Some C&N Holdings (HKG:8430) Shareholders Have Copped A Big 66% Share Price Drop

The nature of investing is that you win some, and you lose some. And there's no doubt that C&N Holdings Limited (HKG:8430) stock has had a really bad year. In that relatively short period, the share price has plunged 66%. We wouldn't rush to judgement on C&N Holdings because we don't have a long term history to look at. Shareholders have had an even rougher run lately, with the share price down 36% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

See our latest analysis for C&N Holdings

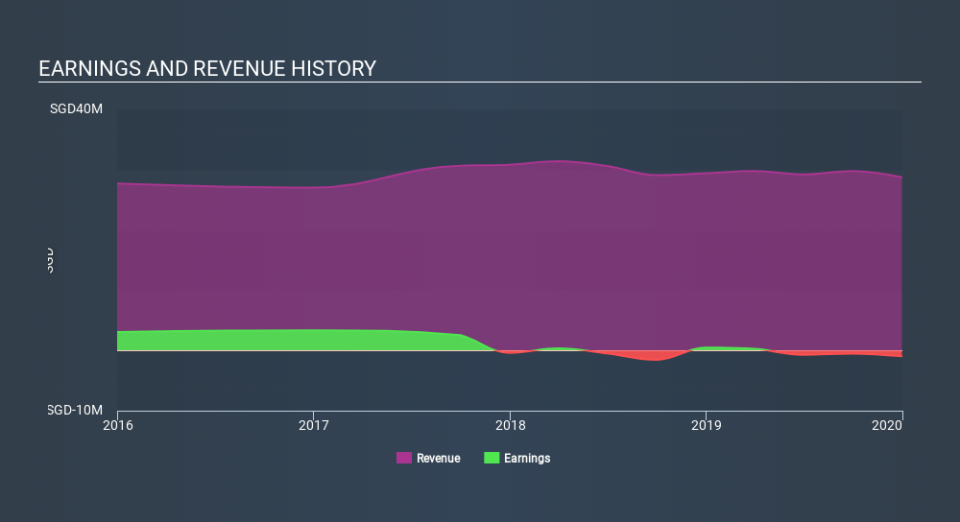

Given that C&N Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In just one year C&N Holdings saw its revenue fall by 2.2%. That looks pretty grim, at a glance. The share price drop of 66% is understandable given the company doesn't have profits to boast of. Having said that, if growth is coming in the future, the stock may have better days ahead. We have a natural aversion to companies that are losing money and shrinking revenue. But perhaps that is being too careful.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on C&N Holdings's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

C&N Holdings shareholders are down 66% for the year, even worse than the market loss of 17%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 36% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for C&N Holdings (2 are potentially serious) that you should be aware of.

We will like C&N Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.