Buffett's Goldman Sachs Boosts Dow's Gain on Wednesday

- By James Li

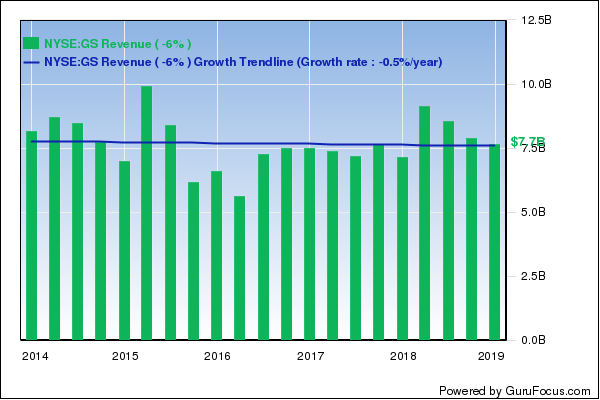

Goldman Sachs Group Inc. (GS), one of Warren Buffett (Trades, Portfolio)'s major bank holdings, said on Wednesday that revenues for the 12 months ending Dec. 31, 2018, were $36.62 billion, up 12% from 2017 on strong revenue growth across the company's key business segments.

Warning! GuruFocus has detected 1 Warning Sign with GS. Click here to check it out.

The intrinsic value of GS

For the fourth quarter, the New York-based investment bank reported $6.04 in diluted earnings per share, outperforming Refinitiv's consensus estimate of $4.45 per share. Revenues of $8.08 billion outperformed Refinitiv's expectations by approximately $0.53 billion.

Bank accelerates revenue growth across key segments

Goldman Sachs CEO David Solomon said the company reported double-digit revenue growth despite a "challenging backdrop" for the bank's market-making business during the second half of the year. Strong revenue growth in key segments like Investment Banking, Investment Management and Institutional Client Services contributed to overall growth.

Chief Financial Officer Steve Scherr said during the earnings call that the Investment Banking segment reported "near-record results" as strong merger and acquisition transaction volumes offset declines in underwriting due to high market volatility and wider credit spreads. Scherr underscored that while the first three quarters featured "continued strength in global equity and credit markets," the fourth quarter featured "negative performance across all asset classes" due to increased market volatility.

Bank stocks propel Dow higher, market trades higher for sixth day over past eight days

Shares of Goldman Sachs traded around an intraday high of $196.26, up approximately 9% from the previous close of $179.95. Such gains, including those from other major Berkshire Hathaway Inc. (BRK-A)(BRK-B) bank holdings like Bank of America Corp. (BAC), JPMorgan Chase & Co. (JPM) and Wells Fargo & Co. (WFC), contributed to the U.S. stock market's sixth up day over the past eight trading days. While the Dow Jones Industrial Average opened trading at 24,139.91, up approximately 74 points from Tuesday's close, the 30-stock index further climbed to an intraday high of 24,285.63 at approximately 2 p.m. Eastern.

Other gurus riding Goldman Sachs' momentum include Dodge & Cox, Spiros Segalas (Trades, Portfolio) and Bill Nygren (Trades, Portfolio).

Disclosure: No positions.

Read more here:

Warren Buffett's JPMorgan Chase Reports 1st Earnings Miss in 4 Years

Record Earnings Send Bank of America Shares Higher

How Will Banks Perform in 2019?

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with GS. Click here to check it out.

The intrinsic value of GS