Brown: They 'bury' you for mistakes. Banks, Wall Street execs shouldn't get bonuses for failures

- Oops!Something went wrong.Please try again later.

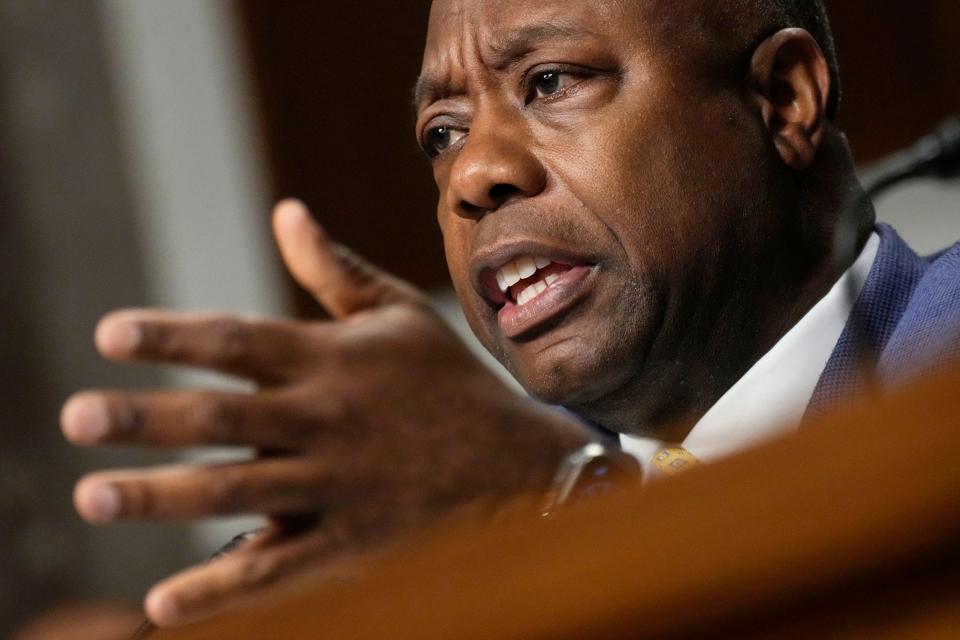

U.S. Senator Sherrod Brown of Cleveland represents Ohio.

When I first heard about Silicon Valley Bank’s collapse in late March, I was driving through Northern Ohio. My mind immediately went to another recent crisis affecting our state: the derailment of a Norfolk Southern train in East Palestine.

More: Silicon Valley Bank collapse explained in graphics

They have one thing in common: corporate lobbyists pushed for weaker rules and less oversight. In both cases, working people paid the price.

East Palestine and neighboring communities in Columbiana County are the kinds of places that are too often forgotten or exploited by corporate America. This disastrous derailment happened because Norfolk Southern chose to invest much of its massive profits in making its executives and shareholders wealthier, at the expense of the Ohio communities along its rail tracks.

It’s the Wall Street business model: executives put short-term profits – and their own compensation – above everything else, including Americans’ physical safety and their economic security.

It’s why the people of East Palestine are living with the toxic aftermath of Norfolk Southern’s disaster, and it’s how we ended up the financial crisis of 2008 that wiped out workers’ savings and permanently set back an entire generation.

But of course Wall Street didn’t change its ways. For as long as we’ve had railroads and big banks, they’ve had too much power in Washington.

Bank lobbyists spent the ensuing years after the crisis lobbying to roll back safeguards we passed in the wake of that crisis. The now-defunct Silicon Valley Bank spent hundreds of thousands of dollars pushing for exemptions for banks like theirs. Their CEO said that they shouldn’t be subject to strong guardrails because of, quote, the “low risk profile of our activities and business model.”

We see how that turned out.

American workers and their families should not be forced to pay the price for other people’s risky bets that don’t pay off – whether they’re on Wall Street or in Silicon Valley.

To most Americans, the lack of Wall Street accountability tracks with their entire experience with our economy.

Fed report: Fed failed to act forcefully to head off Silicon Valley Bank collapse and crisis

Workers face the consequences for bad decisions made in corporate boardrooms. The executives who made those decisions ride off into the sunset.

Ohioans will never forget that, by and large, the Wall Street executives who caused the 2008 financial crisis didn’t face any consequences. Their profits and bonuses weren’t clawed back – they went up.

We cannot – we will not – let that happen again.

It’s why on the Senate Banking and Housing Committee, we have worked to build consensus on the most comprehensive plan to hold Wall Street and other big bank executives accountable in years.

This week our committee will advance the RECOUP Act, my bipartisan bill with ranking member Sen. Tim Scott, R-S.C., that imposes real consequences on bank executives who gamble with customers’ money.

It provides the FDIC with new authority to claw back compensation of failed bank senior executives.

At Silicon Valley Bank, executive bonuses were tied to the bank’s return on equity, so they bought securities with higher yields to chase higher and higher profits. At Signature Bank, executives had incentive compensation plans that were tied to return on assets to, “reflect additional focus on profitability.”

When those investments started to lose money, instead of changing course, executives doubled down. SVB was paying out executive bonuses hours – literally – before the bank crashed.

They need to pay those bonuses back.

Bank executives who take on too much risk and crash their banks shouldn’t get to keep the profits they made by making bad bets with other people’s money – including, in the case of Silicon Valley Bank, the hard-earned money deposited by Ohio small business owners. And they shouldn’t get to take their bad behavior to another bank. It’s why our bill would strengthen regulators’ ability to ban or remove executives who fail to appropriately oversee and manage their bank.

Sherrod Brown: Ohioans are rightly angry at Norfolk Southern

We also need real oversight and deterrence, to make these kinds of bank failures less likely. CEOs and other executives need to know they cannot ignore warnings and enforcement actions from regulators, or otherwise mismanage their banks so badly they fail, and get away with it. That means real fines and penalties.

Our plan increases and strengthens penalties against bad actors. It also requires banks to adopt corporate governance and accountability standards that promote responsible management. Our goal is not to punish for the sake of vindictiveness – it’s to protect American workers and taxpayers.

When their customers make just one mistake, banks bury them in harsh fees and penalties. But when big bank executives and giant Wall Street firms do something far worse, like run their bank into the ground or crash our economy, they’re almost never held accountable.

This is the first major bipartisan bill in years to stand up to Wall Street and hold bank executives responsible for the damage they do to our economy. We are sending a clear message to Wall Street CEOs: it’s time for you to face consequences for your actions, just like everyone else.

U.S. Senator Sherrod Brown of Cleveland represents Ohio.

This article originally appeared on The Columbus Dispatch: RECOUP Act will make banks, Wall Street pay for bad gambles| Sherrod Brown