New to building credit? Consider these unsecured cards to get started

— Our editors review and recommend products to help you buy the stuff you need. If you sign up for a credit card after clicking one of our links, we may earn a small fee for referring you. However, our picks and opinions are independent from USA TODAY's newsroom and any business incentives.

Getting credit cards applications denied because you don’t have enough credit history is one of the more frustrating things in life. Creditors may be hesitant to take a chance on someone without a proven payment history—but there are 45 million Americans who have little to no credit background, according to a 2016 report by the Consumer Financial Protection Bureau. This is the problem Petal aims to solve for a whole lot of us.

During the application process, Petal looks beyond traditional credit scores to approve borrowers for one of its two credit cards, Petal 1 and Petal 2. The company analyzes your “cash score,” its own metric that measures creditworthiness using your income, savings and spending history.

Both Petal cards are issued by WebBank, an FDIC member, which means it’s a financial institution covered by the Federal Deposits Insurance Corporation (FDIC). The cards come with perks such as cash back rewards and an app to help manage your balance, features you’ll rarely find with secured credit cards. You can also get pre-approved for a credit card without it impacting your credit score.

Wondering if you should apply? Generally, the Petal 1 card is for borrowers with low-to-fair credit who are trying to improve their credit history, while the Petal 2 card is for applicants with fair-to-good credit scores, and comes with a better cash back deal and no fees.

Here’s a breakdown of the features, terms and kinds of fees that Petal 1 and Petal 2 have at the time of publishing—but keep in mind that they're subject to change.

Petal® 1 "No Annual Fee" Visa® Credit Card

Annual fee: None

International fee: None

APR: 19.99% to 29.49%

Credit limit: $500 to $5,000

Cash back: 2% to 10% at eligible merchants

Late fee: $29 and then $40 if you miss another payment within six months; however, the fee will not be more than your minimum payment

Returned payment fee: $29

Petal® 2 "Cash Back, No Fees" Visa® Credit Card

Annual fee: None

International fee: None

APR: 12.99% to 26.99%

Credit limit: $500 to $10,000

Cash back: Up to 1.5% cash back for each swipe, plus 2% to 10% at eligible merchants

Late fee: None

Returned payment fee: None

Who should apply for a Petal credit card?

For people trying to build credit, Petal could be an alternative to a secured credit card that requires a deposit and may only offer a credit line of a few hundred dollars.

Petal cards are unsecured—meaning they don't required a security deposit—and credit lines range from $500 to several thousand dollars. The cards have no annual fee, and payments are reported to four credit bureaus—Equifax, Experian, TransUnion, and SageStream—which could help you build positive credit history.

Petal is available to U.S. residents living in the states or a U.S. military location. To apply, you need a valid Social Security number or tax identification number.

While cardholders can use Petal’s mobile app, you don’t need a smartphone to manage your account. Users can use the internet to log into their account from a computer.

How do you apply for a Petal credit card?

Petal offers a pre-approval process that won’t affect your score. You’ll provide your name, address, Social Security number, estimated income and housing payment. The full application uses the same information you entered for a pre-approval, but it does require a hard inquiry that could impact your score.

Keep in mind: Getting pre-approved doesn’t guarantee that you’ll get a final approval. If you have limited credit history, Petal may ask for your bank account information during the application to calculate its cash score. But once you’re approved, your card will arrive in about six to 10 days.

How does Petal’s cash-back program work?

The Petal 1 and Petal 2 cards offer 2% to 10% cash back on eligible purchases when you shop at qualifying merchants. You can find the offers for local merchants in the mobile app, which we’ll get to in a bit.

The Petal 2 card also offers a cash back percentage on all purchases and that percentage increases as you make on-time payments. Here’s how it works:

Automatically earn 1% after activating the Petal 2 card

Earn 1.25% after making six on-time monthly payments

Earn 1.5% after making 12 on-time monthly payments

The 1.5% cash back offer is comparable to other major flat-rate unsecured credit cards on the market, like the Capital One Quicksilver and the Wells Fargo Cash Wise Visa, one of our picks for the best credit cards to help you save money. Plus, Petal 2 cardholders can double-dip: You can earn up to 1.5% cash back on every purchase on top of what you earn through Petal Offers from shopping at qualifying retailers.

