California has dueling budget deficits. Here’s what that means and what lawmakers could cut

- Oops!Something went wrong.Please try again later.

Is it $38 billion or $73 billion? Just how much of a budget gap does California actually have?

The Legislative Analyst’s Office last week threw yet another wrench into Gov. Gavin Newsom’s push for a rosier fiscal picture when it updated its projected budget deficit to $73 billion, based on weak revenue collections.

This is the latest in a series of dueling budget estimates the governor’s administration and the LAO have put forward since December.

The LAO in late 2023 projected the state would see a $68 billion spending shortfall. Newsom and his Department of Finance in January suggested it was closer to $38 billion. An LAO analysis of the governor’s budget said the administration had actually filled a potential gap of $58 billion, meaning the two estimates were about $10 billion apart.

Then, on Tuesday, the LAO issued the $73 billion projection.

That is not entirely strange — the Department of Finance and the LAO have previously had different takes on the budget. The LAO in late 2022 also estimated a slightly larger spending gap than the governor’s administration eventually projected in January 2023.

What has been different is Newsom’s insistence that it was wrong for journalists and observers to take the LAO’s bigger estimate “as gospel,” setting up a continuing comparison between the two.

“We have a difference of opinion in the short run, versus the long run,” Newsom said in January, adding, “We just are a little less pessimistic than they are about next year.”

So where does a budget gap that’s $15 billion bigger leave California leaders? Newsom will not release his revised spending plan until May. But H.D. Palmer, a Department of Finance spokesman, on Tuesday renewed the governor’s January push for the Legislature to adjust the previous budget before the deadline to pass a new one in June.

Here’s what all this means for the next few months of budget negotiations.

LAO vs. Newsom

One of the biggest differences between Newsom’s projections and LAO’s estimates is whether $15 billion in proposed cuts to school and community college funding is an automatic change or a policy choice that doesn’t necessarily have to be made.

Newsom’s office considers that spending reduction to be baseline, while the LAO considers it a policy choice for lawmakers and the governor to make while crafting the 2024-25 budget.

“We take this approach in order to provide the Legislature visibility into the full scope of the administration’s choices,” the LAO said in its Jan. 13 overview of the governor’s proposed budget.

Palmer emphasized the state still has some revenue runway left.

“From now through April, more than $51 billion in income and corporate tax receipts are forecast to come in,” Palmer said in a statement on Tuesday. “No one can say today with certainty how those numbers may change the budget estimate of a $38 billion shortfall.”

