Bruce Berkowitz Leaves 3 Holdings, Axes Buffett's Kraft Heinz

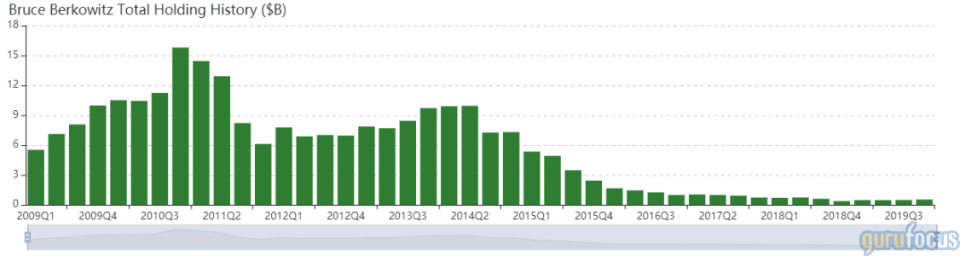

Bruce Berkowitz (Trades, Portfolio), founder and managing member of the Fairholme Fund (Trades, Portfolio), disclosed this month that during the fourth quarter of 2019, he closed his position in The Kraft Heinz Co. (NASDAQ:KHC), a major holding of Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B).

Warning! GuruFocus has detected 3 Warning Sign with KHC. Click here to check it out.

KHC 30-Year Financial Data

The intrinsic value of KHC

Peter Lynch Chart of KHC

Berkowitz said in his quarterly letter that the Fairholme Fund (Trades, Portfolio) gained 32.06% during 2019, outperforming the Standard & Poor's 500 index benchmark return of 31.49%. The Fairholme Fund (Trades, Portfolio) leader concentrates his investments in a few companies, thinking that the more diversified the portfolio, the more average the portfolio returns.

The fund manager seeks companies that have good management, generate free cash flow and are priced at deep discount based on Benjamin Graham's formula. Despite this, the fund manager did not make any new buys during the quarter. As of quarter-end, Fairholme's $528 million equity portfolio contains just three stocks: The St. Joe Co. (NYSE:JOE), Berkshire and Vista Outdoor Inc. (NYSE:VSTO).

Sold out: Kraft Heinz

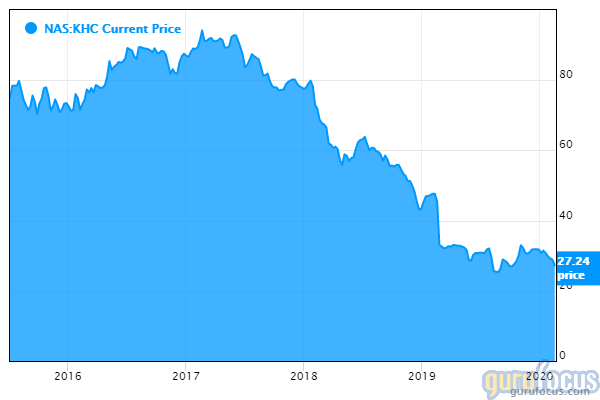

Berkowitz sold 647,300 shares of Kraft Heinz, reducing the portfolio 3.81%. Shares averaged $30.36 during the quarter. According to GuruFocus estimates, Berkowitz gained approximately 5.56% on the stock.

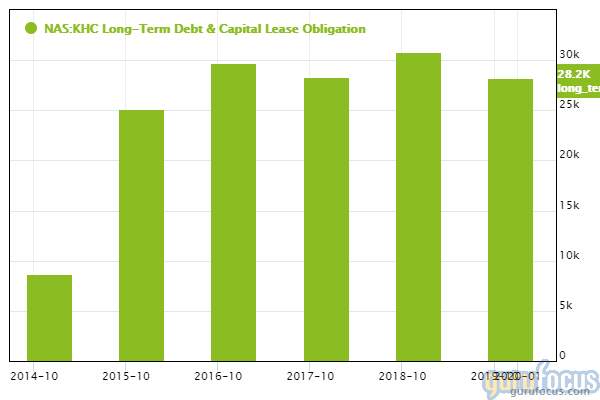

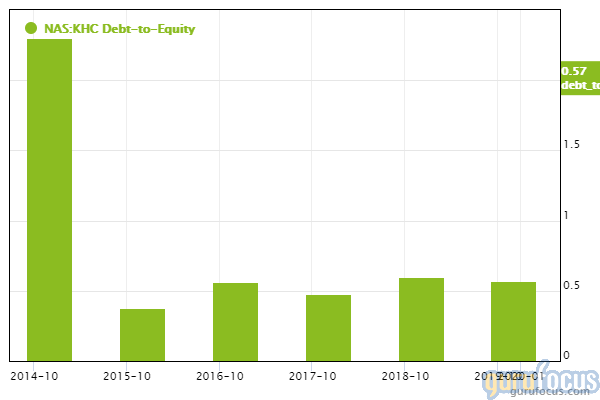

Buffett said in a CNBC "Squawk Box" interview Monday morning that the struggling packaged goods company should "pay down its debt" and that under present circumstances, Kraft Heinz could still maintain its dividend.