Cash back earned is added to your Cash Back Wallet each billing cycle. You can redeem cash back as a statement credit, or you can request a check or ACH payment after your cash back balance reaches $20.

What other features and benefits do Petal credit cards offer?

Cardmembers can take advantage of the following perks:

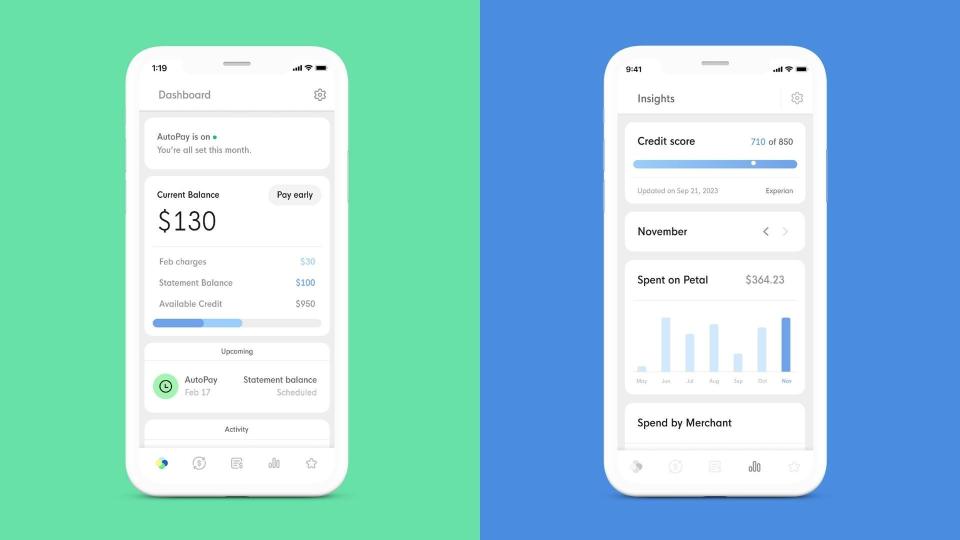

Mobile app: Available for iOS and Android, the Petal app makes it easy to manage your balances, transactions and available credit all in one place.

Free credit score: The cards come with a VantageScore using Experian data, so each month you can track score growth as you use the card and pay back the balance.

Payment calculator: The app calculator can tell you how much interest you’ll pay depending on the payments you make. Notably, it shows how much it’ll cost if you make just minimum payments.

Subscription management: The Petal app lists the subscriptions charged to your credit card so you can decide which to keep and cancel.

Visa® benefits: Cards come with auto rental collision insurance, theft coverage and Roadside Dispatch® through Visa.

What drawbacks do Petal credit cards have?

As of December 2020, the average APR for credit cards assessed interest is 16.34%, according to Federal Reserve data. Considering that, interest rates at Petal (up to 29.49%) are on the higher side.

That’s not entirely surprising since the cards are geared toward consumers who may not yet have established credit. Some of our best secured credit cards, for example, have interest rates ranging from 11.50% to 26.99%. Paying off the balance each month can help you avoid interest charges.

So, should you open a Petal credit card account?

If you're new to credit and having trouble getting an unsecured credit card, Petal could be worth a look. Going through the pre-approval process doesn’t involve a credit check, and your income and banking history can help you get approved.

You may have your eyes on one day getting a credit card with top-tier perks, and Petal could help you get there. Since payment history is reported to all three major credit bureaus, establishing a history of on-time payment with Petal could help you get approved for a major credit card that offers big travel benefits or other rewards later down the road.

Please note: The offers mentioned above are subject to change at any time and some may no longer be available.

Reviewed has partnered with CardRatings for our coverage of credit card products. Reviewed and CardRatings may receive a commission from card issuers.

Other articles you might enjoy

The product experts at Reviewed have all your shopping needs covered. Follow Reviewed on Facebook, Twitter, and Instagram for the latest deals, product reviews, and more.

This article originally appeared on Reviewed: No credit? No problem: Petal credit card review