Call Traders Flock to Rising PG&E Stock

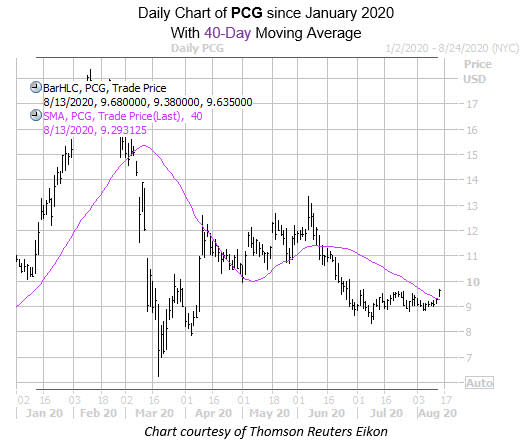

Beleaguered utility giant PG&E Corporation (NYSE:PCG) is up 3.9% at $9.64 this afternoon, amid news that the stock will soon be added to the Morgan Stanley Capital International (MSCI) World Index. On the charts, PCG has been trading sideways with pressure above at the $9.50 region. Today's rise, however, has the equity breaking past pressure at the 40-day moving average for the first time since mid-July. Year-to-date, PCG is still down 11.2%.

Options traders have been all too willing to chime in today, with 61,000 calls and 19,000 puts across the tape so far, nearly double the expected volume. Most popular is the weekly 8/14 9.5-strike call, where new positions are being opened. This means options players are betting on more upside for PCG by tomorrow, when the contracts expire.

This penchant for calls has been the norm recently. PCG's 10-day call/put volume ratio of 14.57 and 50-day call/put volume ratio of 9.28 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) both stand higher than all other readings from the past year. This means traders haven't been more bullish on PCG in the past 12 months.

Now would be a good time to weigh in on these options as well. The stock's Schaeffer's Volatility Index (SVI) of 33% stands in the bottom percentile of all other readings in its annual range, implying that options players are pricing in incredibly low volatility expectations at the moment.