Is Brunel International N.V. (AMS:BRNL) Investing Effectively In Its Business?

Today we'll evaluate Brunel International N.V. (AMS:BRNL) to determine whether it could have potential as an investment idea. Specifically, we'll consider its Return On Capital Employed (ROCE), since that will give us an insight into how efficiently the business can generate profits from the capital it requires.

Firstly, we'll go over how we calculate ROCE. Second, we'll look at its ROCE compared to similar companies. Finally, we'll look at how its current liabilities affect its ROCE.

What is Return On Capital Employed (ROCE)?

ROCE measures the amount of pre-tax profits a company can generate from the capital employed in its business. In general, businesses with a higher ROCE are usually better quality. In brief, it is a useful tool, but it is not without drawbacks. Renowned investment researcher Michael Mauboussin has suggested that a high ROCE can indicate that 'one dollar invested in the company generates value of more than one dollar'.

So, How Do We Calculate ROCE?

Analysts use this formula to calculate return on capital employed:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

Or for Brunel International:

0.11 = €34m ÷ (€434m - €122m) (Based on the trailing twelve months to June 2019.)

Therefore, Brunel International has an ROCE of 11%.

View our latest analysis for Brunel International

Is Brunel International's ROCE Good?

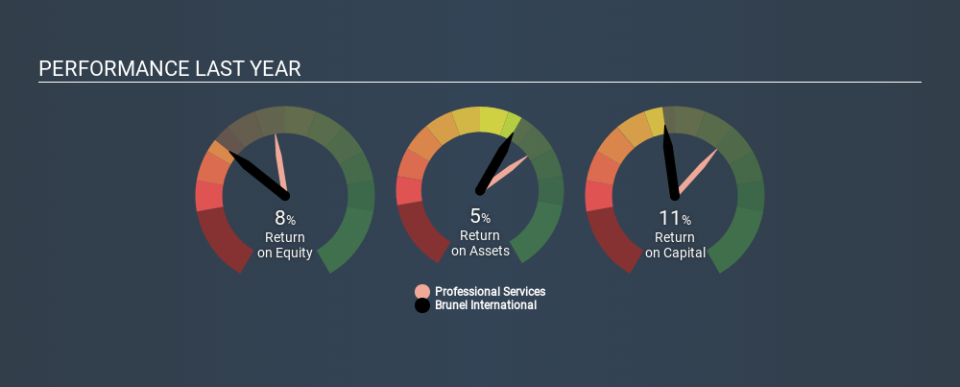

ROCE can be useful when making comparisons, such as between similar companies. It appears that Brunel International's ROCE is fairly close to the Professional Services industry average of 13%. Separate from Brunel International's performance relative to its industry, its ROCE in absolute terms looks satisfactory, and it may be worth researching in more depth.

Brunel International's current ROCE of 11% is lower than its ROCE in the past, which was 17%, 3 years ago. This makes us wonder if the business is facing new challenges. You can see in the image below how Brunel International's ROCE compares to its industry. Click to see more on past growth.

When considering this metric, keep in mind that it is backwards looking, and not necessarily predictive. Companies in cyclical industries can be difficult to understand using ROCE, as returns typically look high during boom times, and low during busts. ROCE is only a point-in-time measure. Future performance is what matters, and you can see analyst predictions in our free report on analyst forecasts for the company.

What Are Current Liabilities, And How Do They Affect Brunel International's ROCE?

Short term (or current) liabilities, are things like supplier invoices, overdrafts, or tax bills that need to be paid within 12 months. Due to the way the ROCE equation works, having large bills due in the near term can make it look as though a company has less capital employed, and thus a higher ROCE than usual. To counter this, investors can check if a company has high current liabilities relative to total assets.

Brunel International has total liabilities of €122m and total assets of €434m. Therefore its current liabilities are equivalent to approximately 28% of its total assets. A fairly low level of current liabilities is not influencing the ROCE too much.

What We Can Learn From Brunel International's ROCE

Overall, Brunel International has a decent ROCE and could be worthy of further research. There might be better investments than Brunel International out there, but you will have to work hard to find them . These promising businesses with rapidly growing earnings might be right up your alley.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.