CACI Wins $376-Million Contract From Department of Agriculture

CACI International Inc CACI has recently secured a $376-million task order under the GSA Alliant II contract vehicle, to continue supporting the U.S. Department of Agriculture’s (USDA) Web-Based Supply Chain Management (WBSCM) system, with cloud migration, modernization to SAP S/4HANA and deployment of additional Salesforce capabilities. Through the task order, the company will modernize and automate software functions to help USDA reduce sustainment costs of food and nutrition assistance programs and increase productivity.

The WBSCM program supports USDA and USAID-administered food and nutrition assistance programs. Notably, the WBSCM has powered the Farmers to Families Food Box program, which bought and distributed food boxes containing American agricultural products to families facing food shortages during the pandemic last year.

In its press release, the company stated, “This award combines CACI’s high-performance cloud computing and secure, reliable supply chain technologies, which our company provides to the USDA and other federal civilian enterprise customers.”

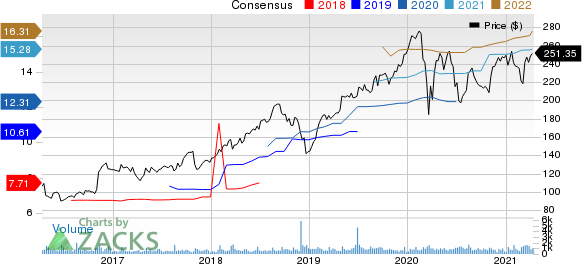

CACI International, Inc. Price and Consensus

CACI International, Inc. price-consensus-chart | CACI International, Inc. Quote

Contracts Keep Flowing for CACI

CACI has been winning a record level of awards, which reflects its disciplined business development actions, consistent operational excellence and high customer satisfaction. The company’s reliability with contracts makes it a preferred choice among contractors.

Markedly, in the last reported quarter, CACI secured a number of notable contracts. These included a five-year, $447-million task order to provide acquisition mission technology. It also won a seven-year task order worth $376 million to provide mission technology to modernize a federal customer’s web-based supply chain system.

These back-to-back wins are the key catalysts driving success perennially for the company. The company’s wins as a prime contractor in most of its deals are a positive. In the last reported quarter, revenues generated as a prime contractor accounted for 90.4% of total revenues.

CACI has a large pipeline of new projects and continues to win deals at regular intervals. Notably, as of Dec 31, 2020, its total backlog was $22.4 billion.

Bright Prospects Despite Competition

Competition from Science Applications SAIC in the IT services space remains steady. Science Applications continues to win high-value contracts and received contracts worth $2.1 billion in second-quarter fiscal 2021.

In the IT services industry, the company also competes with International Business Machines IBM and Accenture ACN, which are among the top IT service providers in the world.

Nonetheless, we believe CACI is comfortably positioned in this space, given its favorable relationship with the Department of Defense. Moreover, cyberattacks are creating increased awareness, leading to more demand for cybersecurity solutions.

CACI currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Accenture PLC (ACN) : Free Stock Analysis Report

Science Applications International Corporation (SAIC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research