Calls Pop on Pinterest Stock After Positive Q1 Guidance

Digital scrapbook platform Pinterest Inc (NYSE:PINS) is charging higher today after the company forecast $269 million to $272 million in revenue for its first-quarter, exceeding analysts expectations. The social media concern also predicted its monthly active users (MAUs) to exceed its fourth-quarter MAUs, though it pulled its 2020 guidance on COVID-19 uncertainty. The stock is up 10.7% at $16.73 at last check.

Analysts aren't as sold on PINS. This morning, Wedbush cut its price target to $22 from $30 and Credit Suisse slashed its estimate to $23 from $29, with the former citing coronavirus uncertainty as impacting advertising. This puts the consensus 12-month target price at $23.81, which is a 41.9% premium to current levels. Meanwhile, Pinterest sports 10 "buy" or better ratings, and nine tepid "hold" ratings.

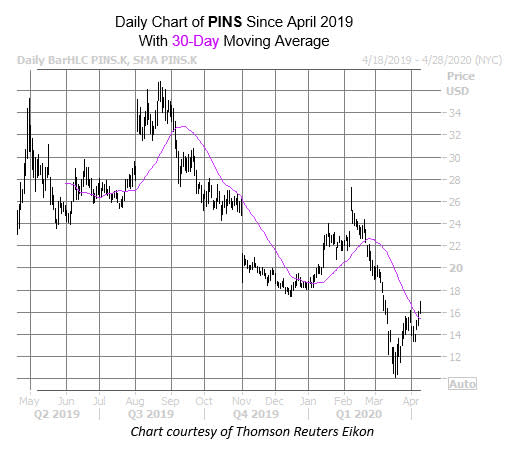

Today's pop has PINS trading at a one-month high, and eyeing its first close atop its 30-day moving average since mid-February. On the other hand, the equity is still off 10.1% year-to-date.

Today's preliminary results has captured the attention of the options pits, with 19,000 calls and 9,213 puts exchanging hands so far, both of which are double the intraday average. The May 20 call is seeing the most activity, with new contracts being opened here, followed by the January 2021 15-strike put.

Looking elsewhere, short sellers have ramped up their bearish bets. In the last reporting period, short interest surged 38.1%. The 20.31 million shares sold short now represent a whopping 23.6% of PINS' available float.