Cabot's (CBT) Q2 Earnings and Revenues Surpass Estimates

Cabot Corporation CBT recorded a profit of $75 million or $1.30 per share in the second quarter of fiscal 2021 (ended Mar 31, 2021) against a loss of $1 million or a penny per share in the year-ago quarter.

Barring one-time items, adjusted earnings per share were $1.38 in the reported quarter, up from 77 cents in the year-ago quarter. The figure topped the Zacks Consensus Estimate of 97 cents.

Net sales increased 18.6% year over year to $842 million in the quarter. The metric beat the Zacks Consensus Estimate of $745.6 million. The company witnessed strength in volumes and favorable pricing in the Reinforcement Materials segment.

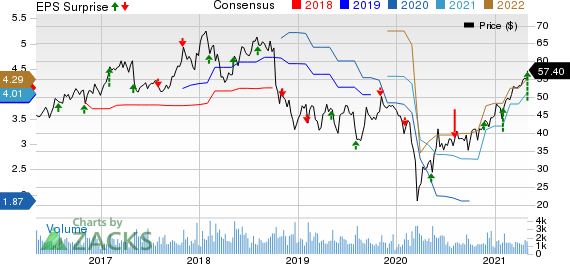

Cabot Corporation Price, Consensus and EPS Surprise

Cabot Corporation price-consensus-eps-surprise-chart | Cabot Corporation Quote

Segment Highlights

Reinforcement Materials’ sales increased 22.3% year over year to $434 million in the reported quarter. Earnings before interest and tax (EBIT) in the segment were $89 million, up from $61 million in the year-ago quarter. The upside can be attributed to improved pricing in Asia and significantly higher volumes across all regions. The segment witnessed higher volumes compared with prior-year quarter’s level, which was impacted by the pandemic shutdowns.

Sales in the Performance Chemicals unit went up around 20% year over year to $294 million in the reported quarter. EBIT increased 87.1% year over year to $58 million mainly due to increased volumes and improved product mix, courtesy of higher sales in automotive applications and target-growth initiatives.

Sales in Purification Solutions remained stable year over year at $63 million in the quarter. EBIT in the segment was $2 million, almost same as $3 in the prior year quarter. The downside in EBIT was due to reduced demand in mercury removal applications, partly offset by reduced fixed costs led by the sale of its mine on Marshall, TX and the related long-term activated carbon supply agreement.

Financial Position

Cabot had cash and cash equivalents of $146 million at the end of the second quarter, up 2.8% from the prior-year quarter’s level. The company’s long-term debt fell to $1,087 million from $1,190 million in the prior-year quarter.

Cash flow from operating activities was $65 million for the quarter, up from $24 million in the prior-year quarter.

Outlook

Cabot stated that it expects continued demand strength across all its segments in the second half of the fiscal. It also anticipates some impact from the flow-through of higher raw material costs in Asia, moderating volumes into automotive applications due to the shortage of semi-conductor chip and higher fixed costs due to the timing of scheduled maintenance activities. The company expects adjusted earnings per share for fiscal 2021 to be between $4.70 and $4.95.

Price Performance

Shares of Cabot are up 85.8% in the past year compared with 76.1% rise of the industry.

Zacks Rank & Other Key Picks

Cabot currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Dow Inc. DOW, Nucor Corporation NUE and Impala Platinum Holdings Limited IMPUY.

Dow has a projected earnings growth rate of roughly 261.5% for the current year. The company’s shares have surged 107.2% in a year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Nucor has an expected earnings growth rate of around 228.4% for the current year. The company’s shares have gained 121.4% in the past year. It currently sports a Zacks Rank #1.

Impala has an expected earnings growth rate of 197.6% for the current fiscal. The company’s shares have skyrocketed 230.5% in the past year. It currently flaunts a Zacks Rank #1.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research