Is Broadridge Financial Solutions, Inc. (BR) A Good Stock To Buy?

While the market driven by short-term sentiment influenced by uncertainty regarding the future of the interest rate environment in the US, declining oil prices and the trade war with China, many smart money investors are keeping their optimism regarding the current bull run, while still hedging many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Broadridge Financial Solutions, Inc. (NYSE:BR).

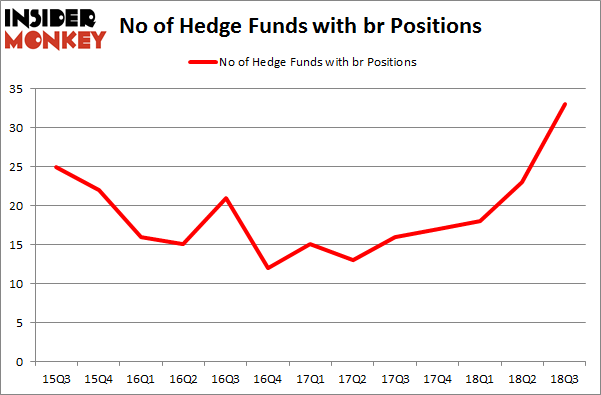

Is Broadridge Financial Solutions, Inc. (NYSE:BR) the right pick for your portfolio? Prominent investors are getting more optimistic. The number of long hedge fund positions increased by 10 recently. Our calculations also showed that br isn't among the 30 most popular stocks among hedge funds. BR was in 33 hedge funds' portfolios at the end of September. There were 23 hedge funds in our database with BR holdings at the end of the previous quarter.

Hedge funds' reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn't keep up with the unhedged returns of the market indices. Our research has shown that hedge funds' small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let's take a peek at the fresh hedge fund action regarding Broadridge Financial Solutions, Inc. (NYSE:BR).

Hedge fund activity in Broadridge Financial Solutions, Inc. (NYSE:BR)

Heading into the fourth quarter of 2018, a total of 33 of the hedge funds tracked by Insider Monkey were long this stock, a change of 43% from one quarter earlier. By comparison, 17 hedge funds held shares or bullish call options in BR heading into this year. So, let's check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the number one position in Broadridge Financial Solutions, Inc. (NYSE:BR). AQR Capital Management has a $134 million position in the stock, comprising 0.1% of its 13F portfolio. Coming in second is Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital, with a $98.9 million position; 0.2% of its 13F portfolio is allocated to the stock. Remaining peers that hold long positions include Jim Simons's Renaissance Technologies, Israel Englander's Millennium Management and Ric Dillon's Diamond Hill Capital.

As industrywide interest jumped, specific money managers were leading the bulls' herd. Renaissance Technologies, managed by Jim Simons, initiated the most outsized position in Broadridge Financial Solutions, Inc. (NYSE:BR). Renaissance Technologies had $69.1 million invested in the company at the end of the quarter. John Overdeck and David Siegel's Two Sigma Advisors also made a $20.6 million investment in the stock during the quarter. The other funds with brand new BR positions are Paul Marshall and Ian Wace's Marshall Wace LLP, Matthew Tewksbury's Stevens Capital Management, and Paul Tudor Jones's Tudor Investment Corp.

Let's now take a look at hedge fund activity in other stocks - not necessarily in the same industry as Broadridge Financial Solutions, Inc. (NYSE:BR) but similarly valued. These stocks are Mettler-Toledo International Inc. (NYSE:MTD), CoStar Group Inc (NASDAQ:CSGP), Liberty Broadband Corp (NASDAQ:LBRDA), and Liberty Broadband Corp (NASDAQ:LBRDK). All of these stocks' market caps match BR's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position MTD,16,325551,-2 CSGP,29,884981,3 LBRDA,22,607395,-3 LBRDK,37,3457184,3 Average,26,1318778,0.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $1.32 billion. That figure was $536 million in BR's case. Liberty Broadband Corp (NASDAQ:LBRDK) is the most popular stock in this table. On the other hand Mettler-Toledo International Inc. (NYSE:MTD) is the least popular one with only 16 bullish hedge fund positions. Broadridge Financial Solutions, Inc. (NYSE:BR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. In this regard LBRDK might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index