California Water's (CWT) Investments, Rate Hikes Bode Well

California Water Service Group’s CWT systematic buyouts and investments to upgrade or replace its water infrastructure will help the utility serve its growing customer base efficiently. Also, rate increases are aiding the company’s performance.

Tailwinds

With its focus on expanding operations in the Western United States, California Water Service continues to explore opportunities for expanding its regulated and non-regulated water and wastewater activities. To this end, the utility invested $66.8 million in the first three months of 2021 after spending $298.7 million in 2020. Its capital expense estimate for 2021 is in the $270-$300 million range.

The company is undertaking acquisitions and replacement projects to enhance the reliability of its services and broaden its business scope. Such efforts improved its customer base by 4.3% year over year in 2020. Other water utilities like American Water Works Company AWK, Middlesex Water MSEX and Essential Utilities WTRG are also investing heavily in bettering system reliability and efficiently serving its expanding customer base.

Moreover, California Water Service has been benefiting from rate hikes since the beginning of 2014. The rate base is expected to rise from $1,607 million in 2020 to $1,864 million in 2021 and further to $1,974 million in 2022. The ongoing rate raises will leave a positive impact on the company’s earnings in the long term.

Additionally, the utility boasts ample liquidity to meet its near-term obligations. As of Mar 31, it had $84.4 million of cash and additional current capacity of more than $115 million on the lines of credit, subject to fulfilling borrowing conditions.

Woes

However, more than 93.8% of California Water Service’s operations is concentrated in the state itself, exposing it to various risks. Also, its aging water infrastructure requires constant investments in maintaining the reliability of services. Moreover, the risk involving contamination of water supplied by the company is a concern.

Zacks Rank & Price Performance

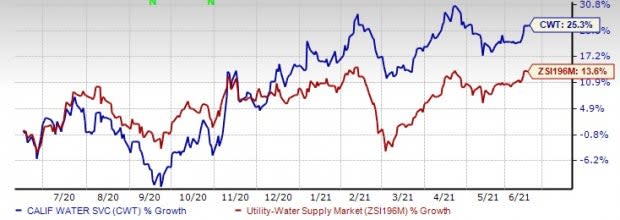

This currently Zacks Rank #3 (Hold) company has gained 25.3%, outperforming the industry’s rise of 13.6% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

One-Year Price Performance

Image Source: Zacks Investment Research

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create "the world's first trillionaires." Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

California Water Service Group (CWT) : Free Stock Analysis Report

Middlesex Water Company (MSEX) : Free Stock Analysis Report

Essential Utilities Inc. (WTRG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research