvant chemoradiotherapy.

In August, Opdivo was approved by the FDA for the adjuvant treatment of patients with urothelial carcinoma who are at high risk of recurrence after undergoing radical resection, regardless of prior neoadjuvant chemotherapy, nodal involvement or PD-L1 status.

In September, the FDA accepted the supplemental biologics license applications (sBLA) for both Opdivo in combination with Yervoy (ipilimumab) and Opdivo in combination with fluoropyrimidine- and platinum-containing chemotherapy as first-line treatments for adult patients with unresectable advanced, recurrent or metastatic esophageal squamous cell carcinoma (ESCC). The regulatory body has set a target action date of May 28, 2022.

In September, the FDA accepted for priority review the BLA for the relatlimab and nivolumab fixed-dose combination for the treatment of patients 12 years and older with unresectable or metastatic melanoma and set a target action date of Mar 19, 2022.

In August, the EC granted Conditional Marketing Authorization for Abecma (idecabtagene vicleucel; ide-cel), a first-in-class B-cell maturation antigen-directed chimeric antigen receptor (CAR) T cell immunotherapy, for the treatment of adult patients with relapsed and refractory multiple myeloma. The therapy is being jointly developed and commercialized in the United States with bluebird bio BLUE.

Bristol Myers Squibb Company Price, Consensus and EPS Surprise

Bristol Myers Squibb Company price-consensus-eps-surprise-chart | Bristol Myers Squibb Company Quote

Our Take

Bristol-Myers’ performance in the third quarter of 2021 was encouraging as key drugs, Revlimid and Eliquis maintained momentum for the company. Opdivo sales were also up in the quarter after a slowdown in the first quarter. The pipeline progress has been impressive and strategic collaborations will further strengthen the pipeline. The approval of new drugs adds a new stream of revenues, which should boost growth in the coming quarters.

Bristol-Myers currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the same space is Regeneron Pharmaceuticals REGN which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Regeneron’s earnings estimates are up $8.21 for 2021 in the last 60 days. The stock is up 22.6% in the year so far.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

bluebird bio, Inc. (BLUE) : Free Stock Analysis Report

To read this article on Zacks.com click here.