Car repossessed? Don't look for government help, like the mortgage or student-loan aid packages.

It was a Sunday night in August, just after midnight, when I was awakened by a loud banging. I opened the front door, ready to deliver a reminder about not forgetting the house key to my college graduate, COVID Class of 2020. Standing too close for comfort was a stocky, unmasked man with what looked like a Billy club in his hand.

“What’s happening?” I wailed, thinking it was a home invasion. “Oh, I’m onto your game, lady,” he barked, adding that the car was going to be auctioned off as he headed to a tow truck that was already hooked up to my Ford C-Max. I trailed, pleading with him to please put on a mask as I whimpered, “I don’t understand.”

That’s the scene that was unfolding as my child approached our home. Afterward, I sank to the floor of the kitchen, where I remained in an almost catatonic state for hours, repeating, “I’m so sorry, I’m so sorry.”

In a childhood marked by dodging creditors on my parent’s behalf, I’d witnessed my share of economic ups and downs. Still, nothing stings like the humiliation of car repo, purposefully designed for maximum traumatic effect.

Lease extended during lockdown

My lease had termed out during COVID lockdown, and because my local dealership wasn’t open, I’d arranged for an extension. Busy managing my family’s health and safety, I hadn’t noticed that the automatic payments that had been deducted from my bank account for three years had been discontinued. Neither the emailed billing statements nor the odd calls originating from unrecognizable numbers, which I had assumed to be spammy robo calls, mentioned being in arrears. I was sure what happened couldn’t be legal.

I was wrong. Only a handful of states mandate prior notification for repossession and in California, where I live, creditors can legally repossess with no notice if you are one day late. It was stunning to discover that consumers don’t have a “right to cure,” meaning creditors aren’t required to offer the chance to catch up on payments to avoid repossession and that offering to bring your account current is no assurance of resolution.

Lenders can simply decide to auction a car off, as my repo man threatened. At auction, cars regularly sell for a lower amount than the purchase price on financing agreements. Guess who is on the hook to pony up the difference?

Given the widespread economic suffering and a need for access to safe transportation, it seemed unfathomable that millions of Americans whose cars have been repossessed and credit ruined during the pandemic had been left to fend for themselves. Who are these reprobate debtors? Who are these reprobate debtors? Furloughed teachers and health care workers, mothers with school age kids and members of marginalized groups.

The federal government has offered student loan relief, a child care credit and extended unemployment benefits, in addition to an unprecedented moratorium on residential evictions. The Biden administration has vowed to extend the moratorium, and a portion of the proposed housing relief includes funding earmarked for landlords that is predicated on forgiveness of at least a portion of the past due rent.

Yet, the federal government has failed to provide relief for auto loan defaults , and the consequences will haunt us long after the pandemic recedes. As the unfortunate but all too true saying goes, you can sleep in your car, but you can’t drive your house. John Van Alst, staff attorney at the National Consumer Law Center, warns: “Lack of a car can greatly reduce access to education, medical care and good jobs, reducing economic success at a generational level.”

Negotiating for my hostage car

Resolving my repossession took on the character of a hostage negotiation.

Overwhelmed and understaffed, the collection agency took a week to locate my car. It turned out that vehicles repossessed in Los Angeles, including mine, had been impounded in Redlands, more than two hours away. This made Ford’s March 2020 statement expressing a commitment to “helping communities in times of need” seem especially hollow. Consumers were expected to schedule appointments within narrowly available timeframes and, because of a backlog of thousands of repossessed cars, prepare for a two to three hour wait at the repo lot. That same month, I'd been diagnosed with stage four lung cancer, further exacerbating my concerns for exposure. As the only driver in my household, now carless, how was I supposed to safely manage that feat?

The next hitch was Ford Credit. Representatives could only be patched in through the collection agency, presumably due to employees working from home, leading to interminable holds, accidental disconnections, and nail-biting waits for return calls. Only after Googling "Help! My car was repo’d!" did I learn of Ford's COVID-impacted customer hotline. Then, because there were no standardized criteria for receiving assistance, my best bet was to weep, beg and plead my case repeatedly.

I was able to make my account whole. Still, negotiating a settlement that included a refund of repossession fees and the delivery of my car to my home is a measure of privilege beyond an ability to pay.

