California’s business tax climate is among the worst in nation, tax study says. Here’s why

For the 12th year in a row, California’s business tax climate ranks a dismal 48th among the 50 states, the latest survey from the Tax Foundation finds.

The state’s perennially low ranking from the Washington-based research group, which generally is wary of higher taxes, is the result of high income, sales and corporate tax rates.

California’s individual income tax rates rank 49th, topped only by New York. Its corporate tax burden is 45th and its sales tax rate is 47th. The state’s unemployment and property taxes rank roughly in the middle of all the states.

“The state has substantial built-in benefits, and the tech sector in particular has long thrived in California, but the state has experienced years of (people leaving the state),” said Jared Walczak, Tax Foundation vice president of state projects and a co-author of the State Business Tax Climate Index.

He predicted as people and businesses become more mobile, and the tech industry is less concentrated in Silicon Valley, “California’s uncompetitive taxes will become increasingly important.”

Sung Won Sohn, president of SS Economics, a Los Angeles-based economic consulting firm, found it was “not surprising that California is near the bottom of the Business Climate Ranking. We don’t need the Tax Foundation to tell us how poor California’s business climate is.”

He, too, cited tax rates as a problem. “When it comes to taxes, less is more,” Sophn said. “With lower tax rates, economic growth speeds up generating more tax revenues.” .

Newsom woos businesses

Gov. Gavin Newsom has made an aggressive effort to lure and expand businesses in the state, whose economy is roughly the world’s fourth largest.

His Department of Business and Economic Development cites data from independent sources showing that California has led the nation in business start-ups and access to venture capital funding.

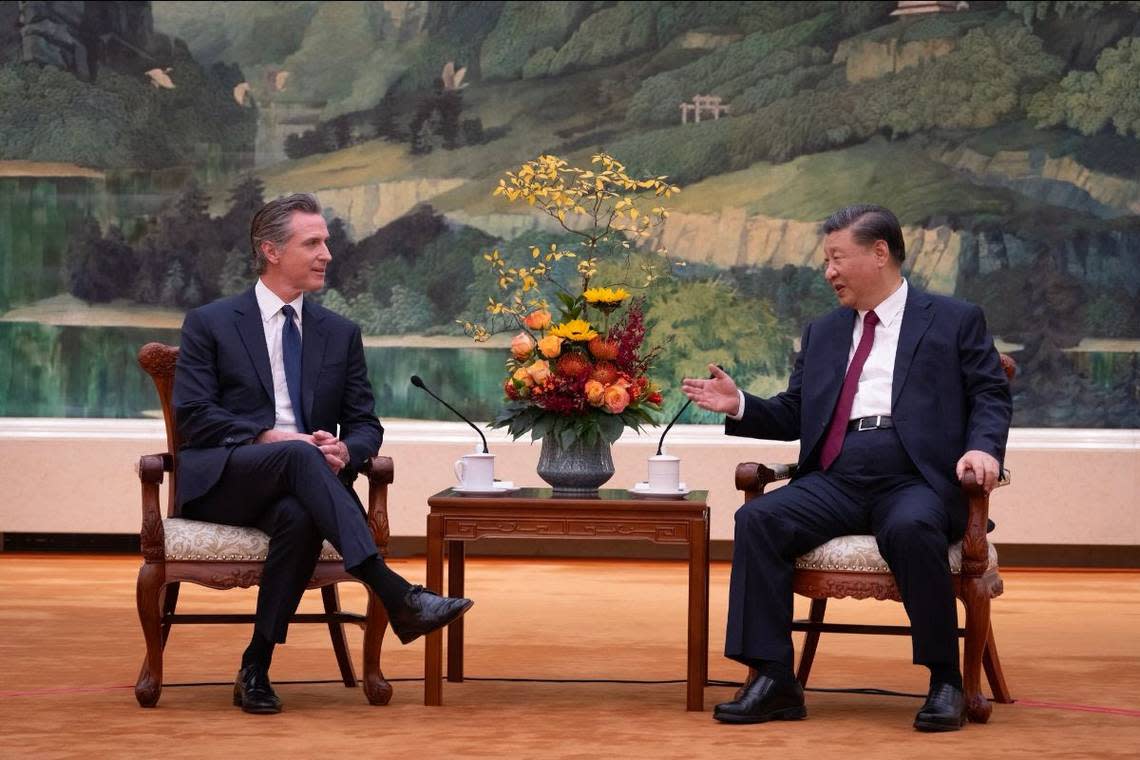

Newsom has just returned from a trip to China where, among other things, he touted California’s business opportunities.

His office Monday provided a lengthy list detailing why the state’s economy is thriving. Citing independent sources, it explained how the state has 12% of the nation’s population but contributes 14.8% to the country’s Gross National Product.

Of Time Magazine’s 2022 list of the nation’s 100 most influential companies, 34 are based in California, more than any state. California’s is the leading agricultural state, with more than one third of the nation’s vegetables and three-fourths of its fruits and nuts grown there.

And California’s small businesses employ 7.42 million people, far ahead of second place Texas with 3.1 million.

But the state has lagged in major measures of economic health. Its unemployment rate has consistently been above the national average. The state September rate was 4.7%, up from 4% a year ago. The national rate last month was 3.8%.

California’s Gross Domestic Product, the value of the economy’s goods and services, was up at an annual rate of 1.2% in the first three months of this year, below the nation’s 2% average.

The Tax Foundation regards taxes as an important culprit in its rating of California’s business climate.

“At every turn, California not only has among the highest taxes in the nation, but also some of the worst-structured taxes,” Walczak said. Only New York and New Jersey ranked lower overall. Wyoming and South Dakota were first and second.

One reason for the rankings: New Jersey has the nation’s highest corporate tax rate, 11.5%. California’s tax rate is 8.84%, below four other states, but well above North Carolina’s nationally-lowest rate of 2.5%.

California is notably hurt by its income tax rates. Its top rate of 13.3%, which applies only to income of more than $1 million, is the nation’s highest.

Next are Hawaii, 11%, New York, 10.9%, New Jersey, 10.75%, Oregon, 9.9% and Minnesota, 9.85%.

Seven states have no individual income tax, while Arizona and North Dakota have a 2.5% rate.

The study also saw California’s tax base as broad. It included the state along with seven others in citing the tax base as being “found to cause an unnecessary drag on economic activity.”

Sales and excise taxes also are criticized in the report. California’s taxes on motor fuel, when combined with the federal gasoline tax, are the nation’s highest at 76 cents per gallon.