Bull Signal Says Restaurant Stock Could Reclaim Pre-Pandemic Levels

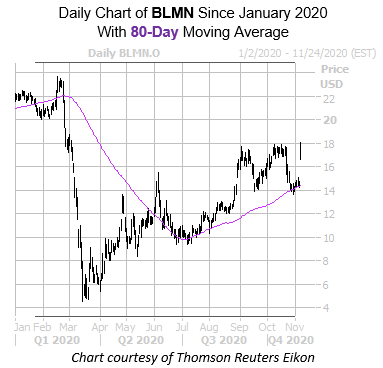

The shares of Bloomin' Brands Inc (NASDAQ:BLMN) are up 17.3% at $16.96 at last check. And while the restaurant concern, which is the parent of chains such as Outback Steakhouse and Carrabba's Italian Grill, still has a ways to go before it reaches this year's pre-pandemic high of $23.65, the stock has gained 48.5% in the last six months. Better yet, the equity's recent pullback has it near a historically bullish trendline, which alongside upbeat vaccine news could help BLMN climb higher in the coming weeks.

More specifically, Bloomin' Brands stock just came within one standard deviation of its 80-day moving average, after spending a few months above this trendline. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, five similar signals have occurred during the past three years. At least 75% of the time, BLMN enjoyed an 18.3% gain. From its current perch, a move of similar magnitude would put the security above the $20 mark -- closer to this year's peak.

Though shorts are already hitting the exits, there is still plenty of pessimism left to be unwound, which could soon push the security even higher. Short interest dropped 3.9% in the last two reporting periods, but the 12.81 million shares sold short still account for a substantial 16% of the stock's available float. In other words, it would take almost a week to buy back these bearish bets, at the equity's average pace of trading.

Now certainly looks like an good time to take advantage of BLMN's next move with options. The security's Schaeffer's Volatility Index (SVI) of 62% sits in the extremely low 13th percentile of its annual range. This means the stock is currently sporting attractively priced premiums.