Should You Buy Ciena Corporation (CIEN)?

Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that's why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can't match. So should one consider investing in Ciena Corporation (NASDAQ:CIEN)? The smart money sentiment can provide an answer to this question.

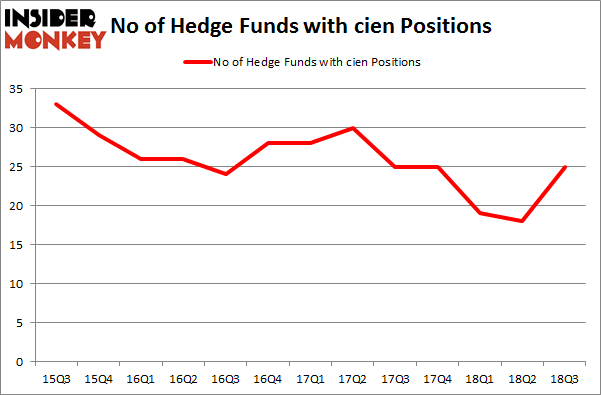

Ciena Corporation (NASDAQ:CIEN) has seen an increase in activity from the world's largest hedge funds recently. CIEN was in 25 hedge funds' portfolios at the end of September. There were 18 hedge funds in our database with CIEN holdings at the end of the previous quarter. Our calculations also showed that cien isn't among the 30 most popular stocks among hedge funds.

If you'd ask most investors, hedge funds are seen as slow, old financial vehicles of yesteryear. While there are over 8,000 funds in operation today, Our researchers choose to focus on the top tier of this club, approximately 700 funds. These investment experts oversee the majority of the smart money's total capital, and by tracking their first-class picks, Insider Monkey has brought to light several investment strategies that have historically exceeded the S&P 500 index. Insider Monkey's flagship hedge fund strategy outrun the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let's take a peek at the new hedge fund action encompassing Ciena Corporation (NASDAQ:CIEN).

How are hedge funds trading Ciena Corporation (NASDAQ:CIEN)?

Heading into the fourth quarter of 2018, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 39% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CIEN over the last 13 quarters. So, let's find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Israel Englander's Millennium Management has the most valuable position in Ciena Corporation (NASDAQ:CIEN), worth close to $50.4 million, accounting for 0.1% of its total 13F portfolio. On Millennium Management's heels is Renaissance Technologies, led by Jim Simons, holding a $38.5 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining professional money managers that hold long positions comprise Lee Ainslie's Maverick Capital, Steve Cohen's Point72 Asset Management and Chuck Royce's Royce & Associates.

As industrywide interest jumped, some big names were leading the bulls' herd. Cavalry Asset Management, managed by John Hurley, initiated the biggest position in Ciena Corporation (NASDAQ:CIEN). Cavalry Asset Management had $22.9 million invested in the company at the end of the quarter. Mike Masters's Masters Capital Management also initiated a $15.6 million position during the quarter. The following funds were also among the new CIEN investors: Mike Masters's Masters Capital Management, Brad Dunkley and Blair Levinsky's Waratah Capital Advisors, and Peter Muller's PDT Partners.

Let's also examine hedge fund activity in other stocks - not necessarily in the same industry as Ciena Corporation (NYSE:CIEN) but similarly valued. These stocks are Skechers USA Inc (NYSE:SKX), JBG SMITH Properties (NYSE:JBGS), Life Storage, Inc. (NYSE:LSI), and Bemis Company, Inc. (NYSE:BMS). All of these stocks' market caps resemble CIEN's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position SKX,20,235713,-4 JBGS,17,280134,2 LSI,12,126980,-4 BMS,26,399893,7 Average,18.75,260680,0.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $261 million. That figure was $328 million in CIEN's case. Bemis Company, Inc. (NYSE:BMS) is the most popular stock in this table. On the other hand Life Storage, Inc. (NYSE:LSI) is the least popular one with only 12 bullish hedge fund positions. Ciena Corporation (NASDAQ:CIEN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. In this regard BMS might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index