The Canadian Imperial Bank of Commerce (TSE:CM) Share Price Is Up 18% And Shareholders Are Holding On

Passive investing in index funds can generate returns that roughly match the overall market. But in our experience, buying the right stocks can give your wealth a significant boost. For example, the Canadian Imperial Bank of Commerce (TSE:CM) share price is up 18% in the last five years, slightly above the market return. Zooming in, the stock is actually down 0.5% in the last year.

See our latest analysis for Canadian Imperial Bank of Commerce

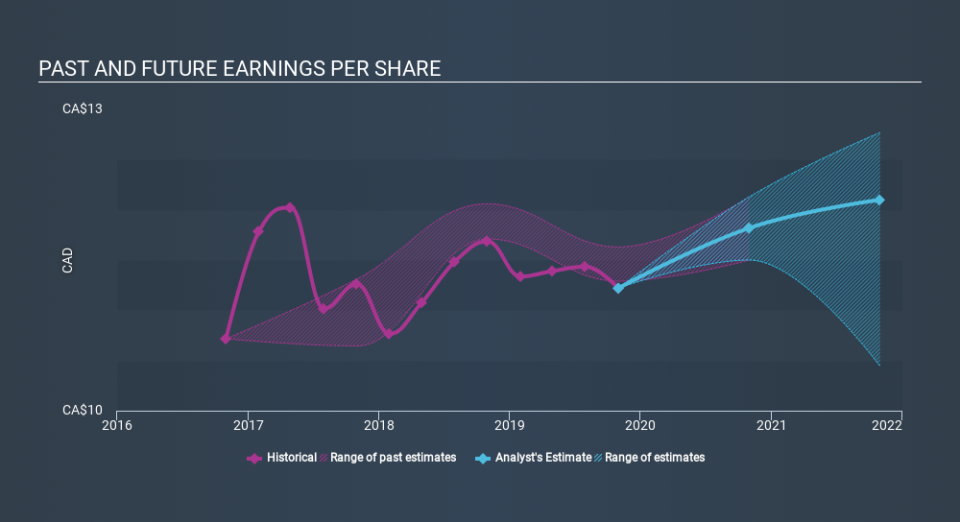

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, Canadian Imperial Bank of Commerce managed to grow its earnings per share at 7.3% a year. The EPS growth is more impressive than the yearly share price gain of 3.4% over the same period. Therefore, it seems the market has become relatively pessimistic about the company. The reasonably low P/E ratio of 9.73 also suggests market apprehension.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. It might be well worthwhile taking a look at our free report on Canadian Imperial Bank of Commerce's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Canadian Imperial Bank of Commerce's TSR for the last 5 years was 50%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Canadian Imperial Bank of Commerce provided a TSR of 4.9% over the last twelve months. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 8.4% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Canadian Imperial Bank of Commerce by clicking this link.

Canadian Imperial Bank of Commerce is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.