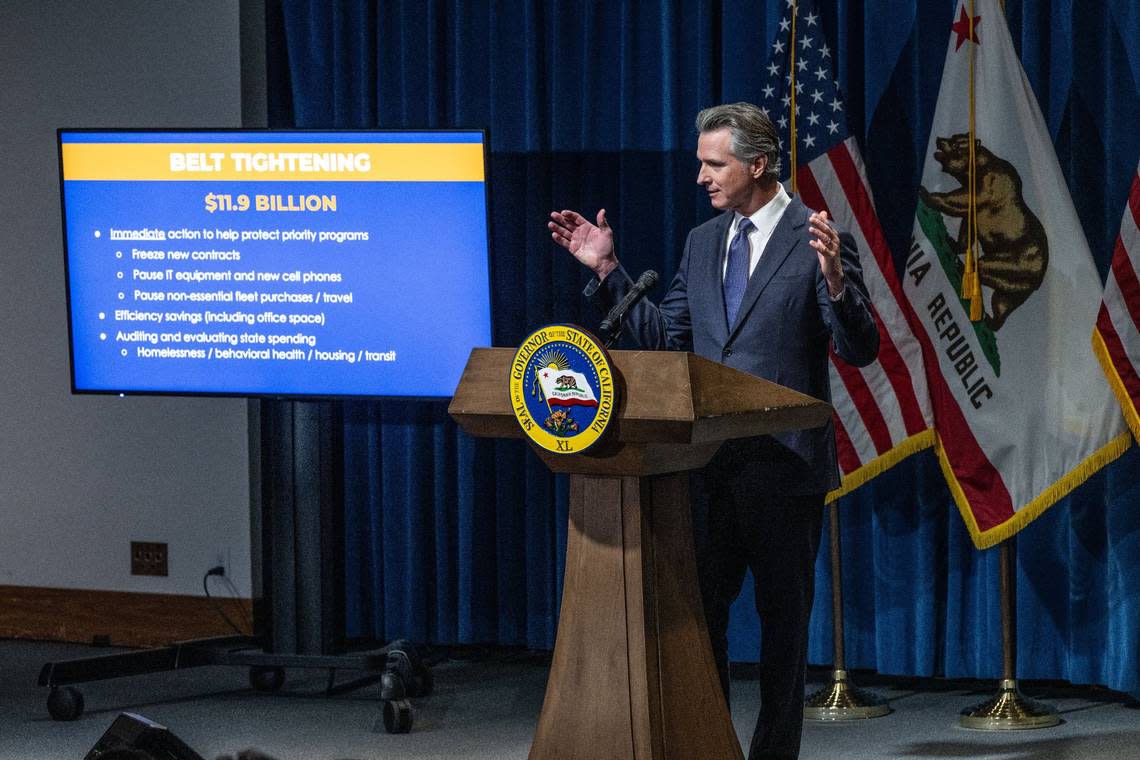

Chris Hoene, executive director of the California Budget and Policy Center, said leaders will possibly need to plan for more belt-tightening, based on current conditions.

“I think the challenge for them from a governance perspective is that I think many people had hoped that January’s projections would actually improve by May because 2023 was, relatively speaking, a good year for the stock market,” he said. “And right now, this early this year, the arrows are pointing in the other direction, which means they potentially have a bigger budget problem to solve than they thought even a month ago.”

Possible spending solutions

Palmer said the Legislature should move on early action budget measures “needed for $8 billion in solutions to help close this gap.”

That means Assembly Speaker Robert Rivas, D-Hollister, and Senate President Pro Tem Mike McGuire, D-Healdsburg, would need to open up the 2023-24 budget and make adjustments to the existing plan.

“Conversations about early action are already underway,” said Cynthia Moreno, a Rivas spokeswoman, in a statement. “The speaker is very concerned about the deficit and does not want short-term fixes for long-term problems.”

The Legislature will likely take at least some of this action during the next month. That’s because one of the solutions would involve increasing the managed care organization tax by $1.5 billion to help fund a Medi-Cal expansion for undocumented immigrants. The federal government must authorize increases to the MCO tax, which health insurers pay.

First, the Legislature needs to approve the increase, which has to go to the Centers for Medicare and Medicaid Services by April 1, Palmer said. Lawmakers leave for spring recess on March 21, so they will probably vote on the proposal before they head out of town, he said.

Assembly Budget Committee Chair Jesse Gabriel, D-Woodland Hills, said lawmakers are “doing the hard work of considering all of the different alternatives and solutions we have.”

When asked whether the LAO’s update changes anything, he said, “not in a profound way.”

“We’ve understood that this is a moment of uncertainty from the beginning and that things could change quickly,” Gabriel said. “And that’s something we’ve been prepared for.”

As for the LAO, the group identified several one-time or temporary spending cuts that could be made to address the budget shortfall from fiscal year 2023-24 through 2025-26.

That includes $542 million from the health and home care workforce package from the Department of Health Care Access and Information; $1.9 billion in the state’s share of school construction projects; $1.3 billion in the Homeless Housing, Assistance and Prevention Program; $1.2 billion in broadband infrastructure; $1 billion in the Clean Energy Reliability Investment Plan; and $1.7 billion in transit and rail funding.

Although Newsom has been staunchly opposed to raising taxes, Hoene suggested it may be time to consider some revenue solutions to prevent “cutting services to the bone.”

“It’s not unprecedented to do so,” he said. ”In prior recessions, state leaders have temporarily suspended tax breaks, kind of imposed tax changes that produce revenues on a temporary basis to help get through these periods.”