Car insurance for seniors

Even if your driving habits remain the same and your record stays clean, the rate you pay for car insurance changes over time. Typically, auto insurance rates drop as drivers move into middle age, having acquired years of driving experience and loyalty discounts. Once you become a senior citizen, however, expect to pay more for car insurance. Here's what you need to know about saving on auto insurance in your 50s, 60s, 70s and beyond.

Car insurance rates for seniors Senior auto insurance by decade Senior car insurance discounts Best car insurance for seniors Safety tips for older drivers State laws specific to seniors

Car insurance rates for seniors

Auto insurance for older drivers often costs more, because senior drivers as a group are more accident-prone than their middle-aged counterparts. The reasons for this include age-related changes in hearing or vision, slower reflexes, health conditions and medications. In addition, regardless of accident severity, older drivers suffer graver injuries and more fatalities than younger people. This makes seniors more expensive to treat following an injury. These factors can increase insurers' claim costs, and those costs are passed on.

The chart below shows fatality rates by age for drivers. By the time people hit their 80s and later, their auto-related death rates exceed those of teenage drivers.

Will your insurance premiums increase just because you join the ranks of "older" drivers? What if you have no accidents or tickets? That depends on your insurance company, but the answer is "probably." Insurance rates are partly determined by the entire group to which you belong, not just your own driving record. So if you live in Mayhem Metro, you may pay more than a driver from Safe City. If you drive a flashy convertible, you're statistically more likely to have an accident than if you've got a mundane minivan.

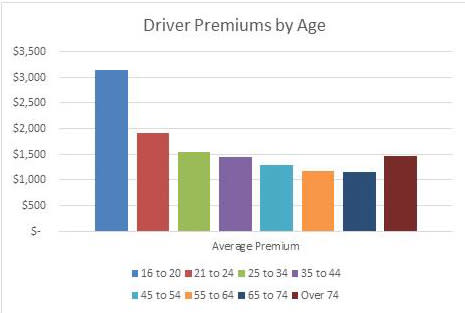

Insurance.com data shows that older drivers do pay more than middle-aged drivers as a group--but not much more.

However, there's a flip side - many states mandate that drivers over 55 be given discounts for good driving and/or for taking approved driving courses.

Thirty-four states that require discounts for driver safety courses are:

Alaska

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Idaho

Illinois

Kansas

Kentucky

Louisiana

Maine

Minnesota

Mississippi

Montana

Nevada

New Jersey

New Mexico

New York

North Dakota

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

Tennessee

Utah

Virginia

Washington

West Virginia

Wyoming

Washington, DC

Senior auto insurance by decade

Here's how your age may affect your driving and your insurance costs in your 50s and beyond. "Not all insurance companies start charging higher rates at the same age, so it pays to shop around if you get a rate hike," says Penny Gusner, consumer analyst for Insurance.com. "It all depends on the internal statistics within the insurance company, so some will raise rates in your 60s while others will wait until your late 70s."

Auto insurance in your 50s

Car insurance for people over 50 is usually cheaper than it is for younger and older drivers. That's because drivers in their 50s are among the safest - you have lots of experience but still have good health, quick reflexes, and reliable hearing and vision.

Auto insurance in your 60s

Barring an unlucky streak or late-onset midlife silliness, you're likely to pay less for car insurance than you ever have between the ages of 50 and 65. At 65, however, some insurers raise premiums. Your current insurer may not be among the best insurance companies for older drivers. Turning 65 might be a signal to shop for a better deal.

Auto insurance in your 70s

Does car insurance go up when you turn 70? Sorry; it probably does. Data from the National Transportation and Safety Bureau (NTSB) and National Automotive Sampling System (NASS) show that drivers 70 and up experience much higher rates of intersection-related accidents and fatalities than younger drivers. More accidents mean more claims and higher rates. However, this is just the point at which accident rates begin to increase -- it isn't until drivers reach their late 70s or early 80s that their abilities degrade significantly. Some insurers recognize this and continue to offer reasonably-priced car insurance for those over 70.

Auto insurance in your 80s and beyond

Driving becomes increasingly hazardous for people 80 and up. According to American Automobile Association (AAA), older drivers' fatality rates are 17 times higher than those for 25- to 64-year-olds, and it's mostly not due to bad driving--it's because of the human body's fragility in its ninth decade of life. Car insurance for older drivers gets increasingly costly with age, so it's critical to shop for car insurance quotes and grab every discount to which you're entitled.

Senior car insurance discounts: tips for saving

There are plenty of discounts available to older drivers, and you should pursue all that apply to you. Below are eight specific actions you can take to reduce your premium costs:

Drive less. If you've stopped commuting and are driving less than you have in the past, inform your insurance company. Depending on your state (some require insurers to consider mileage when setting rates), savings range from almost nothing to more than 10 percent. Most insurers define "low mileage" as 5,000 to 7,500 miles or fewer, but others are more generous. Consider pay-as-you-drive insurance, where a device tracks the number of miles you drive, how fast you drive, how you brake, and what hours of the day you drive.

Bring in Big Brother. Gusner says some seniors can save up to 40 percent with usage-based or pay-as-you-go auto insurance programs. A device installed in your car records your mileage and driving habits--your speed, braking tendencies and acceleration. If your habits mirror those of most middle-aged or older drivers, you could save two ways--for driving safely and for driving less.

Have some class. Mature driver courses offered by AARP and others can reduce your premiums by 5-15 percent. Most states require the discount, but insurers in other states often offer rate reductions for driver training as well. Age eligibility varies by state.