GuruFocus ranks Kraft Heinz's financial strength 4 out of 10 on several weak indicators, which include a low Altman Z-score of 0.74 and a debt-to-Ebitda ratio of 5.83. Kraft's debt-to-Ebitda ratio is higher than Joel Tillinghast's safe threshold of 4 and underperforms 76.56% of global competitors.

Buffett's conglomerate owns 325,634,818 shares of Kraft Heinz as of quarter-end. With a weight of 4.32%, the company represents Berkshire's six-largest holding.

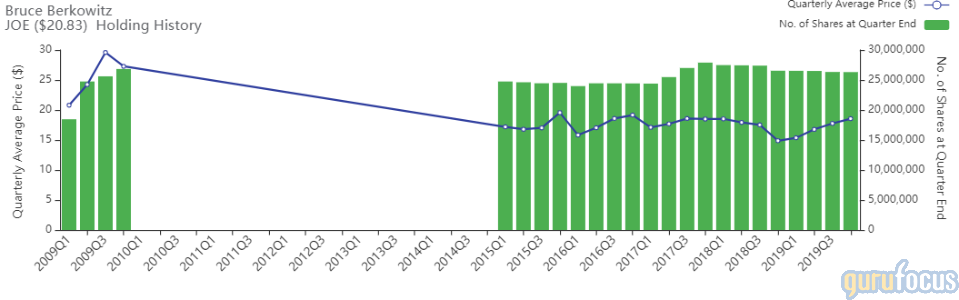

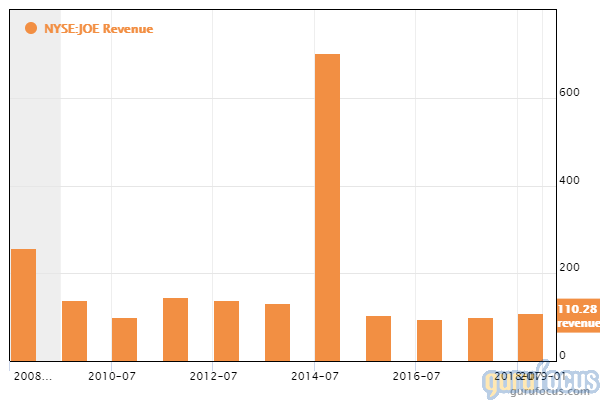

St. Joe

Berkowitz owns 26,317,917 shares of St. Joe, down a slight 0.08% from the third-quarter 2019 holding of 26,340,223 shares. The shares averaged $18.55 during the fourth quarter.

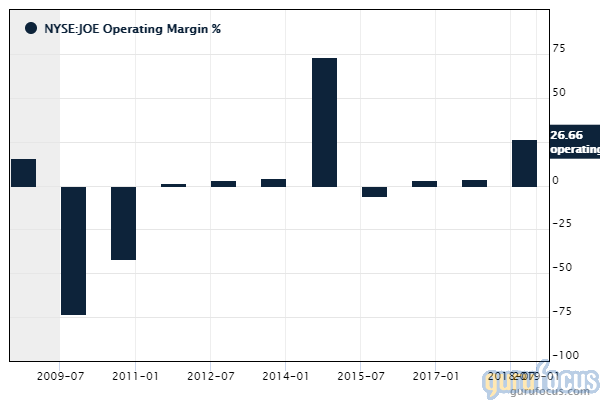

The fund manager said in the letter that the Watersound, Florida-based real estate company contributed to 13.90% of portfolio performance for the year, driven on "record numbers of Americans" working and retiring in Florida. The letter adds that St. Joe's clubs and resorts welcomed over 30,000 guests during 2019, with over 500 new rooms under construction under the Marriot International Inc. (NASDAQ:MAR) and Hilton Worldwide Holdings Inc. (NYSE:HLT) flags.

GuruFocus ranks St. Joe's profitability 4 out of 10: The company has a weak Piotroski F-score of 3 and operating margins that underperform 54.18% of global competitors.

Other gurus with holdings in St. Joe include Charles Brandes (Trades, Portfolio)' Brandes Investment and Mario Gabelli (Trades, Portfolio).