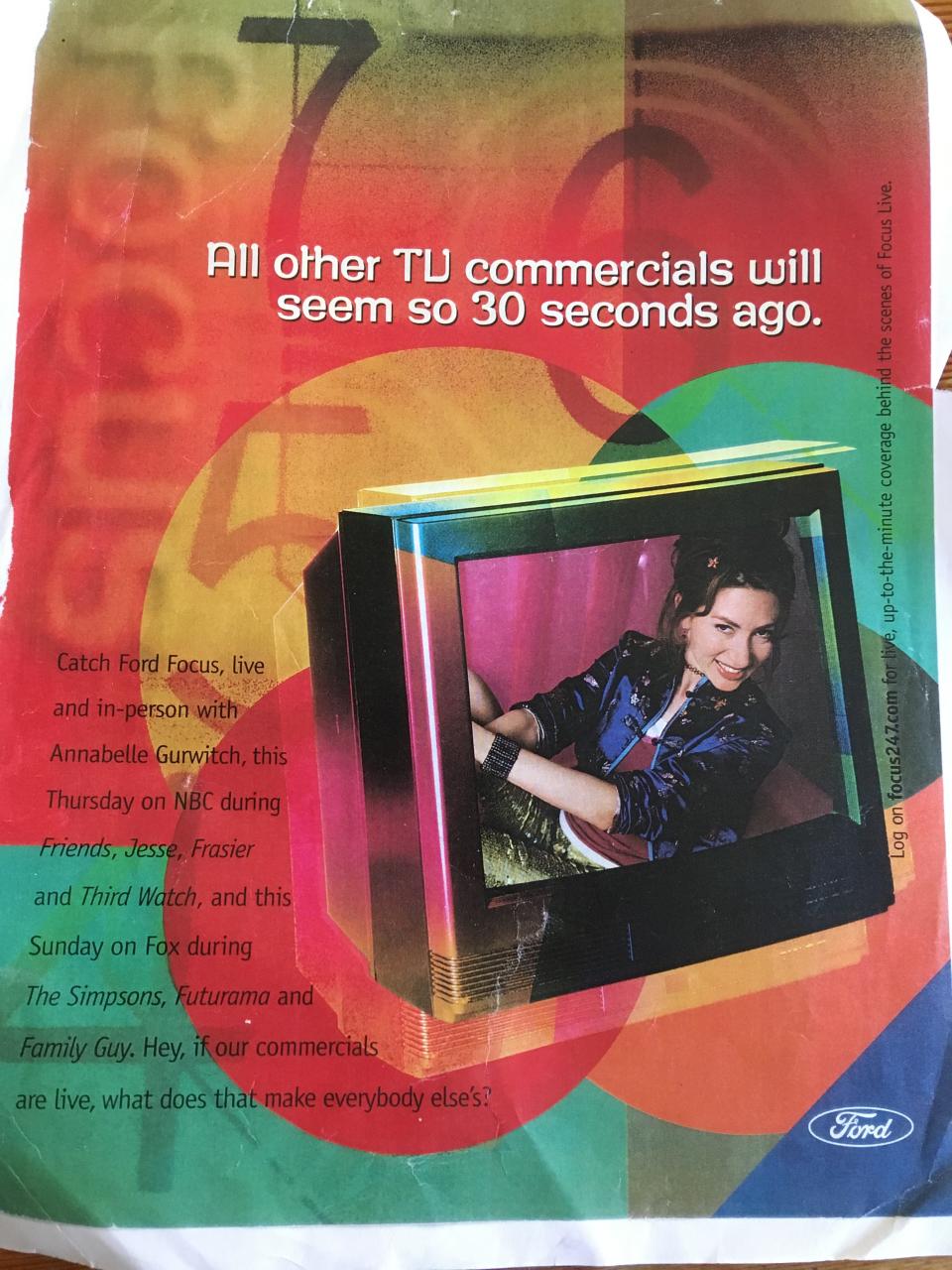

How many hourly-wage workers or parents supervising school children could spare the time I dedicated? I’d unleashed a dogged resolve honed through years of facing down rejection as an actress. The irony didn't escape me that, in 1999, I introduced the Ford Focus to the American market in a series of commercials I was hired to both write and star in. A former Ford spokesperson, my messaging now “focused” on voicing outrage and incredulity about the lack of consumer protection in repossessions.

A well-intentioned provision in the CARES Act instructed creditors to hold off on reporting defaults to credit bureaus. Except protections applied only to accounts in forbearance, and my car had already been repossessed. My credit score plunged overnight, hovering just above subprime rate.

Shadowy scourge of repossessions

We’ll never know how many repossessions took place during the pandemic, in addition to the 1.5 to 2 million cars that are repossessed each year, because the industry doesn’t share those numbers. According to the Federal Reserve Bank of New York, by the second quarter of 2020, 5% of auto loans were 90 days delinquent, the highest rate in more than seven years.

Moreover, the Consumer Federal Protection Bureau reports that 70% of complaints received since COVID are from consumers who were denied relief and 60% of complaints related to lender attempts to repossess or disable a vehicle. This is a doubling of complaints from the prior year, something Gideon Weissman of Frontier Group calls “a signal that consumers are struggling and many lenders are not coming to the rescue."

Compounding the situation is the kind of forbearance creditors offered: outstanding payments were tacked on to end-of-term fees.

“For borrowers with sub prime financing, disproportionally people of color, often with interest rates of 20 to 30%, many of these loans won’t come due for five or six years, and the final cost will be astronomical,” says Van Alst, making the case for legislation addressing prior notice and the right to cure, and loan forgiveness, even more urgent.

If not for my experience, I would have remained in the dark about this shadowy scourge. So much shame is associated with car repossession that people would rather admit to erectile dysfunction than having been stripped of their automobile. I’ve published essays about my vaginal atrophy and downward mobility, so that ship has already sailed for me.

Perhaps there’s a simple explanation for our nation’s collective blindness to the underlying inequities of auto finance and the suffering caused by auto repossessions. The unhoused are visible on the streets of every American city and thus harder to ignore, but for already marginalized and vulnerable Americans, losing their transportation can mean they’ve effectively been disappeared.

Annabelle Gurwitch is a New York Times bestselling author and actress. Her most recent book is "You're Leaving When? Adventures in Downward Mobility" Research for her op-ed was underwritten by a grant from the Economic Hardship Reporting Project.

This article originally appeared on USA TODAY: Car repossessions rise amid COVID, with no help, relief for consumers