Drop a driver. In states that don't require all licensed drivers in a household to have car insurance, you can exclude anyone (such as an older spouse or parent) who no longer drives in order to reduce your rates. Alternatively, you can change the primary driver to a younger member of the household, if that reflects the reality of your circumstances.

Buy some bells and whistles. The latest vehicle safety features may get you a reduced rate on your insurance. Even without a discount, features such as rearview cameras, lane drift, collision warning systems and parking assist can prevent accidents and claims, which can minimize future premium increases.

Join the club. Membership in organizations such as AARP can enable you to access promotional pricing. It's called an "affinity discount."

Dial back coverage. If you have homes and vehicles that you use only part-time, look into cheaper "parked vehicle" or "snowbird" coverage during the months in which you're not driving them.

Stop driving. If your insurance rates are sky-high because of your driving record, it might be time to quit. AARP lists a number of signs that you should give up driving, including frequent close calls, finding dents or scrapes on your car or other objects, getting lost in familiar locations, trouble seeing or following traffic signs and signals, slower response time to unexpected situations, misjudging gaps in traffic, causing other drivers to honk or complain, difficulty concentrating while driving, trouble turning to check the rear view mirror when backing up or changing lanes, and receiving multiple traffic tickets or warnings.

For more information, review our tips on being a safe driver. Drivers of any age can raise deductibles, bundle with home or renter's insurance or reduce coverage in order to save on premiums. Insurance.com's coverage calculator can help you set an appropriate level of coverage for the coming years.

Best car insurance companies for seniors

There is no single "best" car insurance for seniors. Different insurers calculate their rates with proprietary methods and each has a different set of behaviors it chooses to encourage, deter or ignore. The cheapest auto insurance for seniors depends on the driver, vehicle and location. The table below shows six quotes for the same driver--a 70-year-old California woman with a clean record who drives 7,000 miles a year, is an AARP member and takes a defensive driving course. Coverage is the California minimum $15k per person, $30k per accident.

Company | Annual Premium |

The Hartford | $684 |

SafeCo | $792 |

esurance | $648 |

Mercury | $660 |

Safeway | $780 |

Infinity | $828 |

Dairyland | $840 |

Foremost | $960 |

Safety tips for older drivers

The National Institute of Health (NIH) advises that you can be safer on the road by addressing the effects of aging on your driving and being aware that your driving ability will almost certainly be impacted by changes to your body. Here are the most important tips:

Maintain your health. Have your hearing, vision and general health evaluated regularly, and keep any prescription equipment such as glasses and hearing aids up-to-date. If you don't see well after dark, avoid driving at night.

Stay physically active. Physical activity may foster quick reaction times.

Adjust your vehicle. Elevate your seat for adequate vision and switch to power steering, brakes and mirrors to control your car.

Review medications. Understand how your medications may affect your driving ability. Avoid driving after taking any drugs with warnings about operating machinery.

Create a healthy buffer zone. Follow at a greater distance and avoid busy parts of town and busy times of day.

Plan your route. Intersections are especially dangerous for drivers over age 80, and there is no reason to make a risky left turn when three right turns will get you to the same place.

Sharpen skills. Defensive driver classes and behind the wheel refresher courses can sharpen your skills and lead to lower insurance rates.

Maintain your vehicle. Regular inspections and tune-ups reduce the chance of roadside break-downs.

State laws specific to seniors

Some state motor vehicle departments treat you differently once you meet their definition of "older driver." You may no longer be allowed to renew your license by phone or online. Your renewal period may be shortened, and you may be required to pass extra screenings.

Currently, 20 states require senior drivers to renew their licenses more often than younger drivers. The chart below shows the age at which you become a senior in each of those states, and how often you must renew your license.

State | Renewal Years | Age |

Georgia | 5 | 59 |

Idaho | 4 | 63 |

Arizona | 5 | 65 |

Maine | 4 | 65 |

Nevada | 4 | 65 |

South Carolina | 5 | 65 |

North Carolina | 5 | 66 |

Missouri | 3 | 70 |

Hawaii | 2 | 72 |

Iowa | 2 | 72 |

Montana | 4 | 75 |

Rhode Island | 2 | 75 |

Virginia | 5 | 75 |

North Dakota | 4 | 78 |

Florida | 6 | 80 |

Texas | 2 | 85 |

Some states require drivers to have their driving health, vision or hearing tested when they renew their licenses. Here are their requirements:

State | Age for tests | Test type(s) |

Oregon | 50 | Vision |

Maine | 62 | Vision |

Georgia | 64 | Vision |

Arizona | 65 | Vision |

South Carolina | 65 | Vision |

South Dakota | 65 | Vision |

Utah | 65 | Vision |

Alaska | 69 | Vision |

Iowa | 70 | Vision |

California | 70 | Vision |

Washington, D.C. | 70 | Medical |

Louisiana | 70 | Vision |

Maryland | 70 | Vision, Medical |

Nebraska | 72 | Vision |

Nevada | 72 | Vision, Medical |

Virginia | 75 | Vision |

Illinois | 75 | Driving, vision |

Texas | 79 | Vision |

Florida | 80 | Vision |

Driving in the U.S. is a privilege, and it can be an expensive one--especially as you're a senior citizen. Follow the suggestions in this article to ensure your safety and maximize your savings when you buy an auto insurance policy.

Additional reporting by Gina Pogol

Save on auto insurance now >

The original article can be found at Insurance.com:

Related articles