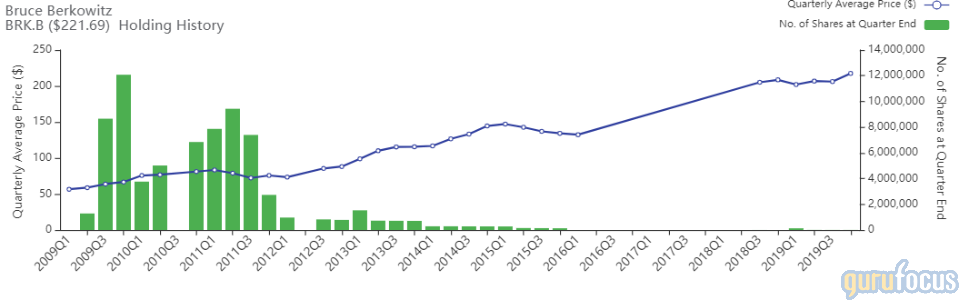

Berkshire

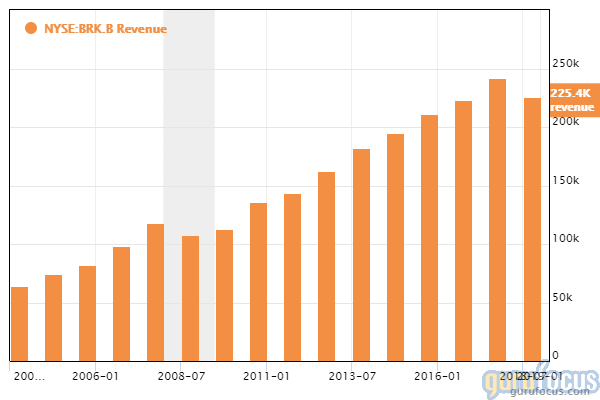

Berkowitz owns 16,295 Class B shares of Berkshire as of quarter-end. The shares averaged $217.51 during the quarter.

Buffett said in his annual letter that Berkshire earned $81.4 billion according to generally accepted accounting principles. The conglomerate seeks "good businesses at fair prices": The letter says that Berkshire's investments are in "controlled businesses that achieve good-to-excellent returns on the net tangible assets each requires for its operations."

Vista Outdoor

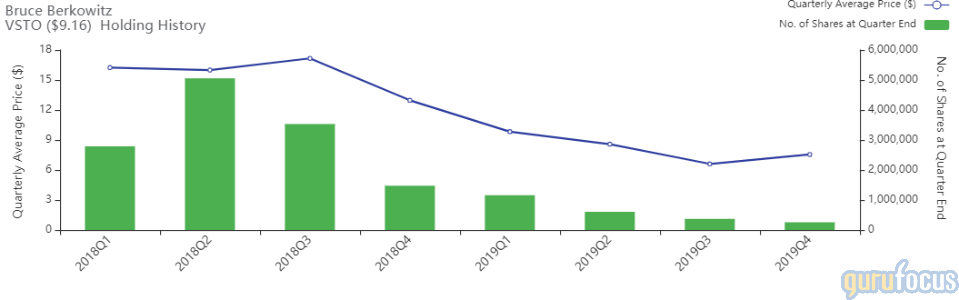

Berkowitz owns 258,300 shares of Vista Outdoor as of quarter-end, down 30.28% from the third-quarter holding of 370,500 shares. The shares averaged $7.55 during the fourth quarter.

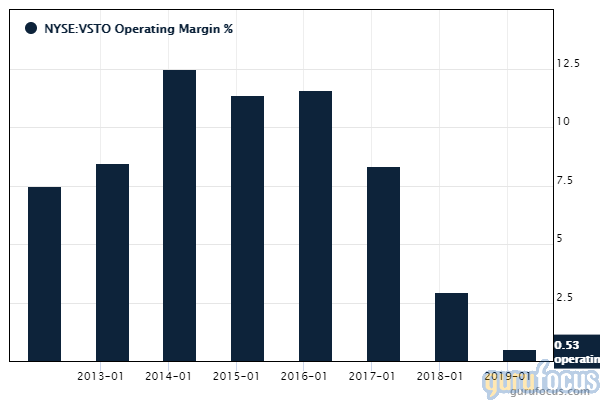

The Farmington, Utah-based company designs, develops and manufactures outdoor sports and recreation products. GuruFocus ranks Vista Outdoor's financial strength 4 out of 10 on several weak indicators, which include debt ratios that underperform over 69% of global competitors. Warning signs of low profitability include operating margins that have contracted over the past five years and are underperforming over 69% of global competitors.

Disclosure: No positions.

Read more here:

4 Warren Buffett Holdings Trading Near 52-Week Lows

The 4 Most-Bought Guru Stocks of the 4th Quarter

Stanley Druckenmiller's Top 6 Buys in the 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.